Proactive Investors - Grayscale Bitcoin Trust (GBTC), the largest bitcoin-only investment vehicle in the world, has enjoyed a healthy recovery in its discount in recent months, but recent JPMorgan Chase & Co (NYSE:NYSE:JPM) analysis contends that the vehicle could have a few headwinds coming its way.

It comes down to Grayscale (OTC:GBTC)’s long-running fight with the UK Securities and Exchange Commission (SEC) for permission to convert the trust into an exchange-traded fund, which would welcome GBTC as the first ETF of its kind onto the traditional stock exchange.

With odds on the application being approved, investors have bought into Grayscale’s discounted price in hopes of healthy returns once the ETF becomes a reality.

According to JPMorgan, around $2.5 billion has flowed into GBTC since the start of 2023 as the market bought into the rumour.

But an equal amount, or even more, could flow back out if these same investors sell the news.

“Assuming this buying flow was mostly speculative in anticipation of GBTC being converted to an ETF, then it is likely that this $2.7b would come out of GBTC as these investors take profit once GBTC gets converted,” analysts led by Nikolaos Panigirtzoglou wrote.

That could just be the beginning.

"Once the SEC approves spot bitcoin ETFs in the US, we envisage a more intense competition with the average fee for bitcoin ETFs converging towards that of Gold ETFs, which currently stands at around 50 basis points," they added.

At the moment, Grayscale has a 200 basis point management fee, which is well above the industry norm. If Grayscale doesn’t heavily reduce this fee, it could be priced out of the market, warned JPMorgan.

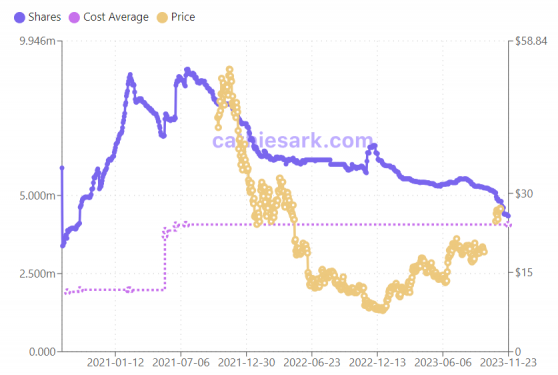

Famous tech investor Cathie Wood has already started paring down her stake in GBTC.

Following nearly $5 million in share disposal earlier in November, Wood’s ARK Next Generation Internet ETF (ARKW) sold another $1.9 million in GBTC shares this week.

ARKW’s holdings have fallen inverse to GBTC’s price recovery – Source: cathiesark.com

Perhaps Wood is already beginning to sell the news, just as GBTC’s price starts to recover.

Read more on Proactive Investors UK