By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Short covering sparked strong rallies for most of Tuesday's major currencies. Both GBP/USD and USD/JPY soared more than 2% as some of the yen crosses enjoyed gains over 3%. There was no specific catalyst but the prospect of new stimulus from Japan and the U.K. continued to revitalize risk appetite and lead to further gains for high-beta currencies. Given the extent of short sterling and long yen positions post Brexit, the magnitude of this week’s reversals is not surprising. The gains for USD/JPY should be sustainable but for sterling, we are convinced that this is nothing more than a short squeeze. There were no major U.S. economic reports released Tuesday but in the last 24 hours we heard from 3 FOMC voters – Mester, Tarullo and Bullard. Tarullo didn’t make any comments on the economy but Mester and Bullard were optimistic with Mester saying he’s positive on the U.S. labor market and Bullard noting that ultimate Brexit impact on the U.S. is close to zero, which supports the sharp rise in U.S. rates and rally in USD/JPY. The yen, on the other hand, fell because the Japanese government is preparing a powerful punchbowl of fiscal and monetary stimulus whereas pound is rising because the U.K. has found a new Prime Minister, eliminating one of many post-Brexit uncertainties. While the nearly 500-pip reversal in GBP/USD may seem large, on a percentage base it amounts to only a 3.5% rally and the pair is still down 11% from its pre-Brexit high.

The Bank of England will be easing monetary policy, probably not Thursday but certainly before the end of summer. Considering that 63% of the economists surveyed by Bloomberg expect a rate cut, the rally in the British pound indicates that investors expect otherwise. However even if the BoE holds rates steady, Governor Mark Carney won’t miss the opportunity to prepare the market for a cut later this summer. He’s already said they are waiting for their August forecasts, which will undoubtedly harden their plans to ease. In his Testimony before the Treasury Tuesday, Carney defended his decision to warn about Brexit and stressed the need to remain vigilant about its risks. With Article 50 still not invoked, we have yet to see the long-term consequences of the U.K.’s decision. But in the near term, investment and consumption will slow, giving the central bank plenty of reasons to be cautious. There was broad-based weakness in the U.K. economy before Brexit with retail sales and average hourly earnings growth slowing alongside construction- and service-sector activity. Now that Britons have voted to leave the European Union, economic reports will worsen in the coming months and if Carney wants to get ahead of all this, he will need to confirm that easing is on its way.

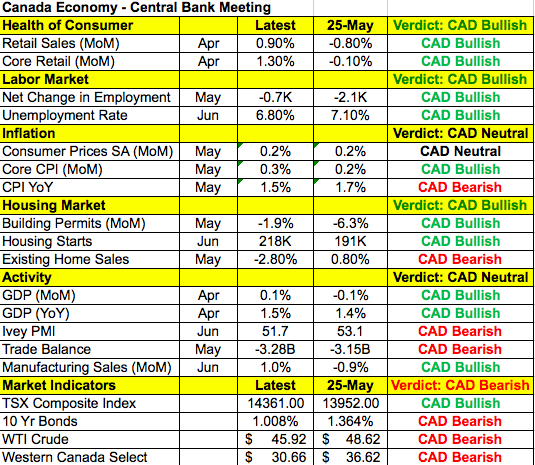

Before the BoE meets, however, the focus will be on the Bank of Canada’s monetary policy announcement. Although economic data in Canada has taken a turn for the worse over the past month with the trade balance, employment and manufacturing activity slowing, the following table shows that on balance, there was still more improvement than deterioration in Canada’s economy since the May meeting. Back then, Canada was still reeling from the wildfires in Alberta and despite the central bank’s lowered GDP forecast, the Canadian dollar soared because they said growth would rebound in the third quarter. Brexit challenges that view but with the market no longer expecting a rate cut from the Federal Reserve this year and U.S. stocks climbing to record highs, the BoC has reason to be optimistic about the North American economy. If the BoC maintains its optimistic Q3 outlook, the Canadian dollar will extend its gains. But if they emphasize Brexit risks, Tuesday’s pullback in USD/CAD will reverse quickly.

The euro did not participate in Tuesday’s rally largely because of EUR/GBP selling. Also, there wasn’t as much speculative short positions in the EUR/USD post Brexit compared to GBP and JPY, so the short squeeze was limited. Eurozone industrial production numbers are scheduled for release on Wednesday and while slower growth is expected, the euro's performance will be determined not by data but risk appetite and sterling flows.

The New Zealand and Australian dollars traded higher against the greenback as both NZD and AUD gained over 1% versus the U.S. dollar. NZD reversed Monday’s losses resuming the upward trend after the RBNZ’s less-dovish views, rising to 1-year highs in the process. The Australian dollar on the other hand benefitted from stronger Australian data with the NAB Business Confidence increasing to 6 compared to 3 for the prior month. Gold prices continued to decline. Since Shinzo Abe’s win and subsequent decision for a new stimulus package for the Japanese economy, the markets have gained a newfound love for risk. The increases in the commodity dollars falls in line with recent tolerance for risk. There are no economic reports scheduled for release from Australia and New Zealand in the next 24 hours but Chinese trade numbers were due Tuesday evening and a smaller surplus was expected. If imports fall sharply, AUD and NZD will give up their gains with AUD likely to be hit harder than NZD because they have greater dependency on China. Also, China’s plan to shift from an export to consumption-based economy hurts Australia and benefits New Zealand. AUD/NZD bounced strongly and is due for a correction.