By Eric Auchard

LONDON (Reuters) - Franco-Italian chipmaker STMicroelectronics promised on Tuesday to take a more aggressive approach to staunching losses at its troubled Digital Products Group, scrutinising individual businesses and "exploring options" for the division as a whole.

ST, Europe's largest semiconductor maker, used its annual Investor Day meeting in London on Tuesday to address questions hanging over its flagging digital products division, which accounted for 15 percent of the company's revenue last year.

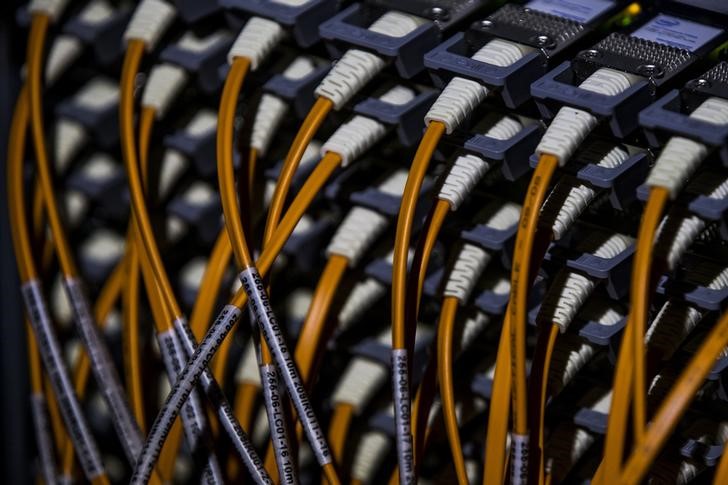

The Digital Products Group (DPG) makes chips used in television set-top boxes, datacentres and networks and specialised image sensors mostly used in consumer devices.

ST, which has struggled to reverse years of declining revenue and weak profit growth and has faced frequent calls to dispose of poorly performing units, promised on Tuesday that sustained revenue growth will return in the course of this year.

But DPG, one of five businesses in the highly diversified company, suffered a revenue decline in 2014 of between 30 and 40 percent while operating losses put a significant drag on the overall operating margin of between 20 and 50 percent.

"Business as usual is no longer an option," Chief Operating Officer Jean-Marc Chery said at the meeting.

Shares in ST, which traded around 2 percent lower in early trade, were up 4 percent at 7.3 euros by 1440 London time, the sole gainer in the 25-component Stoxx 600 Europe technology sector index <0#.SX8P>, which was down 1.3 percent.

"DPG's losses are unacceptable," Chief Executive Carlo Bozotti told the investor meeting. "This problem needs to be fixed and we are exploring options," he said, without specifying whether such actions may include the outright sale of the unit.

"A sense of urgency is there," Bozotti replied when grilled by analysts during a question and answer session at the meeting.

Ahead of the meeting broker Exane BNP Paribas (PARIS:BNPP) called on the company to dispose of the DPG business to free up the company to focus on its healthier business and said investors would shun the stock if the company did not take radical action.

MODEST GROWTH

The company has already engaged in a two-year campaign to kill low-margin DPG products, merge businesses and cut between 1,300 and 1,500 jobs, with some of those leaving the company and other jobs moving to its fast-growing MMS microcontroller unit.

Chery said DPG continues to struggle with its older digital set-top box component business while sales of new ultra high-definition set-top TV products have failed to take off so far.

Two weeks ago the company reported an unexpected cancellation and postponement of an important application-specific chip project which is aimed at consumer markets. An ST spokesman declined to provide further details.

Meanwhile the company said on Tuesday that it expects its revenue in the three months to end-June to increase by about 3.5 percent on the previous quarter.

ST said in April it expected the second-quarter sequential rise to be within a range of 0 to 7 percent, while analysts on average are expecting revenue to be up by 3.9 percent at $1.77 billion (£1.12 billion), according to Thomson Reuters data.

Executives reaffirmed that the company expects to report a significant year-on-year improvement in margins in the second half of this year as the benefits of a strong U.S. dollar begin to be felt more strongly in the fourth quarter.