By Sam Forgione

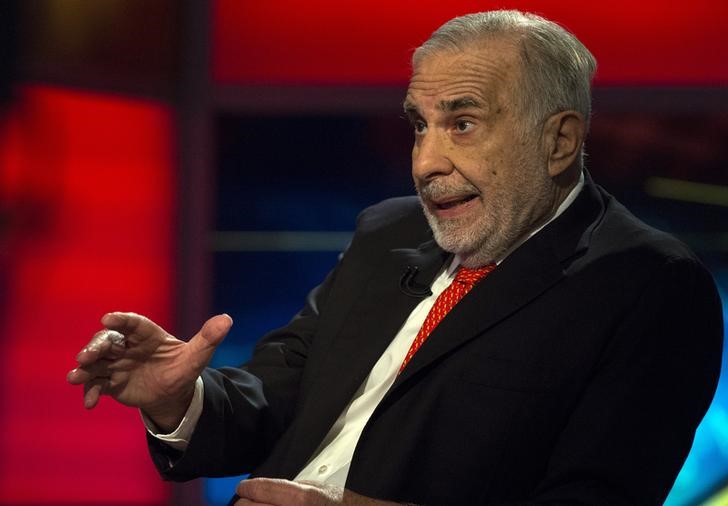

NEW YORK (Reuters) - Billionaire activist investor Carl Icahn on Wednesday lambasted BlackRock Inc (N:BLK), the world's largest asset manager, as an "extremely dangerous company" because of the prevalence of its exchange-traded fund products, which Icahn deems illiquid.

"They sell liquidity," Icahn said in reference to BlackRock's ETF business. "There is no liquidity. That's my point. And that's what's going to blow this up."

Icahn was speaking at the CNBC Institutional Investor Delivering Alpha Conference in New York, sharing the stage with Larry Fink, chief executive of BlackRock. Icahn said he was concerned about the amount of money invested in high-yield ETFs, which he called "overpriced."

Icahn said that when the Federal Reserve hikes interest rates, investors would likely sell their high-yield ETFs, and that he feared the consequences of such a sell-off since he said there would be nobody to buy them. Icahn has previously said he believes the high-yield bond market was in a bubble.

Fink countered that Icahn's characterisations of ETFs were "dead wrong" and that the index funds were just "a tool for buying exposure." Fink also said that ETFs "create more price transparency than anything in the bond market today," especially in high-yield.

The U.S. ETF market has roughly $2.1 trillion in assets, according to ETF.com.

Fink also said higher interest rates would result in more money flowing into the bond market. He reiterated that the Fed would likely raise rates in September and that normalization of the Fed's funds rates would be good for the economy.

On activist investors, Fink said: "there are good ones and there are some bad ones." Fink said BlackRock would continue to be in "deep dialogue" with companies the firm has issues with.

Earlier this year, Fink urged the top executives of the 500 largest publicly listed U.S. companies to take a long-term approach to create value for shareholders or risk losing his firm's support.

In a letter to the chief executive officers of the S&P 500 index dated March 31, Fink asked the companies to avoid short-term pressures created by the increasing activist shareholder activity of recent years.

Fink repeated that sentiment Wednesday and said: "There is a growing network of activists who have now focussed on more short-term proxy harassment ... they're in for one or two years."

He also said that he was "deeply worried" about excessive share repurchases on behalf of companies, instead of companies growing capital investment, research and development, and hiring.

In 2014, dividends and buybacks in the United States totalled $900 billion, the highest ever, according to Fink's letter.

BlackRock had $4.7 trillion in assets under management at the end of the second quarter.