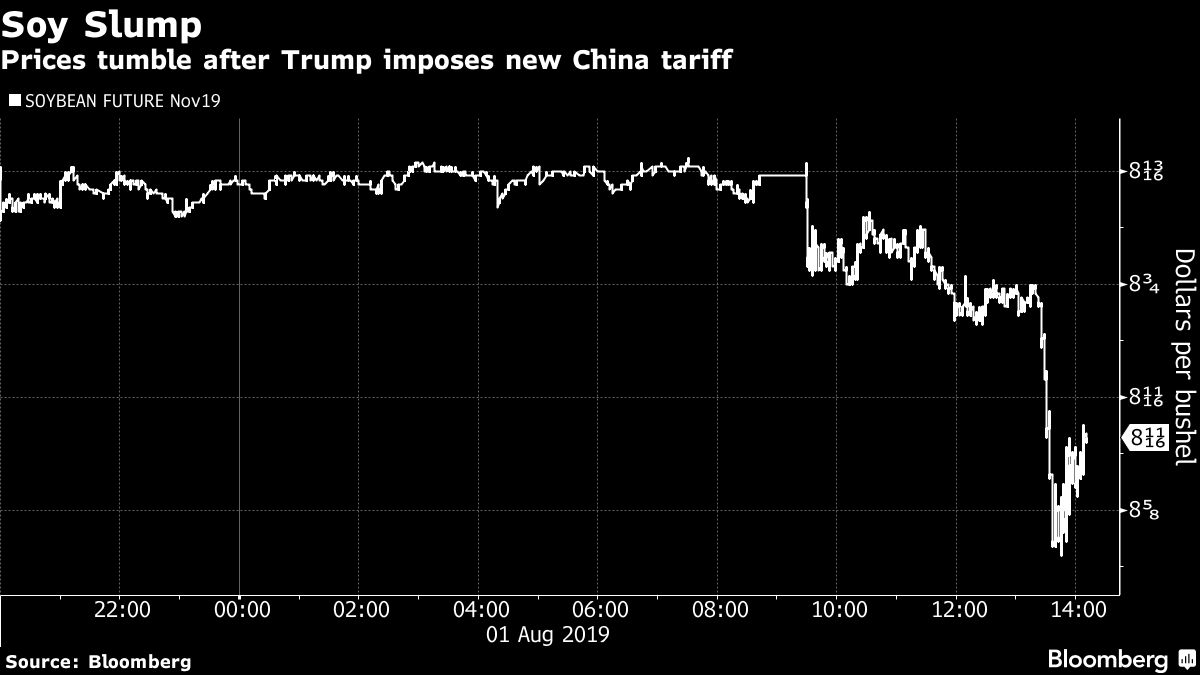

(Bloomberg) -- Most crop markets were roiled after President Donald Trump’s latest tweet on tariffs underscored investor fears that the U.S. and China are moving even farther away from a trade deal.

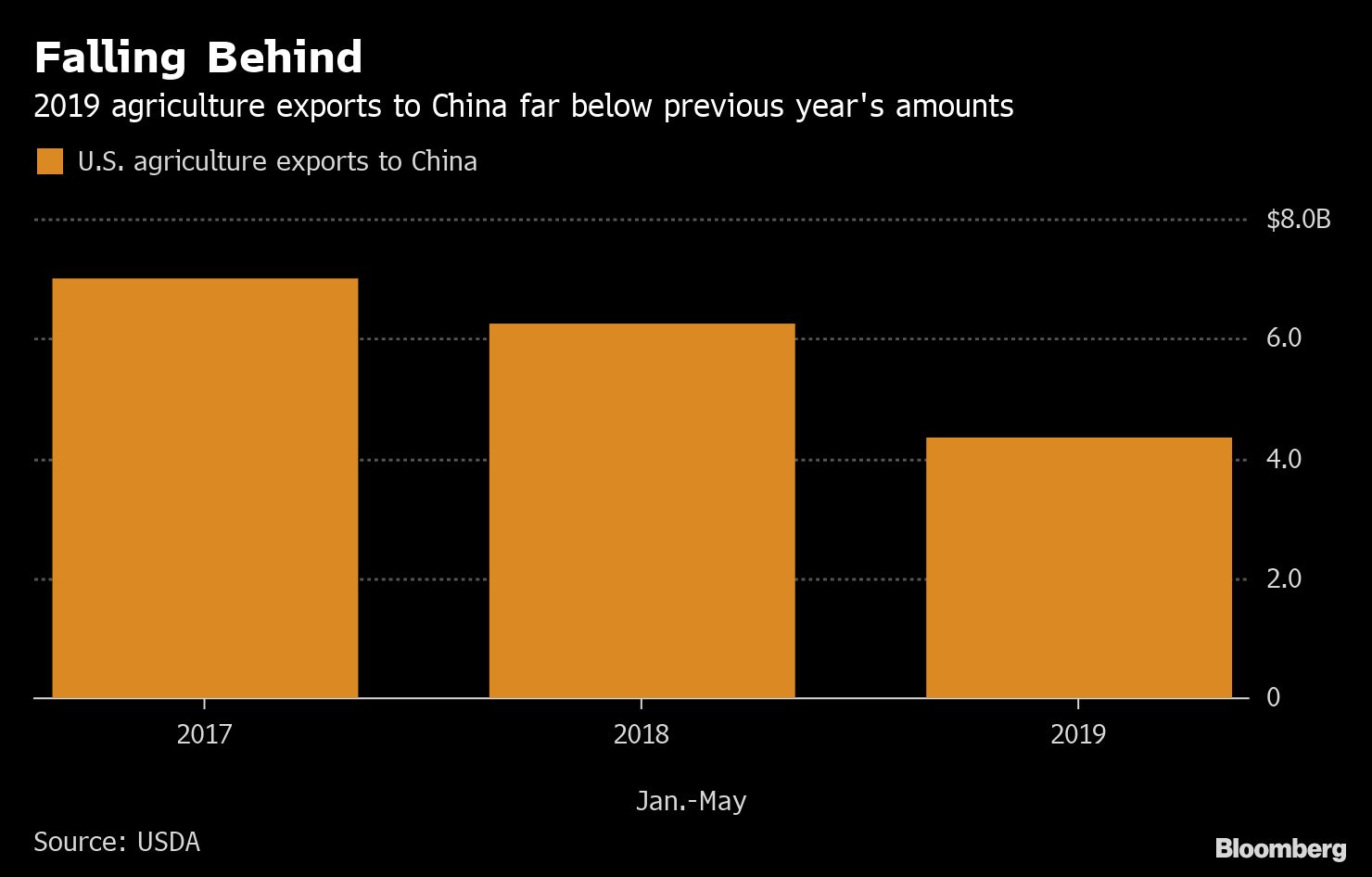

Soybeans fell as much as 2.4%, while cotton and hogs also extended declines. Demand for U.S. farm goods has languished amid retaliatory Chinese duties that have lasted more than a year. Shares of agricultural giants, Archer-Daniels-Midland Co. and Bunge Ltd., pared earlier gains.

“It’s a risk-off trade,’’ Don Roose, president of brokerage U.S. Commodities in Iowa, said by phone. “We had a prelude that things were not going well, and the announcement of the new tariff was all it took to take this market down.’’

Agriculture giant ADM earlier Thursday said it was stepping up a cost-cutting drive to fight thin industry margins as a resolution to the U.S.-China trade war takes longer than expected. Bunge is also going through a similar process, while Cargill Inc. said last month that it was reviewing its business plans due to a slowdown in earnings and headwinds to its operations.

Farmers are suffering from depressed incomes as the trade war adds to bulging U.S. inventories. While the Trump administration has unveiled two rounds of federal aid to help producers mitigate their losses, most growers have said they’d rather see an end to the dispute.

China, the world’s biggest consumer of soy, pork and cotton, has largely snubbed American purchases during the yearlong trade dispute between the nations.