By David Milliken

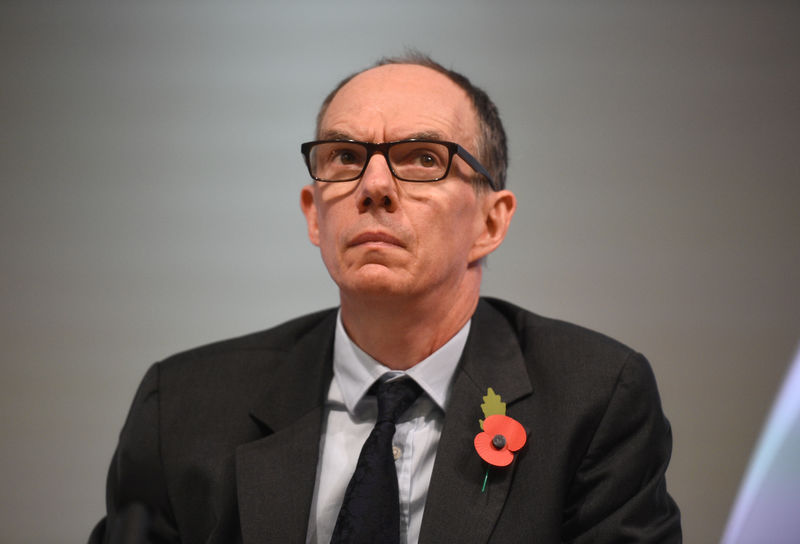

LONDON (Reuters) - Bank of England Deputy Governor Dave Ramsden said he still saw a case for a gradual increase in interest rates if Britain manages a smooth departure from the European Union, maintaining a slightly more hawkish tone than some of his colleagues.

Britain's parliament is due to vote on Saturday on a new transition deal Prime Minister Boris Johnson agreed with Brussels, which would maintain existing trade arrangements for more than a year while longer-term trade barriers are discussed.

"The kind of guidance we've been giving - in the world ofa deal it still applies," Ramsden said in an interview with Bloomberg News published on Friday.

"We're not saying over what timeframe, but limited and gradual (rate increases) is a reasonable qualitative framing," he added, referring to the BoE's longstanding guidance on rates.

Sterling edged higher against the dollar following Ramsden's remarks, which differ from the position of others on the BoE's Monetary Policy Committee, who have said a rate cut could be needed if there is uncertainty after a Brexit deal.

Ramsden said he believed a transition deal could create some pick-up in investment and productivity if it brought clarity to businesses.

Brexit uncertainty up to now had damaged business investment and productivity, he said, lowering the rate at which it could grow without generating excess inflation, which in turn weakens the case for a rate cut.

"(This) all adds up to me to be quite a weak position on the supply side, which, for us, then limits the speed limit in which the economy can grow," he said, echoing remarks in an interview with the Daily Telegraph newspaper published online on Sunday.

Other BoE officials, such as external MPC members Michael Saunders and Gertjan Vlieghe, have identified less of a hit to the economy's supply capacity, pointing instead to a need for lower interest rates to help restore growth to its potential.

Britain's economy shrank by 0.2% in the three months to June, its first fall since 2012.

Ramsden said the BoE would keep a close eye on currency markets after Saturday's vote, where Johnson will need support from opposition politicians to pass his deal.