Well, the growing chorus of MSM pundits seem to think it a real possibility. For instance, one I spotted has the headline: “Pound risks dollar parity after worst month in six years.” If achieved, that would be another 10% fall from the current 1,15 on top of the ‘worst month in six years’.

Long time readers know that when MSM pundits pen articles that asks the question what if a current well-established downtrend continues, will it reach even lower levels? – that is often a signal to expect the very opposite.

I have shown time after time that the experts are really good at spotting an obvious trend (that even a five-year-old can see), but not so clever at identifying a new trend when early in development. That takes a lot more skill and insight than they possess.

Yes, I still have my wooden ruler I had while at school – and I can lay it on any chart showing a definite trend and voila! – draw a line extending it.

But as we all know, trends do terminate – and they do so when the herd least expect it; usually when the ‘data’ appears gloomiest. That is just one of the ironies of financial markets. In fact, it can not be otherwise. When sellers have exhausted their firepower, the buyers start to take over and buy the cheap market and force short covering.

So have we reached such a point in sterling?

The above article lays out the logic of why sterling is so cheap from the worsening economic outlook for the UK to rising gilt yields to the widening current account and concerns over the policies of the new PM. It all makes sense – but what effect (if any) will it have on sentiment on traders at the margin who will determine the next market moves?

Yes, a solid case can be made for why sterling has collapsed, but of course that was based on old data looking in the rear view mirror. We traders need to keep our eyes firmly on the road ahead (while noting what we have just passed).

A currency exchange rate is in reality a beauty contest – the other side is the rampant US dollar and that has reached levels of vertigo not seen in 20 years based partly on what the Fed has done to match sharply rising rates. The dollar must be the most over-loved currency today – and vulnerable to an exhaustion top.

A point worth reflecting on for UK readers: Sterling made its latest major top in May at the 1.42 level and has plunged to 1.15 in just four months. And back in 2007 just prior to the Credit Crunch, it traded at an amazing 2.11 for a relentless decline of 45%. Yes, holidays in the USA are very expensive.

And that is one major reason why we are a very expensive country to live in – and is set to become even more so this winter. And we can blame our glorious leaders for this as they have waged war on our domestic energy supplies with Mr Putin helpfully putting the boot in recently. Needing to buy expensive energy is not a recipe for a strong currency.

Of course, trends do terminate – and with bullish sentiment in the basement we are very likely near that point now.

The market has declined to meet my lower tramline after a five down to a mom div. At the very least, we should expect a decent bounce that may be tradable.

The Dow is following my roadmap lower – but what now?

This is another market in a relentless decline having lost 3,000 pips in just two weeks. Before that, the rally off the major June low took it to an exact Fib 62% retrace of the entire drop off the 5 January ATH at 36,900. That was textbook!

Also textbook was the time taken to that high – nine weeks off the low for a near 40% of the time taken in the drop off the ATH. That was well within my parameters I had formed in a July post.

When using Elliott waves, I have a rule that the size of the waves must ‘look right’. For instance, a fifth wave must not look too small (or large) compared with a first wave. If it does, I look for another wave count. That keeps me out of a lot of trouble!

But what now? I managed to lock in shorts in January around the 36,900 area and again in mid-August around the 34,000 region. After the hard down to Friday’s 31, 180 low post- Non Farms, is there a decent bounce forming and should we be looking to take some profit off the table? Let’s take a look.

First, the market’s low yesterday has hit the Fib 62% retrace of the June-Aug rally. Second – look at the bottom oscillator which is the Relative Strength Indicator. It moved well above the 70 level at the mid-August high that indicated a very over-bought market – and ripe for a decline (which we caught accurately).

But moving off that high, the RSI has plummeted to reach the lower 30 line which is considered oversold. Just go across to see where previous hits on the 30 level were made (arrows) – right on major lows. Hmm.

So does this add up to a high probability bounce phase ahead? Remember we are in the throes of a third wave – and these are notoriously relentless. As I like to say, third waves take few prisoners. Bounces are quickly stomped on (such as Friday’s bounce pre-Non Farms). And we are in the very early stages of this phase.

But there are few signs of selling panic – that will come later (see my long range targets on the monthly I posted last week.)

On balance, it appears a prudent strategy is to take some profit here and look for a bounce to reinstate. A bounce here could span several hundred pips.

What would be the downside of doing this? The ‘worst’ case scenario would be if the market continues its plunge right past all support levels next week after Monday’s Labor Day holiday.

But that’s not so bad – our remaining shorts would gain value even more and we would have a great realised profit in the bank. We could look for a lower low and the inevitable bounce and repeat the process!

Of course, the set-and-forget strategy that is best suited for traders who like a quiet life (!) would also make a lot of sense. As ever, it’s horses for courses and we have options.

Gold and Silver have very likely reversed

Last week my analysis indicated that the PMs are at or very near major lows. Since then, Gold dipped a little further to Thursday’s $1690 low and Silver to 17.56 low before staging a rebound on Friday.

So are these the major lows I have been looking for? Here is Silver on the weekly

The last few weeks have seen it testing the major support line which lies around the Fib 62% retrace of the rally off the 2020 Corona Crash low. And that has created a strong mom div to last week’s low.

Often, Labor Day in the US marks significant trend changes. Perhaps that is partly because traders are returning from their fun and frolicking holiday mode (!) and get serious about making money again.

They review their positions and their market views with the benefit of August’s data and chart patterns (if they use them).

Those that are short wonder if the current much lower prices offers them a great opportunity to take profits – and help to offset the large losses on their share portfolios they have suffered especially these last two weeks. Many will be staring at the equity abyss and wondering if they are too late to sell.

Such are some of the cross-currents that are in the minds of traders.

But with the dollar in the final stages of its great bull run, it is highly likely that when it does finally turn, the PMs will react very very positively.

Yes, the Net Zero fantasy is dying

One of the greatest bubbles that has been blown up by Net Zero has been the Carbon Emissions market for EU permits. Companies that produce much CO2 must offset their ‘footprint’ by buying permits off companies that produce little or no CO2 (such as Tesla!).

Of course, the whole idea is a farce since all manufacturers use energy and produce CO2 at some stage of the process (how are wind turbines and solar panels made, not to mention EVs?).

Thus, the state of the market for Carbon Emissions is a measure of the state of the manufacturing economy.

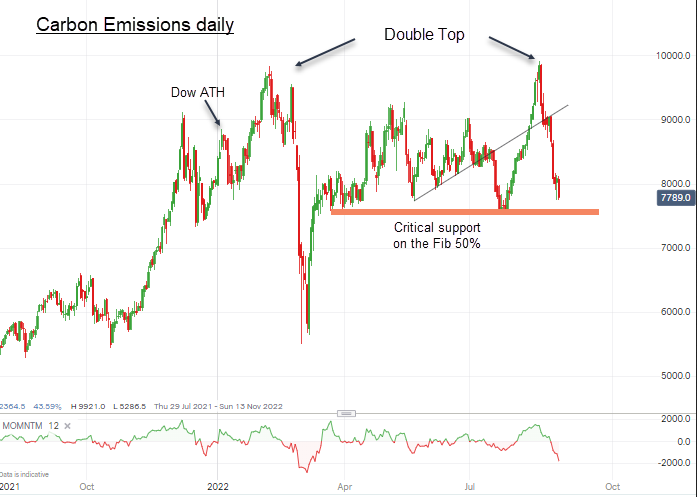

I have been tracking this market and noted that in mid-August, it had made what I suggested then could turn out to be a Double Top terminating the massive bull run from around 6 in 2017 to the recent 100 high (it just missed the round number by pips).

That huge percent increase is a measure of just how manic the belief in Net Zero had become. But with the energy crisis upon us, many longs will now be forced sellers and produce an avalanche of destruction up ahead. This is just the down payment.

I figured that a sharp reversal in this market would indicate a sharp reversal in the global economy (and a bear market in equities). And lo and behold, the market has turned sharply lower in recent days

and has very likely confirmed my Double Top thesis. The key level now is the pink area around 76 which is on the Fib 50% retrace.

Thus, this market and shares are totally aligned to the downside.

But I do not expect this level to give way lightly and a decent bounce should be forthcoming – and that would align to the suggested bounce ahead in the Dow (see above).

September is often a negative month for shares (October is more so), but I would not be surprised if a relief rally of some sort lies ahead.