Marcus Sotiriou, Analyst at the UK based digital asset broker GlobalBlock

Bitcoin (CRYPTO: BTC) dropped along with equities yesterday and continues its downtrend trading at $43,880 at the moment. The Federal Reserve’s Lael Brainard said that the central bank needs to start acting quickly and aggressively to fight inflation. She said that the Federal Reserve could start reducing the balance sheet as soon as May and at a rapid pace. As Brainard is typically dovish, meaning she normally favours low rates and accommodative policy, global markets including Bitcoin reacted negatively. However, I think this is an over-reaction from the markets, as Brainard pointed out things that we are already aware of.

Brainard also confirmed that the Federal Reserve wants to raise rates steadily and methodically, indicating that they will raise rates by the planned 0.25% in May. Federal Reserve Chairman Jerome Powell has said that he will try to emulate a tightening cycle like that of 2004 where the Federal Reserve raised rates by 0.25% 17 times. Therefore, unless inflation data being released next Tuesday on April 12th is significantly worse than expected, I am not concerned with how aggressive the Federal Reserve will be in the short term.

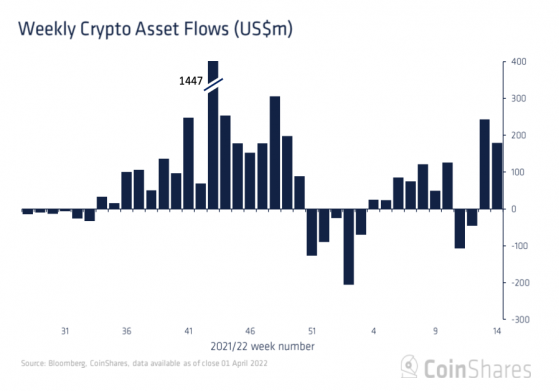

Institutions have been largely unphased by the macro headwinds recently, as cryptocurrency funds attracted inflows for the second consecutive week, according to a report from CoinShares. Around 99% of the inflows went into European funds, with some into Americas-based funds. Crypto funds saw $180 million of net inflows last week, which was lower than the $244 million of inflows during the prior week, yet still the second highest number of inflows in 17 weeks.

flows during the prior week, yet still the second highest number of inflows in 17 weeks.

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga