Proactive Investors - Bitcoin's breakout performance in 2023 was partially a result of turmoil in the traditional financial markets following a spate of crises hitting Silicon Valley Bank, Signature Bank and, most critically, Credit Suisse (SIX:CSGN).

A run on deposits saw investors turn to what they considered safe-haven assets to guard against further TradFi turmoil, with gold and bitcoin pipped as the short-term saviours.

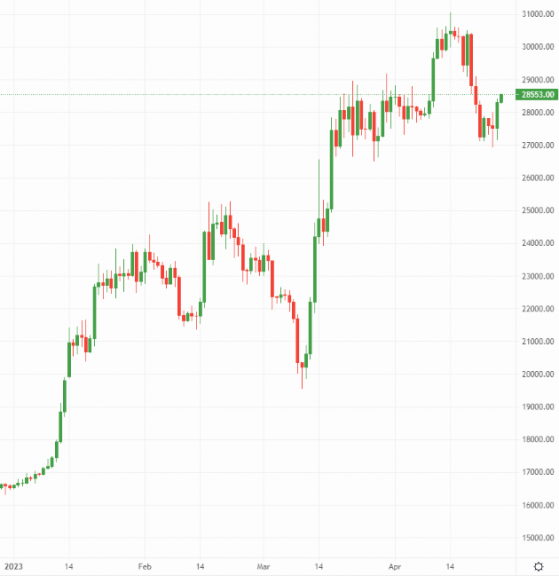

Bitcoin surged as high as US$31,000 – an 80% year-to-date increase – by mid-April, only for a pretty sharp correction back to around 27k earlier this week.

Yet the spectre of TradFi volatility reared its ugly head once again in the form of earnings from First Republic Bank (NYSE:FRC) - one of the US’s premier regionals and among the most exposed to SVB’s collapse.

First Republic’s shares dropped like a stone on Tuesday after disclosing unprecedented deposit outflows of 40% to $104.5bn in its latest quarter, a fair chunk worse than consensus estimates.

Conversely, Bitcoin rallied close to 3% following First Bank’s disclosures, in something resembling an inverse relationship with the perceived health of the US financial sector’s mid-tier. At the time of writing, the BTC/USDT pair was changing hands at US$28,700.

Bitcoin back above 30k? – Source: currency.com

While open interest in the derivatives market has not noticeably surged, the tick higher on bitcoin’s spot price implied a rush of inflows as investors seek to diversify.

Ethereum joined yesterday’s rally by adding 1.3% to US$1,870, with an incremental reversal to US$1,860 in this morning’s Asia trading session.

ETH’s post-Shanghai price rally has largely been slashed, but the world’s second-largest cryptocurrency appears to be consolidating around the 1.8k mark, where substantial buying support is evident on the Binance order book.

Week-on-week, ether has underperformed against bitcoin, with 8% in losses racked up against bitcoin’s 3.5%.

Global cryptocurrency market capitalisation ticked 2.7% higher to US$1.18tn by the close of Asia trades.

Binance drops Voyager Digital

In other news, Binance.US has ditched plans to buy bankrupt crypto lender Voyager Digital’s (NASDAQ:VYGR) assets for US$1bn, less than one week after the courts gave it the go-ahead.

The reason, Binance.US said was: “The hostile and uncertain regulatory climate in the United States has introduced an unpredictable operating environment impacting the entire American business community.”

Voyager called it a “disappointing” development, but said it “will now move swiftly to return value to customers via direct distributions”.

This marks the second failed deal for Voyager, which was one of the most high-profile collapses throughout to crypto winter of 2022.

FTX initially agreed to buy out the group, but that deal fell through for reasons I don’t need to explain.

Read more on Proactive Investors UK