By Andrew Mills and Maha El Dahan

DOHA (Reuters) -Germany is set to receive new flows of Qatari liquefied natural gas (LNG) from 2026 after QatarEnergy and ConocoPhillips (NYSE:COP) on Tuesday signed two sales and purchase agreements for its export covering at least a 15-year period.

Since Russia's invasion of Ukraine in February, competition for LNG has become intense, with Europe in particular needing vast amounts to help replace Russian pipeline gas that used to make up almost 40% of the continent's imports.

The deal, the first of its kind to Europe from Qatar's North Field expansion project, will provide Germany with 2 million tonnes of LNG annually, arriving from Ras Laffan in Qatar to Germany's northern LNG terminal of Brunsbuettel, QatarEnergy's chief executive said.

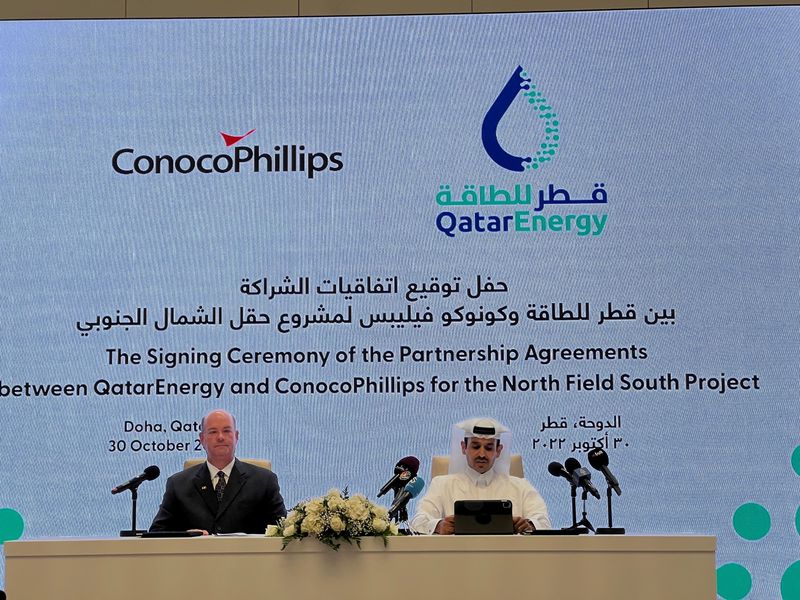

"(The agreements) mark the first ever long-term LNG supply agreement to Germany, with a supply period that extends for at least 15 years, thus contributing to Germany's long-term energy security," Saad al-Kaabi said in a joint news conference with ConocoPhillips CEO Ryan Lance.

A ConocoPhillips subsidiary will purchase the agreed quantities to be delivered to the German receiving terminal, which is currently under development.

QatarEnergy and German utility firms have been thrashing out long-term LNG deals for much of this year as Berlin looks for alternatives to Russia, which is Germany's biggest gas supplier.

Europe's biggest economy, which mainly relies on natural gas to power its industry, aims to replace all Russian energy imports by as soon as mid-2024.

Germany is Europe's biggest importer of Russian gas and would need around 40 million tonnes of LNG to replace the 50 billion cubic meters (bcm) of pipeline gas it used to get from Moscow. Its gas consumption in 2021 was around 88 bcm.

"By 2027, we think Germany's gas consumption would be around 73 bcm a year so this deal could cover around 3.7% of that," said Kaushal Ramesh, senior LNG analyst at Rystad Energy. "This is not an inconsequential volume and is a big step in diversifying supplies."

TALKS ONGOING

German Economy Minister Robert Habeck said on Tuesday the 15-year term of the deal was "great".

ICIS head of energy analytics Andreas Schroeder said the starting date of 2026 was late, as Germany needed LNG for 2023 and 2024.

"If German players do not secure sufficient volumes at an OK price for 2023, they will have to revert to spot LNG markets, and expose themselves to global price volatility."

Kaabi said negotiations were still taking place with other German companies for further supply.

Asked on Tuesday whether some German politicians' criticism of Qatar hosting the soccer World Cup had had any impact on talks, Kaabi, who had previously ruled out the possibility, said QatarEnergy separated politics and business.

The deal comes a few days after QatarEnergy signed a 27-year sales and purchase agreement with China's Sinopec. The North Field is part of the world's biggest gas field, which Qatar shares with Iran.

QatarEnergy earlier this year signed five deals for North Field East (NFE), the first and larger of the two-phase North Field expansion plan, which includes six LNG trains that will ramp up Qatar's liquefaction capacity to 126 million tonnes per year by 2027 from 77 million.