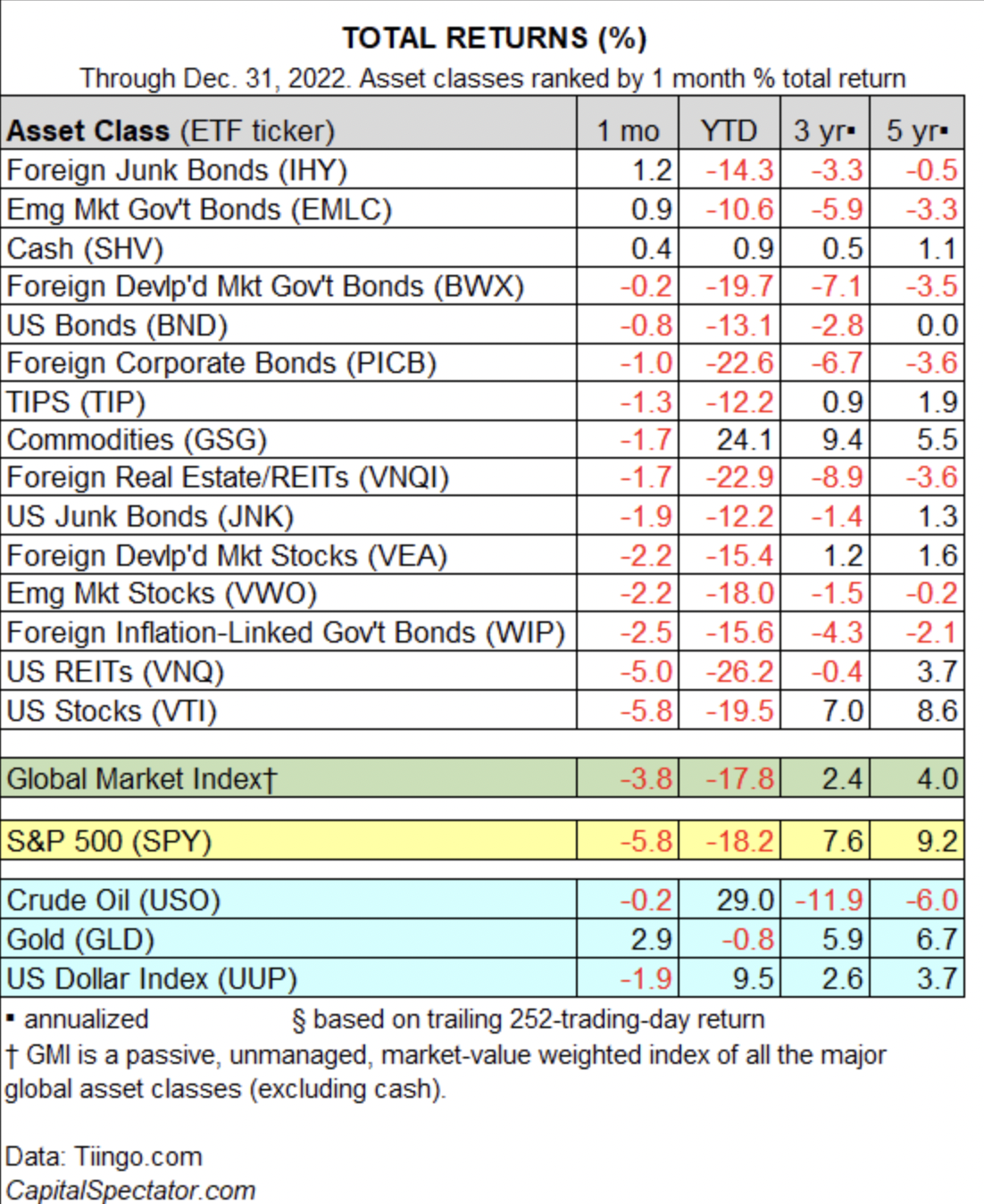

Losses dominated market activity for the major asset classes in 2022. Commodities and cash are the exceptions. The rest of the field lost ground last year, in some cases by hefty degrees, based on a set of proxy ETFs.

The big winner: broadly defined commodities. The iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) rallied 24.1% in 2022. The gain follows an even stronger increase in 2021.

