(Bloomberg) -- Zinc reached its highest since 2007 and other industrial metals extended a powerful rally fueled by trade turmoil and rising energy costs amid Russia’s increasing economic isolation.

The metal used to coat and protect steel rose as much as 3.6% on the London Metal Exchange to reach $3,999 a ton, while aluminum notched a fresh record high and nickel surged.

Commodities markets from metals to oil and gas have been upended by the Ukraine crisis as big corporates withdraw from Russia, lenders pull back from financing deals and the threat of new sanctions deters buyers. Bloomberg’s gauge of commodity prices reached an all-time high on Wednesday.

It’s getting increasingly difficult to transport commodities like metals, which are shipped in containers as almost half of the world’s container ships will no longer go to and from Russia. Soaring global fuel prices add to upward pressure for metals by raising production costs and piling pressure on smelters.

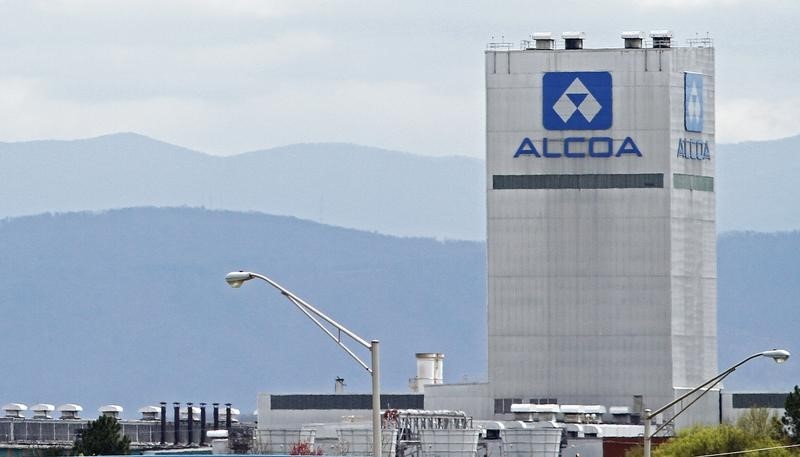

Alcoa (NYSE:AA) Corp., the largest U.S. aluminum producer, said it will stop selling products to Russian companies, and halt buying of raw materials from the country.

The turmoil comes at a time when global metals stockpiles are already low and falling further. Orders for aluminum jumped by 70,700 tons -- the most since June. Freely-available nickel stockpiles fell to the lowest since December 2019, while zinc holdings declined to the lowest since July 2020.

The U.S. Federal Reserve’s reassuring comments on monetary-policy tightening are also boosting risk appetite, boosting broader sentiment across markets including stocks. In testimony to U.S. lawmakers, Fed Chair Jerome Powell backed a measured Fed interest-rate liftoff and vigilance on inflation.

Zinc traded at $3,984 a ton by 11:47 a.m. Shanghai time. Aluminum surged as much as 2.3% while nickel gained 3.8%.

©2022 Bloomberg L.P.