By Elzio Barreto

HONG KONG (Reuters) - Private equity firm KKR & Co (N:KKR) said on Friday it raised $9.3 billion for its most recent Asia-focused buyout fund, more than expected and setting a record for the region as it looks for larger deals.

Topping its initial target of $7 billion, the size of its Asian Fund III underscores greater opportunities and appetite for deals in Asia Pacific, where private equity firms are increasingly looking to buy control of companies.

"We see a diverse set of opportunities across Asia Pacific stemming from rising consumption and urbanization trends in key markets as well as larger carve-out and cross-border transactions in countries such as Japan," Ming Lu, head of Asia private equity at KKR, said in a statement.

KKR set a previous record for Asia private equity fundraising with its $6 billion Asian Fund II in 2013, which has been fully deployed and posted a gross internal rate of return (IRR) of 29.1 percent through March 2017.

Returns above 20 percent are considered good for private equity funds.

KKR said it has invested more than $12 billion across the region in about 55 companies since it first set shop in Asia in 2006.

It has been particularly busy with large deals in Japan in recent months, announcing a $2.3 billion acquisition for Hitachi Ltd's (T:6501) chip-making equipment and video solution unit in April and $1.3 billion deal for power tools firm Hitachi Koki Co Ltd (T:6581) in January. That followed a $4.5 billion deal for auto parts supplier Calsonic Kansei Corp <7248.T> late last year.

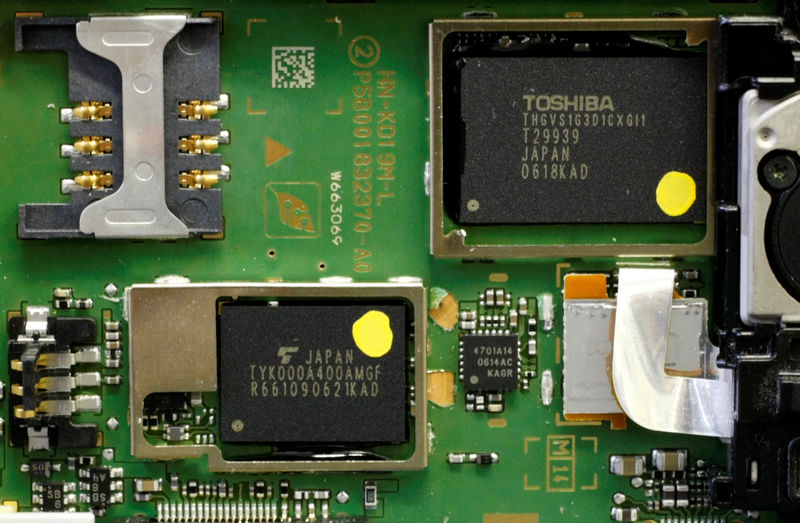

KKR is also one of the bidders for Toshiba Corp's (T:6502) semiconductor business - a deal that the Japanese conglomerate has valued at at least $18 billion. It is expected to team up with Japanese state-backed investors in a consortium for its offer.

Other recent deals include teaming up with Canada Pension Plan Investment Board (CPPIB) for a 10.3 percent stake in Indian telecom tower operator Bharti Infratel (NS:BHRI) worth $953 million in March, and an investment of $250 million in Vietnamese food producer Masan Group Corp (HM:MSN) in April.