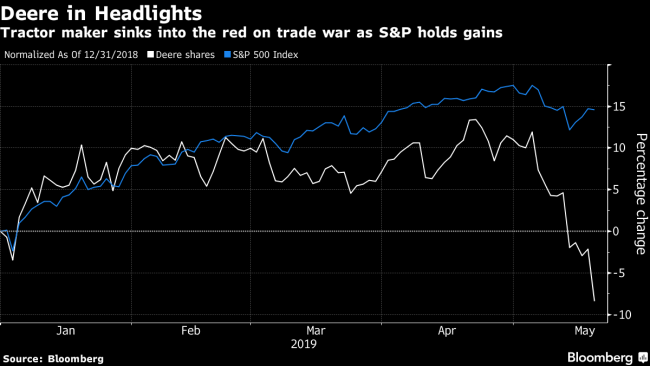

(Bloomberg) -- Demand for new farm equipment should be in full swing. American growers have outdated fleets of tractors, and they need to be replaced. Yet there’s a reluctance to buy, and Deere & Co. has even started cutting production to deal with it.

The machinery giant’s order books show demand that’s trailing last year, executives told analysts on an earnings call. In the second half, it sees some of its larger facilities shipping as much as 20% less than a year ago. Just last year demand was so strong that the company was ramping up production so fast it experienced bottlenecks in its supply chain.

“Until there’s some kind of stability on crop prices or a resolution on the trade front, farmers will continue to repair equipment as best they can or go to used markets,” said Chris Ciolino, an analyst at Bloomberg Intelligence. “When we do get stability, the replacement cycle will kick back into gear.”

U.S.-China trade tensions are flaring and African swine fever in China is decimating hog herds. That’s shaking up the market share and production of key commodities like soybeans, and American farmers in many cases are bearing the brunt of the changes. In addition, wet weather in the U.S. has kept farmers from planting, exacerbating worries.

The situation is “credit negative for Deere,” according to Bruce Clark, a senior vice president at Moody’s Investors Service.

"Deere’s plans to reduce production in its core Ag business to levels below retail sales, which will strain sales but also control the field inventory, are characteristic of the company’s approach to contend with operating stress and cyclical downturns,” Clark said.

Still, executives told analysts that fundamentals, though deteriorating in the near term, are intact in the long play. Global grain demand is still going to rise compared to last year, said Cory Reed, president of Deere’s agriculture division, and the company’s helped by its focus on technology to make the North American farmer more competitive.

It’s too early “to say we’ve seen permanent shifts in production or market share globally” due to African swine fever and the trade wars, said Josh Jepsen, director of investor relations.

Farmers replace their machinery in cycles. Following three years of declines, Deere’s revenue growth turned positive in 2017 due to demand for replacements. The industry is still in the early innings of an upcycle, which is likely to last for the next few years, according to Matt Arnold, an analyst at Edward Jones & Co.

“Investors are overly focused on the near-term downturn in the agriculture economy, while not appropriately pricing in Deere’s long-term growth opportunities,” Arnold said in a note Friday.

What Bloomberg Intelligence Says:

“Deere’s reduced 2019 guidance isn’t a complete surprise, given the lack of trade visibility and eroding farmer confidence, yet mounting headwinds from lower crop prices, rising soybean inventories, waning China demand and weather add to downside risk the longer trade tensions persist.”-- Christopher Ciolino and Karen Ubelhart, industrial analystsClick here to view the research