Good Morning Everyone!

Inflation:

+8.3% YoY in August. Higher than +8.1% expected.

Average interest rate of savings account in America: 0.06%.

Do with this what you want.

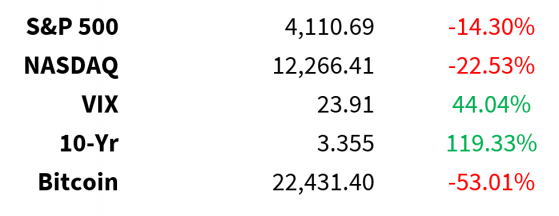

Prices as of 4 pm EST, 9/12/22; % YTD

MARKET UPDATE Market has rallied on:

But interest rates continue to trend higher at the same time (usually moves in opposite direction)

CPI year-over-year

- June 9.1% highest since 1981 (40+ year high)

- July 8.5%

- August 8.3% inflation dropped less than expected (8.1% expected)

Core CPI

- Up 6.3% versus 5.9% in July

10yr 3.4% moved from 3.3% to 3.4% after today’s inflation data

Federal Reserve meeting

- Next week (Sept. 21)

- 75-basis point increase in the bag

- Federal Funds Target (NYSE:TGT) Rate Range 2.25% to 2.5%

- New expected Range 3.0% to 3.25%

US$ 109

C$ 76

VIX 24

Crude 87 -0.5%

- Supply constraints vs. China/U.S. recession fears

- U.S. Strategic Reserves at lowest level since 1984

- Versus

- China 3-day Festival holiday trips fell by 16.7%

- Tomorrow: U.S. Department of Energy report

Emmy Awards

- HBO took home the most Emmy Awards last night

- 38 wins including Succession and White Lotus, up from 19 wins last year

- Netflix (NASDAQ: NASDAQ:NFLX) at #2 with 26 wins, down from 44 last year

Meta (NASDAQ: META)

- This is the opportunity ahead of Zuck (Value Stock)

- Close the 10-to-1 gap.

- According to WSJ:

- Users cumulatively spending

- TikTok 197.8 million hours a day

- Reels 17.6 million hours a day

Earnings

- Oracle (NYSE: NYSE:ORCL) - stock flat, building cloud but no EPS upside

CRYPTO UPDATE Institutional adoption

- Fidelity considering Bitcoin (CRYPTO: BTC) trading on its brokerage platform

- Chicago Mercantile Exchange (NASDAQ: CME) launching ether options

Coffee & NFTs

- Starbucks’ (NASDAQ: SBUX) new NFT-based loyalty rewards program

- Built on Polygon (CRYPTO: MATIC) PoS network

- “Starbucks (NASDAQ:SBUX) Odyssey” - waitlist open

Digital asset flows

- Total outflows = $62.7 million

-

5th consecutive week of outflows

- 5-week total = $99 million

- Relatively small

- Weak volume at 46% of year average

- Contrarian inflows out of Europe ($7 million)

- Altcoins minor inflows

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga