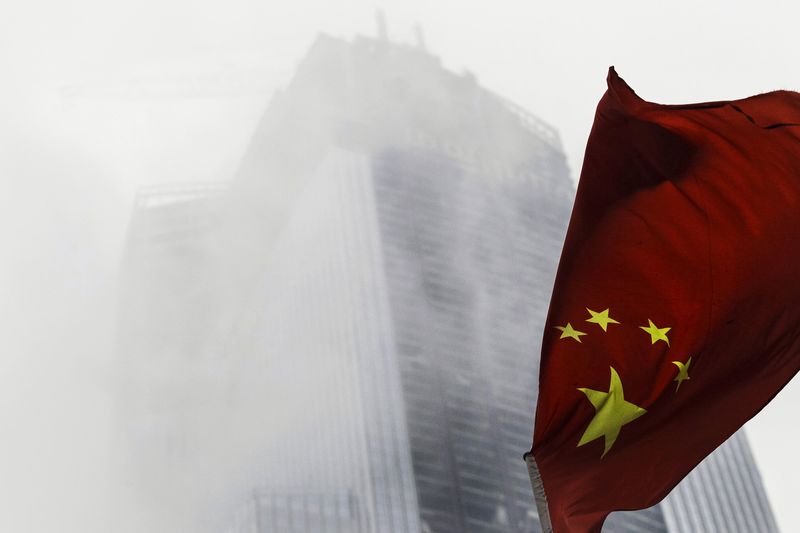

(Bloomberg) -- China’s drive toward bluer skies has been boosting demand for the cleaner burning -- and more expensive -- iron ore supplied by the top exporters. But the good times may be over.

The proposition that there’s a structural shift underway in the iron ore tastes of Chinese steel mills toward the less-polluting varieties is just a myth, according to Liberum Capital Ltd. The London-based broker joins Barclays (LON:BARC) Plc in arguing that the rising preference for high-quality will wane and the premium it commands over lower-quality supply will shrink.

Iron ore’s at risk of sliding back into a bear market after racking up three weeks of losses. Barclays has forecast that the commodity will probably drop back into the $50s a metric ton as the profitability of mills ebbs, undercutting demand for higher-grade material. In contrast, Goldman Sachs Group Inc (NYSE:GS). had flagged it expects the shift to premium ore to endure.

Premiums for higher-grades have always had a close relationship to the level of profitability of Chinese steel mills, according to Liberum. “As margins fall, lower-grade material becomes more economic and the discount shrinks,” analysts Richard Knights and Ben Davis said in a note.

“We expect grade premiums will narrow with steel profitability as weaker credit and housing markets impact steel demand,” they said. “The iron ore market is oversupplied.”

Benchmark spot ore with 62 percent iron content was at $67.05 a ton on Monday, while the higher-quality supply with 65 percent was at $84.50, a $17.45 spread, according to Mysteel.com. The price difference between the two grades, at its highest in the past year, was $25.25 in September.

“Most steel mills are adopting a wait and see attitude and only a small portion of them have concrete plans to purchase high-grade iron ores," Shanghai SHZQ Futures Co. said in a note Monday. “We understand from some mills that recent procedural environmental checks have impacted production, resulting in high stockpiles.”

The issue of iron ore quality and discounting, along with the broader outlook for the market, will be discussed at a conference starting Wednesday in Perth to be attended by executives from the biggest miners including Rio Tinto (LON:RIO) Group and BHP Billiton (LON:BLT) Ltd., the China Iron and Steel Association and industry analysts.

READ: Iron Ore Sinks as Holdings, Demand and Data Land Multiple Blows