(Bloomberg) -- Jeff Bezos isn’t coming to Long Island City anymore, but the future of small-batch coffee roasting may already be taking root there.

About a mile north of the site that Amazon.com Inc (NASDAQ:AMZN). abandoned for its proposed New York City campus, a tiny coffee roasting co-op is welcoming anyone from cafe owners to hip consumers wanting to prepare their own green beans. Regalia’s model, which lets customers rent time at its roasting machines, is attracting a wave of trendy Americans looking to ditch the traditional brands that have long dominated the coffee scene in favor of specialty beans and a more artisan cup of joe.

“The visions and the goals of the coffee roasters and the visions and goals of a cafe or bakery owner didn’t always align,” said Paolo Maliksi, one of the owners of Regalia. “We are here to make sure that anyone can come in and roast for whatever reason.”

Maliksi and other small-batch roasters are at the forefront of a trend that has spilled over from the beer industry. Much like the boom in U.S. craft breweries, more and more coffee shops are now roasting their own beans from New York to Chicago to Seattle. The shift away from mass-produced coffee lets discerning cafe owners tell caffeinated customers exactly where their beans came from -- something sustainability-minded clientele increasingly care about.

$5 Coffee

The trend toward self-roasting is good news for the millennial cafe-goer concerned about where food comes from and who isn’t deterred by prices that can be more than double that of a drip coffee at Starbucks Corp (NASDAQ:SBUX). A sign of a more plugged-in consumer, it’s helping reshape America’s coffee industry, where Folgers and Maxwell House once ruled.

The rise of self-roasting has been helped by online commerce and social media, which allow newcomers to establish their brands and give roasters an outlet to connect with customers.

Rabobank says roasting shops alone aren’t yet a major threat to Big Coffee, but as young consumers move away from traditional brands, that’s forcing the old guard to adapt. JM Smucker Co., for example, has rolled out a new line of coffee called 1850 intended to attract younger drinkers who wouldn’t think to pick up a pound of sister brand Folgers. Last month, Maxwell House-owner Kraft Heinz (NASDAQ:KHC) Co. took a $15.4 billion writedown on assets in a stunning acknowledgment that changing consumer tastes have destroyed the value of some of the company’s most iconic products.

“If this eventually scales up and it takes over more grocery stores, it could be a bigger risk to a large industrial roaster,” said James Watson, a beverages analyst at Rabobank. Big brands like Maxwell House are stagnating, Euromonitor data show, “and in general there’s a move towards smaller batches, more specialty coffee and roasting to match that,” he said.

Machine Makers

While big brands may be squirming, the shift to small-batch roasting is a boon for the makers of roasting machines, especially as models have grown smaller and cheaper. Bellwether Coffee makes a roaster that’s the size of a standard fridge, 70 percent smaller than typical models.

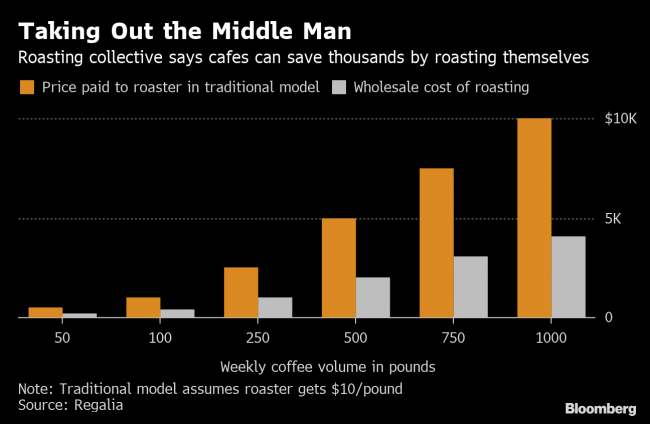

At Regalia, where the main coffee roasting machine is affectionately called “Big Mama,” a cafe roasting 1,000 pounds a week can save more than $200,000 a year by buying and roasting green beans, instead of purchasing roasted ones, the co-op estimates.

Some of the top coffee traders are also adapting their business models to supply the exotic origins and micro lots these specialized shops need. Buyers are looking for smaller batches than traditional 60-kilogram bags and some beans -- usually those used in competitions -- are so expensive that they are transported by plane, instead of the 20-foot containers that dominate the global coffee trade.

“The equipment has become more available, more accessible,” said Rich Futrell, who oversees sales in the U.S. Midwest for Genuine Origin, a unit of coffee trader Volcafe, which which operates an Amazon-like website for specialty roasters and ships its beans in 30-kilogram cartons delivered via UPS.

“Graphic design, information and knowledge have become more accessible, but green coffee is still traded the way it’s been traded for a long, long time,” he said.

One way traders are pulling off the gear shift is through M&A. Neumann Kaffee Gruppe, the world’s largest coffee trader, bought a majority stake in Atlas Coffee Importers in Seattle and Olam International acquired East African coffee specialist Schluter SA. Sucafina, another coffee trader, invested in specialty coffee merchant 32cup.

“It absolutely opens the doors for new ways of doing business,” said Cory Bush, managing director of 32cup. “Smaller specialty roasters are forcing importers and traders to become more responsive. When people are buying smaller quantities of anything, I think they expect to buy them in the same way they buy stuff from Amazon or their online grocers. We are having to find new platforms and new approaches to sell to people the way they want to be sold to.”

Niche Industry

To be sure, specialty coffee is a niche industry and there are still no precise figures on what percentage of the global market it accounts for. Still, Americans report drinking more and more gourmet coffee. A survey carried out by the National Coffee Association earlier this year showed that gourmet’s share of all coffee consumed reached a record 61 percent in 2019.

At Regalia, which opens to the public for a few hours every weekend, a filtered cup of coffee might go for anywhere from a few dollars to $10 a pop, depending on what was roasted recently. That’s a lot for a coffee in the slightly grittier part of Long Island City, which is more known for the warehouses that house and clean the city’s halal meat carts than for the glass high-rise apartment towers shooting up in other parts of the neighborhood. But it’s not insurmountable.

“You can buy a good cup of coffee for $3 and a great cup of coffee for $5; we are not talking about the difference between buying a Honda Civic and a Ferrari (NYSE:RACE),” 32cup’s Bush said. “Choosing the better option is not going to fundamentally change your household economics.”