Cash also posted a positive performance last year. The iShares Short Treasury Bond ETF (NASDAQ:SHV) edged up 0.9% in 2022, rebounding from a fractional loss in the previous year.

Overall, markets suffered far and wide, including losses for US stocks and bonds in the same calendar year. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) tumbled nearly 20% in 2022, the first calendar-year setback for the ETF since 2018.

US bonds also lost ground in the year just passed. Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) shed more than 13%, marking a second straight calendar-year loss for the ETF.

The widespread losses weighed on the Global Market Index (GMI), an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights. The benchmark’s sharp loss last year contrasts with a solid gain in 2021.

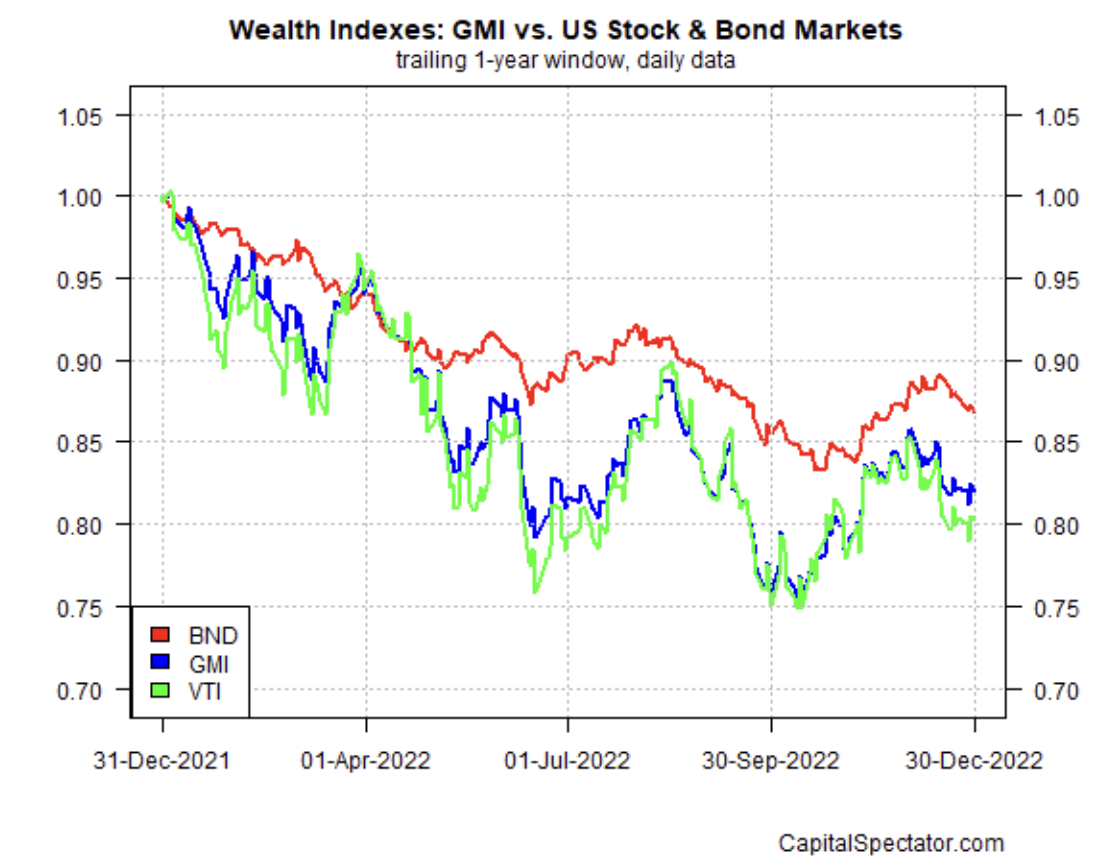

Reviewing GMI’s performance relative to US stocks and bonds over the past year reflects a weak performance for this multi-asset-class benchmark (blue line in chart below). GMI fell in line with US stocks (VTI) in 2022. US bonds (BND) also lost ground, but at a softer rate. By the year’s close, the negative trends on these fronts remains conspicuous, raising doubts about when markets will begin to stabilize and recover.