Good Morning Everyone!

Busy week with midterms on Tuesday, an inflation report Thursday and earnings from Disney, AMC, Palantir, Beyond Meat (NASDAQ:BYND).

Cambiar a la suscripción paga

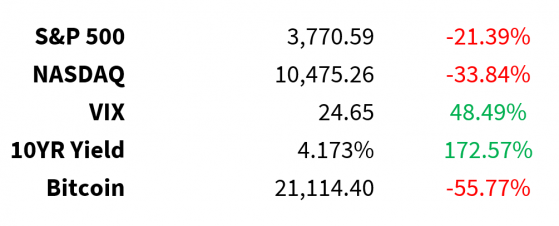

Prices as of 4 pm EST, 11/4/22; % YTD

MARKET UPDATE 38 trading days left in 2022 and we get 2 major events this week

- Midterms

- CPI

Higher rates have been death for long duration assets (technology and growth stocks)

- (NASDAQ: QQQ) did hold the October lows

- (ARCA: SPY (NYSE:SPY)) slightly above October lows

$3 trillion of market cap has been lost over the past 12 months (Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Google (NASDAQ:GOOGL), Meta).

- Microsoft (NASDAQ: MSFT) -33%

- Amazon (NASDAQ: AMZN) -48%

- Apple (NASDAQ: AAPL) -8%

- Google (NASDAQ: GOOGL) -42%

- Meta (NASDAQ: META) -73%

- This group’s market cap has shrunk from $9 trillion 12 months ago to just $6 trillion

- Where did this go? Fixed Income? Cash? Energy (only S&P 500 sector up over 1 year)?

Crude 92.45 flat

- China’s trade data for October disappointed with both imports and exports missing consensus

Berkshire Hathaway (NYSE:BRKa)

- Bought $1.05 billion of stock during the quarter

- Bought back $1 billion in Q2 and $3.2 billion in Q1

- Berkshire is trading at 1.4 times Q3 book value

- Auto insurance weak. GEICO loss ratio was 97% vs. last quarter of 88.4%

- Railroad BNSF below expectations on lower freight volumes and higher fuel and labour

- Q3 pretax loss from Hurricane Ian was $3.4 billion

Meta (NASDAQ: META) +4%

- WSJ reports on rumours that layoffs are coming this week

- Zuck says Meta will likely be smaller in 2023 than 2022

- Goal may be to cut at least $3-4 billion in operating expenses

- Barry Diller on CNBC this morning thinks: TikTok will eventually be banned in the U.S.

Apple (NASDAQ: AAPL) -2%

- Plans to produce at least 3 million fewer iPhone 14

- Aim to make 87 million devices vs. 90 million

- Softer demand and supply problems at Zhengzhou due to Covid-19 lockdowns

Microsoft (NASDAQ: MSFT)

- News out that MSFT’s $69 billion purchase of Activision Blizzard (NASDAQ:ATVI) is facing scrutiny from regulators

- $3 billion break-fee

Earnings

- BioNTech (NASDAQ: BNTX)

- Palantir (NYSE: PLTR)

CRYPTO UPDATE

Binance to liquidate FTX token holdings- Binance to sell $529 million of FTT (CRYPTO: FTT) (FTX’s token) due to “recent revelations”

- FTX experiencing high volume of withdrawals based on on-chain flows

-

FTX offered to buy tokens from Binance at $22

- Current price = $22.30

Digital asset flows

- Digital asset investment products saw minor outflows of $15.6 million last week

- Bitcoin snaps 7-week inflows streak…outflows of $13 million

- Short-Bitcoin 3-weeks consecutive outflows totaling $28 million

- Flows remain relatively muted (past ~2 months)

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga