Benzinga - To gain an edge, this is what you need to know today.

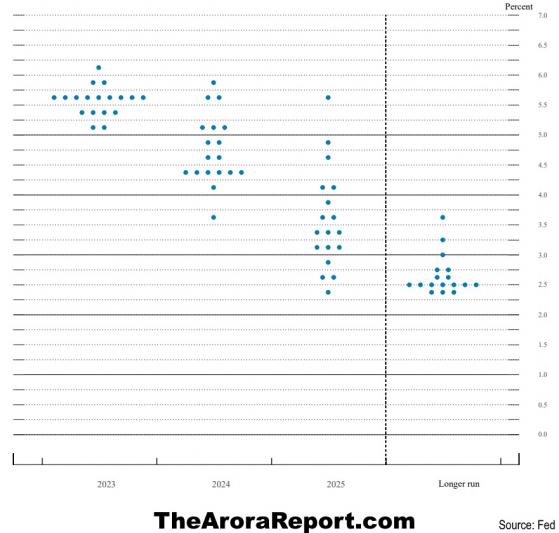

Dot Plot Please click here for the Fed’s prior dot plot.

Note the following:

- The FOMC meeting is starting today. Tomorrow, the Fed will announce its decision at 2pm ET followed by Powell’s press conference at 2:30pm ET.

- The dot plot shows each FOMC participants’ projected mid point of the target for the federal funds rate. Each dot represents an FOMC participant.

- The chart shows that no FOMC participants projected a federal funds rate of less than 5.125% in 2023.

- The chart shows that one FOMC participant projected a federal funds rate above 6% in 2023.

- The chart shows wide dispersion in 2024. The highest projection is 5.875%. The lowest projection is 3.625%.

- In The Arora Report analysis, there is enough uncertainty in the economic data that the high end of the projection at 5.875% and the lower end of the projection 3.625% are both possible. This is why it is important for investors to start from Arora’s Second Law of Investing and Trading. Arora’s Second Law states, “Nobody knows with certainty what is going to happen next in the markets.” It is important to not get locked into a bullish or bearish point of view. Consider flowing with the new data points. The Morning Capsules are your best source of new data points that matter. For the most part, you can ignore new data points that are not mentioned in the Morning Capsule.

- The Fed is expected to release a new dot plot tomorrow.

- The most important information from the Fed meeting will be the dot plot.

- The consensus is that the Fed will have a hawkish statement but leave the rate unchanged.

- Regarding the dot plot, momo gurus believe the dot plot will show as many as five interest rate cuts. This is the reason momo gurus are giving to urge their followers to aggressively buy stocks. The historical record is clear – momo gurus have consistently been wrong, yet being wrong does not stop momo gurus from making new projections and pretending that they know what the market will do. Keep in mind that momo gurus’ real job is to run up the stock market under the disguise of analysis. Nonetheless, it is important to pay attention to what momo gurus are saying because they have legions of followers who do not deeply analyze but instead, blindly buy.

- Prudent investors should note that in contrast to the momo crowd, smart money is not engaging in wholesale buying of stocks at this time.

- The Arora Report has consistently called every major Fed move correctly over the last 16 years.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

Housing Starts Housing starts fell, but building permits went up. This indicates that high interest rates are beginning to reduce immediate demand for housing, but builders remain optimistic for the future. Here are the details:

- Housing starts came at 1.283M vs. 1.435M consensus.

- Building permits came at 1.543M vs. 1.442M consensus.

Magnificent Seven Money Flows In the early trade, money flows are positive in Apple Inc (NASDAQ: AAPL). Anecdotal evidence is that orders for iPhone 15 in China are strong. Yesterday, we shared with you that iPhone 15 preorders in the U.S. appear to be better than expected.

In the early trade, money flows are negative in Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc Class C (NASDAQ: GOOG), Meta Platforms Inc (NASDAQ: META), Microsoft Corp (NASDAQ: MSFT), NVIDIA Corp (NASDAQ: NVDA), and Tesla Inc (NASDAQ: TSLA).

In the early trade, money flows are negative in SPDR S&P 500 ETF Trust (ARCA:SPY) and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is