Good Morning Everyone!

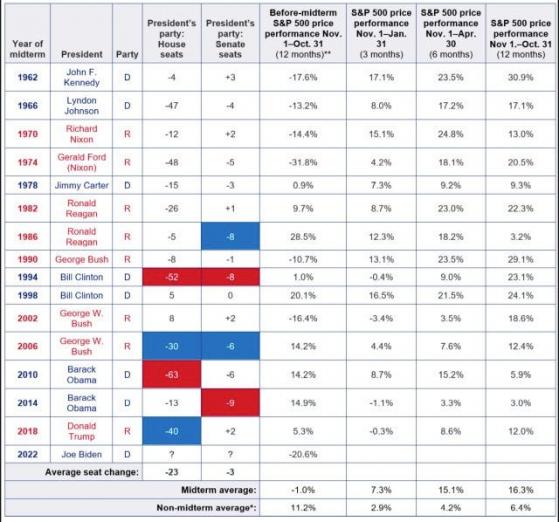

Today is midterm Election Day in the U.S. The S&P has historically outperformed the market in the 12-month period after a midterm election, with an average return of 16.3%. Let’s hope the trend is our friend!

Prices as of 4 pm EST, 11/7/22; % YTD

MARKET UPDATE Midterms

- Republicans are favored to take the House

- U.S. Senate is a dead heat

November 15

- Trump intentions on 2024 election

VIX lowest volatility since mid-September

- This will not last

- Midterms tonight

- CPI data on Thursday.

Crude 91 -1%

- A little weaker this morning on news that there’s a total of 7,000 covid cases in China, the most in 6 months

TikTok, Meta (NASDAQ: META)

- Brendan Carr, a Republican member of the Federal Communications Commission

- Reiterated his view that TikTok should be banned in the U.S.

Heading into the midterms, it’s interesting to note……

- 5-year total return of the S&P 500 Energy Sector and QQQ 0.10%↑ (Nasdaq 100) has now converged

- The outperformance of the Energy sector started exactly on the date Biden was elected in 2020 (green line)

- Recall, one of Biden’s first moves was to cancel the Keystone XL Pipeline

Used Cars, Manheim Index

- October at 200

- Down 2.2% month-over-month

- Pickup trucks down 1.3% month-over-month

-

This is interesting:

- Besides temporary shocks, 2008 and 2020, there has been no sustainable downturn in used car pricing in 20 years

Earnings

- Lyft (NASDAQ: NASDAQ:LYFT) -17%, ridership less than pre-pandemic

- TripAdvisor (NASDAQ: TRIP) -24%, soft Q4 guide

- Take-Two (NASDAQ:TTWO) Interactive (NASDAQ: TTWO) -17%, weaker mobile results

- Activision Blizzard (NASDAQ: NASDAQ:ATVI)

- Welltower (NYSE: WELL)

- Diamondback Energy (NASDAQ: FANG)

- International Flavors (NYSE: IFF)

- Mosaic (NYSE: MOS) - volume in-line, costs higher, Q4 guide below street

- Constellation Energy (NASDAQ: CEG)

- DuPont (NYSE: NYSE:DD) +3%, EPS 0.82>street 0.79, guide up modestly, buyback announced

Tonight

- Disney (NYSE: DIS) 7% implied move

CRYPTO UPDATE Crypto broadly down this morning

- Demand for protective puts spiking

- Ripple effects of FTX/Alameda/Binance drama

- Sam Bankman-Fried: “FTX is fine”

1) A competitor is trying to go after us with false rumors.SBF @SBF_FTXFTX is fine. Assets are fine.

Details:

— SBF (@SBF_FTX) November 7, 2022

1) A competitor is trying to go after us with false rumors. FTX is fine. Assets are fine. Details:

12:38 PM ∙ Nov 7, 2022

11,666Likes2,062Retweets

Bitcoin vs. the field

- Chart shows relative strength of altcoins vs. Bitcoin over past 10 days

- Several outperforming led by Dogecoin

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga