(Bloomberg) -- It’s the second day of CERAWeek by IHS Markit, the annual week-long gathering in Houston of some of the energy industry’s biggest names. Today’s agenda includes African oil exploration, North American refining and the impact of electric cars on crude demand.

Time stamps are Houston.

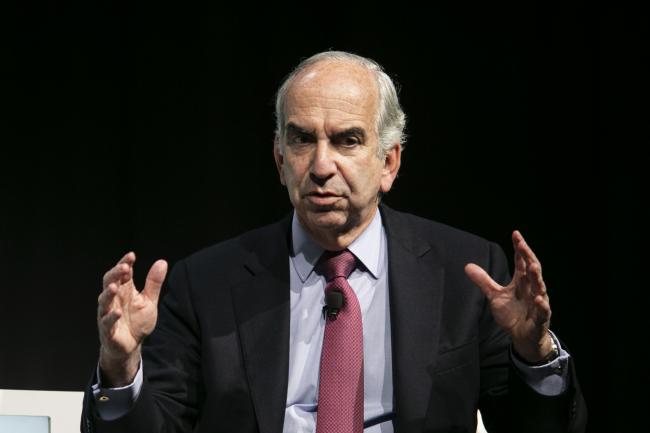

Shale Pioneer Papa Warns Oil Growth Is at Risk (2:14 p.m.)

Shale pioneer Mark Papa is warning again that the industry he helped create is facing fundamental obstaclesthat will slow America’s oil boom.

While technological advances will help improve the rates at which drillers recover oil, that growth will be offset by challenges with well spacing and the “degradation” of shale rock quality, said Papa, the chief executive officer of Centennial Resource Development Inc.

OPEC Is Said to Warn Wall Street on NOPEC (1:26 p.m.)

OPEC is sending a clear message to Wall Street banks and big investors: if Washington passes legislation that would allow the U.S. government to sue the cartel, the first victim will be shale.

Suhail Mohammed Al Mazrouei, the United Arab Emirates oil minister and the former president of OPEC, told a group of U.S. financiers Monday that if the so-called NOPEC bill becomes law, the cartel would stop working and therefore every member would raise production to maximum capacity, causing a crash in oil prices, according to people who attended the meeting.

The discussion took place in a closed-door meeting between Organization of Petroleum Exporting Countries officials and the financial community on the sidelines of CERAWeek.

DEA-Wintershall Ready for IPO by 2Q 2020: CEO (1:15 p.m.)

DEA Deutsche Erdoel aims to be ready for an initial public offering after its merger with Wintershall closes, CEO Maria Moraeus Hanssen said in an interview.

Pompeo Said to Meet With Oil Executives (12:51 p.m.)

U.S. Secretary Of State Mike Pompeo will meet with senior U.S. oil executives in Houston on Tuesday to discuss boosting boost crude exports and advancing America’s position as a global energy powerhouse, according to people with knowledge of the meeting.

Pompeo will talk about the role energy can play in advancing the Trump administration’s foreign policy goals, said the people, who declined to be named because the meeting is private. U.S.-granted waivers allowing some companies to buy Iranian crude despite sanctions are set to expire in May.

Marathon Hunting (LON:HTG) for Cheap Shale Outside Texas (12:03 p.m.)

Marathon Oil Corp (NYSE:MRO). is mirroring private equity as it looks for the next big thing in U.S. crude.

Instead of buying up smaller players in the crowded Permian Basin of West Texas and New Mexico, the explorer is opting to gobble up cheap drilling rights in overlooked areas like the Louisiana Austin Chalk, Chief Executive Officer Lee Tillman said in an interview.

NOPEC Legislation Counterproductive: OPEC Chief (11:19 a.m.)

Anti-OPEC legislation favored by some U.S. lawmakers won’t benefit the nation or its oil industry, OPEC Secretary General Mohammad Barkindo said.

The cartel is closely following the proposal’s progress in Washington D.C., he said. Shale drillers have confided they’ve actually seen benefits from OPEC measures aimed at culling a global supply glut, Barkindo said.

Shippers Will Stockpile Diesel, Says Marathon Chief (10:19 a.m.)

The shipping industry will begin stockpiling low-sulfur diesel by the middle of this year in preparation for tougher maritime fuel rules, Marathon Petroleum Corp (NYSE:MPC). CEO Gary Heminger said.

Heminger was commenting on the impact of the International Maritime Organization’s regulation kicking in next year that will bar the use of high-sulfur bunker fuel.

‘Show Me the Money’ Plea Reins in Shale: Hess CEO (7:58 a.m.)

Spending discipline has become the new rallying cry for investors in the shale patch, according to Hess Corp (NYSE:HES).’s chief executive officer.

Shareholders’ expectation “a couple years ago was ‘drill, baby, drill,’ ” John Hess said Tuesday in an interview with CNBC at the CERAWeek conference. “Now it’s ‘show me the money.’ ” The drive to cut capital expenditures means the industry isn’t investing enough to grow production, he said.

Petrobras Looks for Reserves From Contract Review (4 a.m.)

Brazilian oil giant Petrobras is looking to pocket undeveloped reserves instead of cash as compensation for a deep-water contract review that is nearing a conclusion, Chief Executive Officer Roberto Castello Branco said in an interview.

Petroleo Brasileiro SA, as the Rio de Janeiro-based company is formally known, has been negotiating for compensation from the so-called Transfer of Rights contract since late 2013. The producer is entitled to claim cash from the government after buying rights to produce 5 billion barrels of oil when prices were higher.

OPEC Splits Avocado Appetizer With Shale Rivals (12:12 a.m.)

Barkindo met with senior executives from North America’s booming shale oil industry for dinner in Houston as the balance of power in global energy markets continues its swing to the U.S. from the Middle East.

The dinner Monday night included “a friendly conversation on current industry issues and the immediate prospects and challenges for all,” Barkindo said in an interview after the meal. It marks the third consecutive year that rival producers have gathered on the sidelines of the CERAWeek event.

The menu began with an avocado appetizer followed by Texas steaks and a pineapple dessert.