Good Morning Everyone!

Hedge Fund leverage is near all-time lows and retail investment accounts have record cash. Sounds like we’re closer to stock market bottom than top.

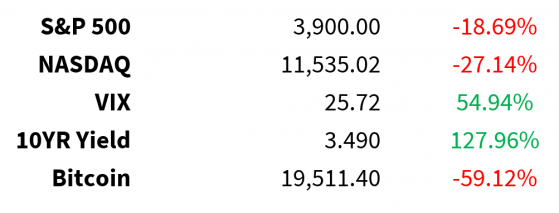

Prices as of 4 pm EST, 9/19/22; % YTD

MARKET UPDATE S&P

- Sitting on 3900-support ahead of FOMC meeting tomorrow

- Decision at 2 p.m. tomorrow

10yr 3.5% highest level since 2011

2 yr 3.9% highest level since 2007

- Only 16% of the S&P 500 stocks have dividend yields higher than the 2-year Treasury

- Lowest since 2006

US$ 109.7

C$ 75

Crude 85 flat

- International Energy Agency called for a global ban on petrol and diesel cars by 2035

- Electric cars are currently 1% of global car sales

- The IEA says this needs to increase to 20-25% by 2030.

Ford (NYSE: F)

- Cuts Q3 guide on shortages and inflation

- Ford expects to end Q3 with over $2 billion worth of vehicles (40-45 vehicles) awaiting parts, pushing profit to Q4

- Supply chain tightness not over yet

- Ford announced based on recent negotiations, inflation-related supplier costs will run higher in Q3

Earnings: None

CRYPTO UPDATE Nasdaq’s big crypto push

-

New Nasdaq Digital Assets unit

- Run by former Gemini employee

- Offer custody services for BTC (CRYPTO: BTC) and ETH (CRYPTO: ETH) to institutional investors

- Competing with Coinbase (NASDAQ:COIN), Anchorage Digital, Bit Go, etc.

- Open to exploring partnerships and deal opportunities

SEC charges influencer over unregistered 2018 ICO (initial coin offering)

- ICO charge is not the big story

- SEC’s language suggests it believes ALL Ethereum transactions fall under its purview

- “Saying that enables [the SEC] to characterize doing business on the Ethereum blockchain, as doing business on a US securities exchange” - Brian Fyre (University of Kentucky law professor)

Bitcoin supply

- Supply held by long-term holders (HODLers) reaches new ATH at 13.62 million

- HODL: 65% of Bitcoin’s supply hasn’t moved in at least a year:

MEME OF THE DAY

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga