Good Morning Everyone!

Turns out free money is very expensive.

- FTX/Alemeda collapse will cost US$7-12B - FTX worth almost NOTHING

- Meta - lost US$730 billion in 12 months – soon be worth NOTHING?

- Tiger Global - hedge fund losing US$40MM a day

The system needs a reset.

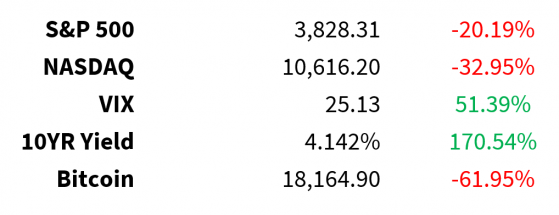

Prices as of 4 pm EST, 11/8/22; % YTD

MARKET UPDATE Markets move to Thursday’s CPI number after Midterm results trickle in

- Midterms did not move the markets

- CPI likely will (Thursday)

- Cleveland Fed Inflation Nowcast:

Crude 88 -1%

- Lower on a large crude build in the API weekly

Midterms

-

Senate

- Control is up in the air

- Georgia, Arizona, Nevada are too close to call

- Georgia likely to go to a run-off in December

- Democrats flipped a Senate seat in Pennsylvania, Fetterman defeated Dr. Oz

-

House

- Republicans likely to take the House but by a smaller margin than forecast

Meta (NASDAQ: META) +5%

- Letting go of around 11,000 employees and extending a hiring freeze through Q1

- 13% of its staff

- First ever broad restructuring at Facebook/Meta

- 2023 operating budget $97 billion at mid-point vs. prior $98.5 billion

- 2023 capital expenditures $35.5 billion at mid-point vs. prior $36.5 billion

Disney (NYSE: DIS) -8%

- Revenue miss = 5%

- EBIT operating miss = 23%, largely due to Parks

- Parks margins missed

- Bigger losses at direct-to-consumer streaming and linear

- Disney+ sub adds beat 12.1 million but average revenue per user declined 5% y/y

ByteDance/TikTok

- Also getting hit with lower Advertising revenue

- Slashed $2 billion off its 2022 Ad Revenue target ($12B to $10B)

Tesla (NASDAQ: TSLA (NASDAQ:TSLA))

- Elon Musk sold around $4 billion of Tesla stock to close Twitter deal

- Elon also sold stock in August

Taiwan Semiconductor

- Plans to build another chip making plant in Arizona

- Already announced a $12 billion complex

- The two plants will be north of Phoenix

Earnings

- Affirm (NASDAQ: AFRM) -16%, lowered 2023 guide

- Occidental Petro (NYSE: NYSE:OXY) -1%, cash Flow, FCF and production beat, EPS slight miss

- Lucid (NASDAQ: LCID)

- D.R. Horton (NYSE: DHI) -2%, Revenue $9.87B vs. guide $10-10.8B, EPS $4.67 vs. $5.07

- Roblox (NYSE: RBLX) -15%, revenue miss, less gaming

- AMC (NYSE: AMC) -1%

CRYPTO UPDATE FTX (CRYPTO: FTT) update: things very much not “fine”

- FTX facing serious liquidity crunch

-

Binance signs non-binding LOI to acquire FTX

- No guarantees…due diligence underway

- Just months ago FTX was doing the bailouts

- Who is left to bailout Binance if it fails?

- Is FTX’s Sam Bankman-Fried the next Warren Buffett: A Hard NO

- FTT (FTX token) crashed…down >80%

- Surge in withdrawals out of Jump Trading, Alameda Research (both owned by FTX):

Ripple effects felt throughout crypto

- October crypto gains have been erased

- Prices back at June lows

MEME OF THE DAY

Welcome pic.twitter.com/vUumPVw92r© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.— Yuno (@yuno0Zy) November 8, 2022

Read the original article on Benzinga