Good Morning Everyone!

Remember, tough markets don’t last but tough investors do.

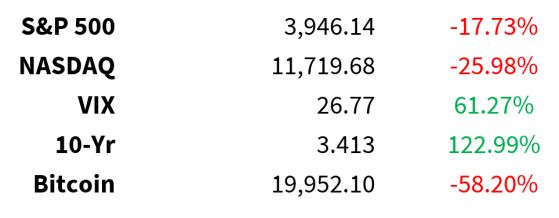

Prices as of 4 pm EST, 9/14/22; % YTD

MARKET UPDATE Yield curve remains inverted

- 10yr 3.4% - highest since 2011

- 2yr 3.8% - highest since 2007

- Fed typically ends tightening after inversions…

- …different this time…

Retail Sales +0.3% MoM (vs. 0.0% expected)

- Retail sales ex autos dropped (-0.3% vs +0.1% expected) for first time this year

Regional manufacturing - contraction

- NY Empire State Manufacturing -1.5 (vs. -13 expected)

- Philly Fed Manufacturing Index -9.9 (vs. 2.8 expected)

Import prices -1% (vs. -1.2% expected)

Export prices -1.6% (vs. -1.2% expected)

US 30-year mortgage interest rate tops 6% for first time since 2008

Railroad strike - crisis averted

- White House reaches tentative agreement

- Would have been massive disruption to economy

- 27% of US freight moved by rail

- Ports already bottlenecked:

- And food shipments threatened:

Crude $87.5

-

China eases Covid restrictions in Chengdu (megacity, 21 million people)

- BUT, growth projections have been declining

- EIA small crude inventory build (2.4 million barrels)

Earnings None

CRYPTO UPDATE

And we finalized!Merge SUCCESSFUL: Ethereum (CRYPTO: ETH) switches to proof-of-stakeHappy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.

— vitalik.eth (@VitalikButerin) September 15, 2022

- Initiated at 2:45 am EST, completed 13 min later

- Nothing seems to have broken

- Estimated to reduce blockchain’s power consumption by 99.95%

- Move will drop new supply issuance of ETH by 90%

- ETH mined per day down to 1,600 from 13,000

- Miners replaced by validators

- End-user experience unchanged

- Focus will now be to grow scalability via rollups

MEME OF THE DAY

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga