Benzinga - To gain an edge, this is what you need to know today.

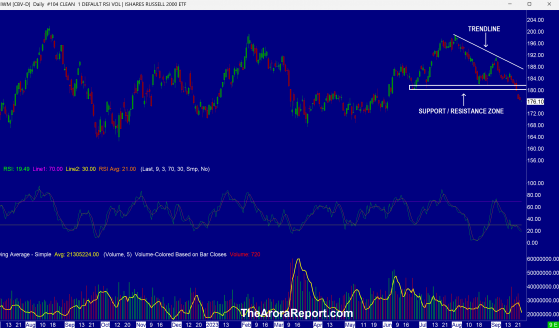

Recession Worries Please click here for a chart of iShares Russell 2000 ETF (ARCA: IWM).

Note the following:

- The chart shows that small caps have accelerated to the downside and are now far away from the downward sloping trendline. This is negative for the stock market.

- The chart shows that small caps have now broken below the support/resistance zone shown on the chart. This is negative for the stock market.

- In contrast to the small caps, large caps are holding up. Here are the reasons for this discrepancy:

- Small caps are more impacted by a recession than large caps.

- Large caps are held up by the AI frenzy. The AI frenzy is not helping small caps.

- Small caps are signaling a recession ahead at a time when the momo crowd believes in no landing.

- In addition to small caps, there are other troubling signals. The economy has been held up by excessive spending by the consumer. However, consumer defaults on loans are rapidly increasing, as are bankruptcies.

- In The Arora Report analysis, the liquidity that the consumer has enjoyed is going to become less and less going forward.

- To add to the troubles, the U.S. government shutdown is looming if both parties cannot come to an agreement.

- UAW is expanding its strike against General Motors Co (NYSE: GM) and Stellantis NV (NYSE: STLA). If the strike is prolonged, it will have a negative impact on the stock market.

- Global trade is falling at the fastest rate since 2020. This has a negative economic impact.

- Worries about the Chinese property sector are resurfacing causing stocks in Hong Kong to fall 1.8%.

- On the positive side, there is excitement about Amazon.com, Inc. (NASDAQ: AMZN) investing $4B in AI startup Anthropic. Amazon is trying to follow the same play Microsoft Corp (NASDAQ: MSFT) made with OpenAI, the creator of ChatGPT. OpenAI uses Microsoft’s Azure platform. Anthropic will use Amazon’s AWS cloud platform.

- Anthropic will also use AI chips from Amazon. In the early trade, this is having a negative impact on NVIDIA Corp (NASDAQ: NVDA) and Advanced Micro Devices, Inc. (NASDAQ: AMD). Even though a fortune is to be made in AI over the next seven years, this illustrates that, at times, it will be treacherous. It is important to completely follow The Arora Report system to minimize risks and maximize returns in AI. It is especially important to follow the Trade Management Guidelines and not get carried away with enthusiasm about AI.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

Magnificent Seven Money Flows In the early trade, money flows are positive in Amazon and Apple Inc (NASDAQ: AAPL).

In the early trade, money flows are negative in Nvidia, Microsoft, Alphabet Inc Class C (NASDAQ: GOOG), Meta Platforms Inc (NASDAQ: META), and Tesla Inc (NASDAQ: TSLA).

In the early trade, money flows are mixed in SPDR S&P 500 ETF Trust (ARCA:SPY) and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is