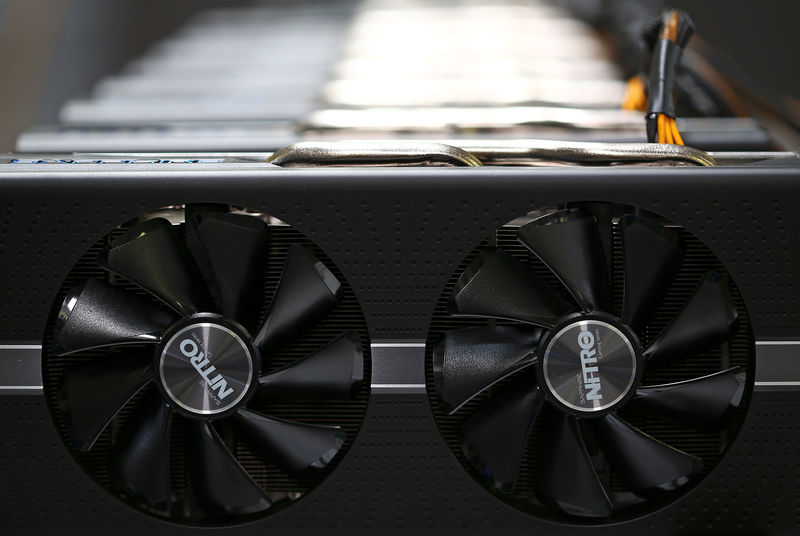

Bitcoin’s energy consumption surged 41% year-on-year despite significant efficiency improvements and a more diverse and sustainable mix, with record-high mining difficulty being a big factor.

Bitcoin mining difficulty just reached an all-time high… Why does it matter?

This once again raised concerns amongst crypto miners that regulators may soon intervene and clamp down on the activity.

A third-quarter 2022 report by the Bitcoin Mining Council (BMC), which represents 51 of the world’s biggest BTC mining companies, found that the most popular cryptocurrency’s mining consumed 0.16% of global energy production.

Bitcoin mining was also found to emit 0.1% of the globe’s carbon emissions, which the BMC labelled “negligible.”

Environmentalists have long been pressurising Bitcoin miners, claiming the amount of power consumption is detrimental to the ecosystem.

Greenpeace has been running a “change the code not the climate” campaign to incentivise the BTC network to move to the more environmentally friendly proof-of-stake approach.

Although in Q3 2022, Bitcoin’s mining efficiency reportedly increased by 23% when compared with the same period last year.

The European Union rejected a proposal in March that would have entirely banned cryptocurrency mining but tighter regulation could still be around the corner.

Bitcoin’s energy usage uptick came as its hash rate (processing power used) rose 8.3% in the third quarter and 73% year-on-year, despite fewer blocks being made and downward price pressure, Coin Telegraph said..

Blockchain data analytics company Glassnode insisted the “hash rate rise is due to more efficient mining hardware coming online and/or miners with superior balance sheets having a larger share of the hash power network.”