Benzinga - Back from vacation and diving into a big week. The S&P 500 is just over 5% away from hitting its all-time high, FED's poised for a rate hike, second quarter GDP and big tech earnings are rolling in. Coffee in hand? Let's conquer this week together!

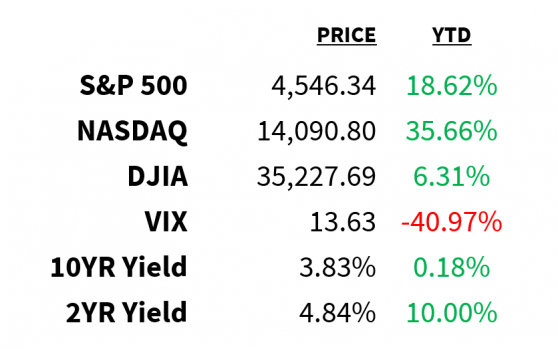

Market

Prices as of 4 pm EST, 7/21/23

Macro Institutional investors have never been more bearish on the US dollar.

- Net short positions on USD jumped by 18% last week.

- Driving the sentiment is continued progress on the inflation front.

- Improving inflation means a less hawkish Fed which could pose a significant headwind for the dollar.

- All eyes will be on the Fed’s next move.

Speaking of, the Fed will make its interest rate decision on Wednesday afternoon.

- With markets placing a 99.8% chance on a 25bps rate hike, investors will be parsing Powell’s words for clues on future policy.

- Following this week’s hike, markets expect the Fed funds rate to remain at 5.25-5.50% through Q1 2024.

- The first cut is seen happening in March:

CME Group

Stocks After 3 straight weeks of inflows, US equity funds saw $2.3 billion in outflows last week.

- Money still found its way into Tech, Financials, and Consumer Goods.

- In terms of positioning, investors are overweight Staples, Tech, and Telecom.

- Aggregate positioning in equities is in the 82nd percentile, according to Deutsche Bank, led by discretionary investors.

- Still lagging in exposure: hedge funds and mutual funds.

Deutsche Bank

With leadership at its narrowest in 30 years, the current rally’s breadth is worse than that of the Dotcom Bubble, according to JPMorgan.

- But bad breadth could be masking hidden opportunities.

- Goldman calculates the aggregate forward P/E of the “Magnificent 7” at 32x, putting the overall index at 20x.

- Beneath those 7, the bottom 493 carry a 17x multiple.

- Will the laggards close the gap?

Goldman Sachs

Energy Goldman Sachs and JPMorgan are predicting higher oil prices ahead.

- The former sees demand growing to all-time highs and a significant deficit in the second half.

- Both expect Brent to end the year at $86 a barrel:

JPMorgan

Earnings

Q2 earnings season update:

- 18% of S&P 500 companies have reported.

- 75% and 61% of companies have topped earnings and revenue estimates, respectively.

- Sectors reporting EPS growth: Discretionary, Communications, Industrials, Real Estate, Financials, Staples

- Sectors reporting sales growth: Financials, Discretionary, Healthcare, Staples, Real Estate, Industrials

- Blended earnings have dropped 9% while revenue has declined by 0.3%:

Fact Set

What we’re watching today:

- Cadence Design Systems (NASDAQ: CDNS)

- NXP Semiconductors (NASDAQ: NXPI)

- Alexandria Real Estate (NYSE: ARE)

- Brown & Brown (NYSE: BRO)

- Domino’s Pizza (NYSE: DPZ)

- Packaging of America (NYSE: PKG)

- Crown Holdings (NYSE: CCK)

- Logitech (NASDAQ: LOGI)

Top Headlines

- UK slowdown: Rising interest rates are hitting consumer spending and manufacturing in the UK.

- Japan inflation: The BOJ may be increasing its inflation forecast to 2.5% from 1.8%.

- Foreign investment: Chinese investment in the West has been slowing.

- Housing rally: Robert Shiller says the 10-year rally in US home prices could be ending.

- Crisis averted: Yellow struck a deal with 22,000 of its Teamsters-represented workers to avoid a strike.

- Barbenheimer: Barbie and Oppenheimer brought in a combined $235 million at the box office over the weekend.

- RIP Twitter: Musk has rebranded Twitter as “X”.

- Market narratives: These are the 2 competing market narratives according to Apollo’s Torsten Slok.

Week Ahead

- Monday: Chicago Fed National Activity Index, S&P Global Flash PMIs

- Tuesday: Redbook, Case-Shiller Home Prices, House Price Index, CB Consumer Confidence, Richmond Fed Manufacturing/Services Indexes, API stocks change

- Wednesday: MBA mortgage data, new home sales, EIA stocks change, Fed decision

- Thursday: GDP growth rate, Durable Goods orders, goods trade balance, initial jobless claims, retail/wholesale inventories, pending home sales, Kansas City Manufacturing

- Friday: Personal income/spending, PCE Price Index, Employment Cost Index, consumer sentiment

- Crypto

Prices as of 4 pm EST, 7/21/23

- HODL: Some 75% of Bitcoin’s (CRYPTO: BTC) circulating supply is controlled by long-term holders.

- BTC vol: Bitcoin’s 30-day volatility is at its lowest since mid-January.

- Risk-averse: Activity in futures markets suggests Bitcoin traders remain cautious.

- Worldcoin: Sam Altman’s Worldcoin launched its WLD token today which investors have met with open wallets.

- XRP ruling: An SEC appeal in its case against Ripple doesn’t appear to represent a significant setback for the ruling.

Deals

- Shadow bank: Bain Capital will buy Gautam Adani’s stake in his shadow bank.

- Investment banking: While big Wall Street firms downsize, smaller players are bulking up.

- M&A traders: Merger arbitrage is among this year’s worst-performing hedge fund strategies.

- Aerospace: Safran will buy Collins Aerospace’s flight controls business for $1.8 billion in cash.

- ESPN search: In its search for a strategic partner, ESPN has talked with the NBA, NFL, and MLB.

Meme Of The Day

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga