It’s clear that owning mega-cap technology has been the “higher for longer” trade, but what’s even more apparent now is how that trade is being timed.

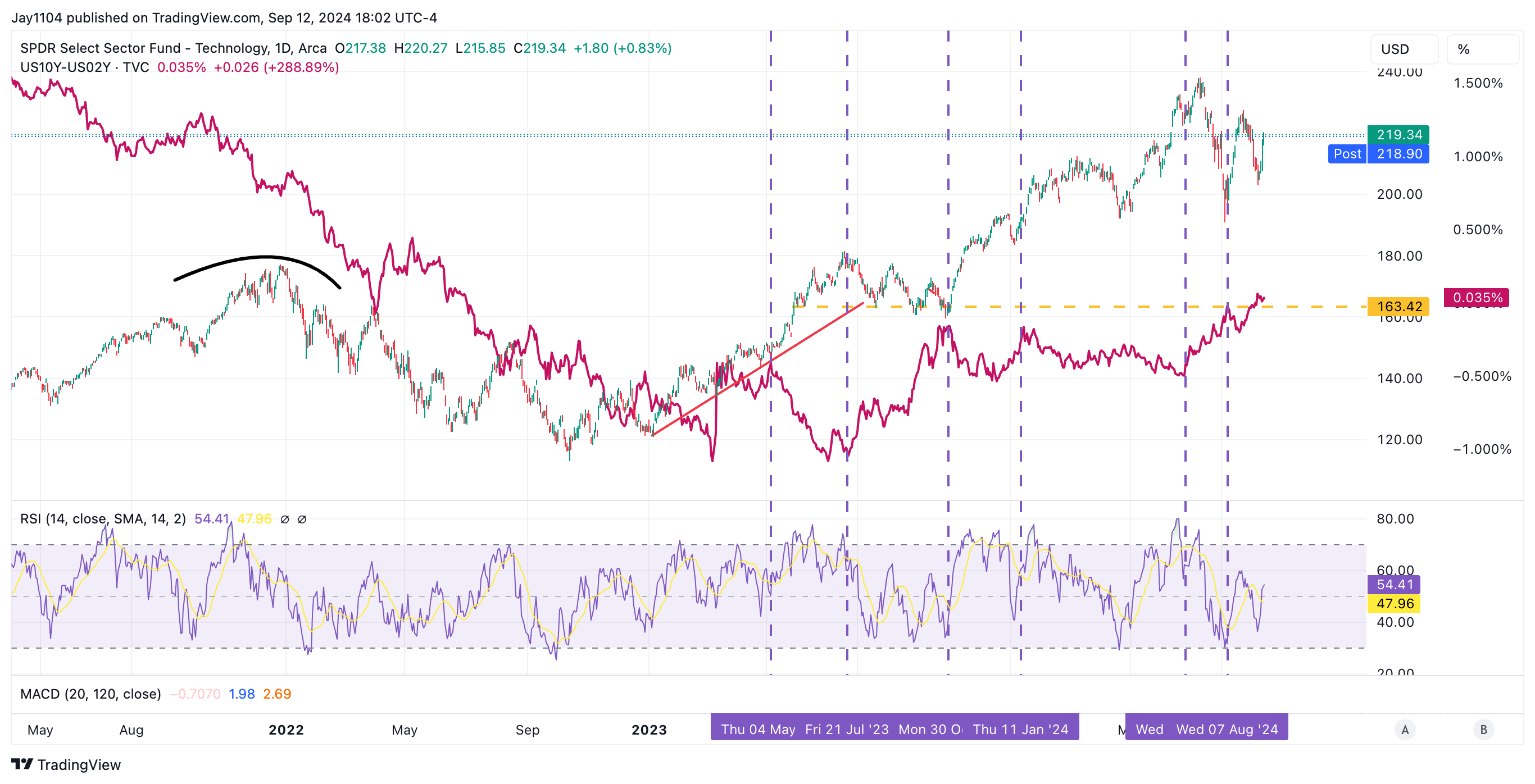

The timing mechanism seems as simple as the yield curve, specifically the 10/2 spread. When the yield curve inverts, the XLK rallies, and when the yield curve steepens, the XLK declines.

The next obvious question is why, and it’s likely because money rotating out of bonds needed a place to go—perhaps mega-cap technology provided that refuge.

There were certainly instances of this in 2022, but it seems that XLK and the 10/2 curve became mirror images around the May FOMC meeting.

When it became clear that the Fed would continue raising rates, the yield curve inverted sharply, and many questions swirled about the economy and the banks.

It’s also easy to see how major inflection points—whether the yield curve bottoming or XLK topping—occurred around the same time.

It becomes even clearer when looking at the ratio of XLK to TLT and how those changes align with movements in the yield curve.

This suggests that as money was being pulled out of bonds, it was largely flowing into technology stocks.

This also ties in with the liquidity from the carry trade in recent months. As the yield curve inverted and yields rose, the spread between the U.S. and other nations, like Japan, widened, strengthening the dollar.

As a result, borrowing in Japanese yen to buy dollar-denominated assets became very profitable.

This is important because if we reach a point where the yield curve continues to steepen, bonds will start to outperform stocks.

The liquidity that previously flowed into stocks will shift back into bonds. The uptrend in the XLK to TLT ratio has been broken, marking the first real sign of change.

This helps explain yesterday’s price action beyond just Nvidia (NASDAQ:NVDA). Following the CPI report, the yield curve initially moved lower, then higher, which caused that sharp morning reversal shortly after the market opened.

Then, around 11 a.m., the yield curve flipped and started moving lower again, followed by the equity market snapping back.

I’m not entirely sure what drove yesterday’s price action, though. Despite the higher yield curve after the Treasury auction, the equity market avoided a sell-off.

If we believe the yield curve is going to steepen further, it will be crucial to pay very close attention to how things develop from here.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI