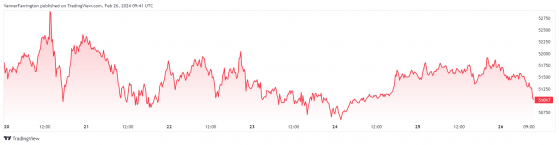

Proactive Investors - The cryptocurrency markets opened the new week on the back foot despite a bullish weekend session, with bitcoin paring back 1.4% against the US dollar in opening European exchanges.

It follows a strong showing on Saturday and a buoyant Sunday, which saw the benchmark cryptocurrency surge around 2% against the dollar.

At the time of writing, the BTC/USD pair was swapping just above the $51,000 price point, roughly 2.3% lower week on week.

Ethereum (ETH), meanwhile, had easily its strongest weekend in 2024 to date, adding 2.4% on Saturday before ramping up over 4% against the US dollar on Sunday.

Monday morning trades have been less bullish for the ETH/USD pair, but it has managed to safely hold above $3,000, with buying support camped at the $3,050 mark per Binance’s order book.

Nasdaq-listed cryptocurrency exchange Coinbase Global Inc (NASDAQ:COIN) has thrown its weight behind Grayscale’s Ethereum ETF ambitions in a recent letter to the US Securities and Exchange Commission.

According to Coinbase, the SEC should approve ether ETFS for “virtually identical reasons” as bitcoin ETFs.

The SEC, however, has made no indication that it is considering Grayscale’s ether ETF applications.

In the wider altcoin space, Binance’s BNB token has pulled forward, adding 9.5% week on week, while decentralised finance (DeFi) coin Uniswap (UNI) has rocketed up nearly 40%.

Global cryptocurrency market capitalisation is sitting at $1.97 trillion, with bitcoin dominance at 52.3%.