By Meng Meng and Josephine Mason

TIANJIN, China/BEIJING (Reuters) - On a recent visit to the area around Tianjin Port Co Ltd, there were more than one hundred empty trucks parked at the coal storage centre run by Ningdong Logistic Co.

Once one of the busiest places close to Tianjin's sprawling port, the storage facility was now silent as activity had ground to a halt after the port operator last month announced a ban on trucking in coal or storing it there. The announcement was sooner than expected.

It is a sign that Beijing's years-long war on pollution is disrupting the logistics of the market for coal - one of China's crucial commodities - as well as the lives of what trucking industry insiders estimate are 60,000 drivers who carry coal to and from the port.

The central government has said it may extend the measure to ports in heavily industrialised Hebei province by September as it tries to combat choking pollution that often blankets the north of the country, including nearby Beijing.

"I was sending coal from Inner Mongolia to the port and carrying imported iron ore from the port to other places. The government has completely cut my livelihood," said Wang Fangyuan, who was based in Tianjin but has left with a fleet of 40 trucks and their drivers to ply the trade in Erdos, 800 miles to the northwest in Inner Mongolia.

"I have been working in this tough business for more than six years. What they have done is just adding more difficulty to our harsh life," he said by phone.

CLEANER AIR

Until now, Beijing's efforts to cut overcapacity and pollution had little impact on the output of the country's favourite fuel. Outdated, inefficient mines were shut, only to be replaced with production from leaner, cleaner ones. The ban has helped knock about 20 percent off Tianjin Port's shares but had its desired effect on air quality, at least locally.

"The air is so much cleaner now," said Wang Di, 29, who lost his job driving a coal truck and lives next to what had until recent weeks been a main trucking route near the port.

"It used to be very dirty. We couldn't even keep the windows open for more than five minutes. Otherwise, my face would be covered in coal dust."

A key coal hub, Tianjin Port last year handled about 110 million tonnes of coal arriving by truck and rail.

The port has said it is taking measures to increase rail freight to help offset the loss of trucked coal.

"The ban is aimed at reducing pollution from trucking coal, but they can use railways instead," said an analyst at Lianxun Securities who asked that his name not be used.

Total coal stocks at the port dropped to 1.9 million tonnes on May 8, from 2.82 million tonnes on April 21, according to data provided by consultancy China Sublime Information Group.

"The ban has sharply weakened Tianjin port's role as a leading trade port in China," said Zhang Min, a coal analyst with Sublime, putting it at a disadvantage to other ports such as Tangshan and Caofeidian.

It has also created traffic jams at nearby Huanghua port in Hebei province, and threatens to increase the cost of moving coal as traders shift to rail, which is more expensive.

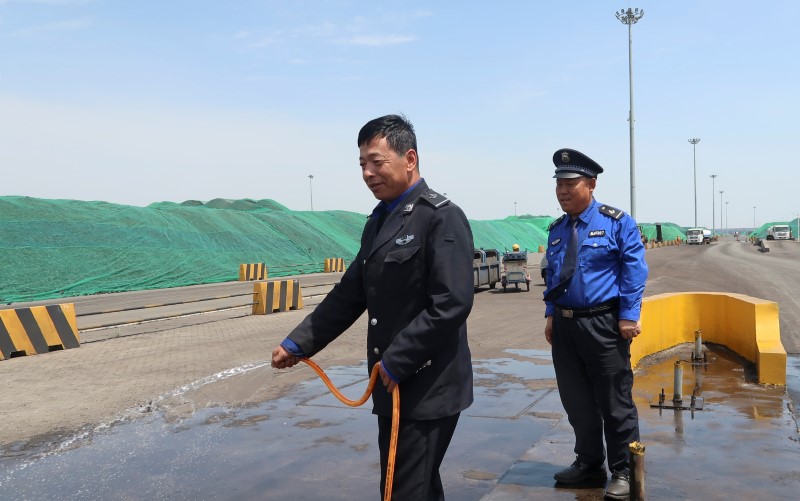

Inside the port's own coal storage area, around 600,000 tonnes of coking coal is covered in green plastic webbing since the start of May to reduce dust. Sprinklers are used to keep the dust down.

At a parking lot outside the port, driver Zhao Haidong is looking to sell his treasured Dongfeng Motor Hercules for just 40,000 yuan ($5,793) to 50,000 yuan ($7,240) after waiting around the port area for more than two weeks without work.

Six years ago, Zhao paid 160,000 yuan for the vehicle, and since then had been trucking the black stuff the short distance from a bulk commodities centre in Tianjin to the port.

A migrant from northeast China with two children in school in Tianjin, Zhao won't consider moving to Huanghua port.

"Drivers at the nearby port are underpaid and overworked because of a large group of drivers flooding into that port. I can only earn less than half of my current rate if I move."