This article was written exclusively for Investing.com

- Cocoa has gone nowhere fast

- Sugar and coffee rose to multi-year highs

- Cotton and orange juice exploded to the upside

- 4 reasons why cocoa could break higher

- NIB ETF tracks cocoa futures prices

Chocolate is a universal treat, and the primary ingredient is the cocoa bean. Cocoa trades on the ICE in the futures market as a member of the soft commodity sector. Brazil is the leading producer and exporter of sugar, coffee and oranges. Cotton production comes from India, China, and the United States.

More than 60% of the world’s annual cocoa supplies come from West Africa, with the Ivory Coast and Ghana the top producing countries. Cocoa beans require an equatorial climate, making West Africa the ideal growing region. The Middle East is home to half the world’s crude oil reserves and dominates the petroleum market. The IC and Ghana are the OPEC of cocoa, as their economies rely on production, logistics, and worldwide demand for revenues.

Four of the five soft commodities rose to multi-year highs over the past year, but cocoa has not followed. Cocoa’s time could be coming as the price has been making higher lows over the past years. The iPath® Bloomberg Cocoa Subindex Total Return(SM) ETN (NYSE:NIB) follows cocoa futures higher and lower.

Cocoa Has Gone Nowhere Fast

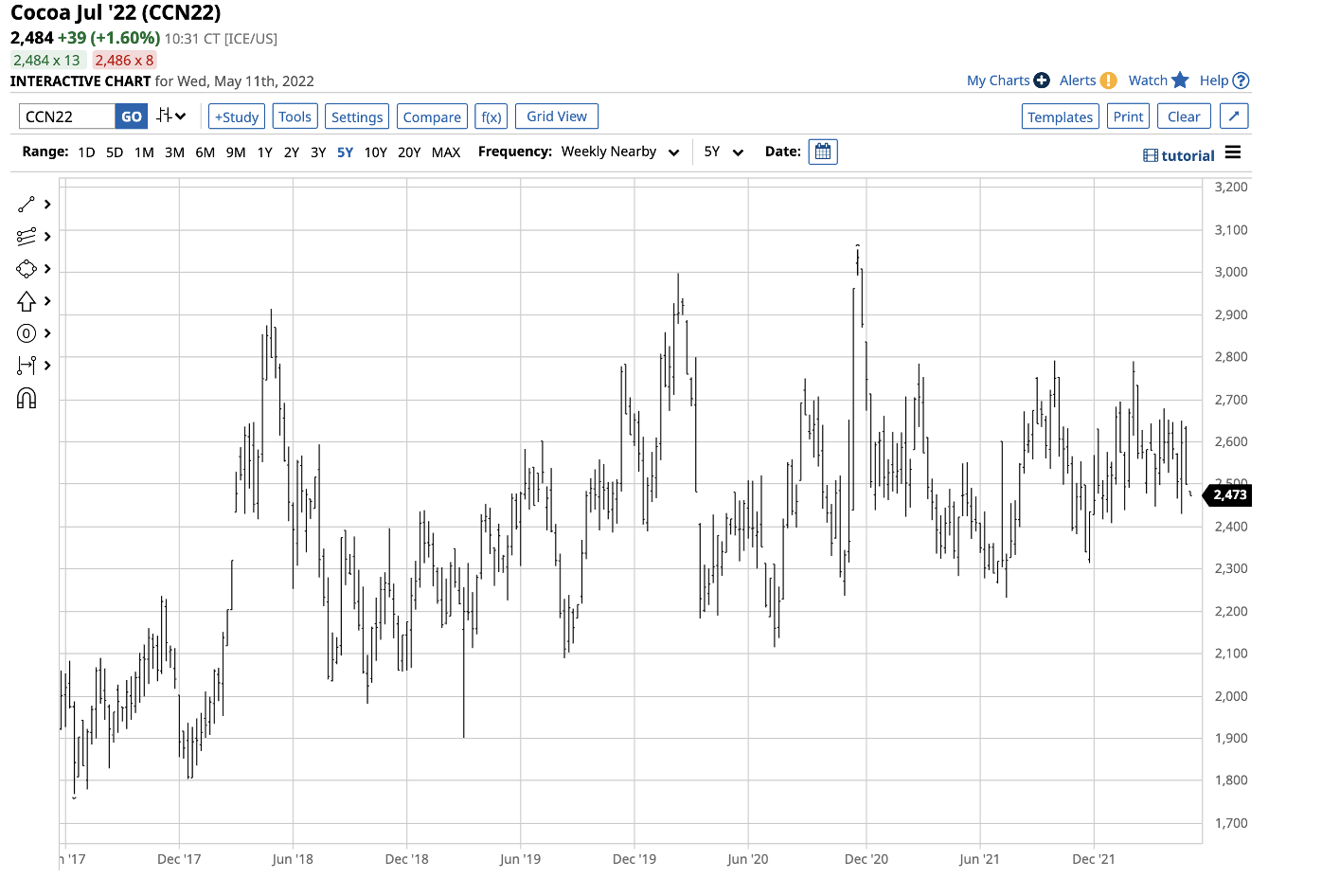

Nearby cocoa futures have been trading in a range over the past years, but the bias has been to the upside.

Source: Barchart

Since 2018, the concentration of prices in the cocoa futures market has been between $2,400 and $2,800 per ton, with the occasional move below or above. Meanwhile, the range has narrowed since the 2020 high of $3,054, suggesting an eventual break to the up or downside of the range.

The price action in other soft commodities increases the odds of an eventual break to the upside.

Sugar, Coffee Hit Multi-Year Highs

In November 2021, ICE sugar futures rose to a high of 20.69 cents per pound, the highest level since February 2017. Nearby sugar futures rose to a slightly lower high of 20.51 cents in April 2022. They were below the 19 cents per pound level on May 11.

Meanwhile, ICE coffee futures exploded to $2.6045 per pound in February, a level not seen since September 2011. Coffee corrected to below the $2.20 level on May 11 but remains at a multi-year high. A frost in Brazil in July and August 2021 did considerable crop damage, lifting coffee prices. Brazil is the leading producer and exporter of Arabica coffee beans and free-market sugar cane. Aside from the weather, rising oil and gasoline prices put upward pressure on sugar futures, as the sweet commodity is the primary input in Brazilian ethanol production.

Cotton, FCOJ Exploded To The Upside

Brazil is also the world’s leading orange producer and exporter. ICE frozen concentrated orange juice futures (FCOJ) reached $1.9445 per pound in April, the highest price since January 2017. FCOJ was over $1.65 per pound on May 11.

While Brazilian issues pushed sugar, coffee beans, and oranges to multi-year highs, cotton production comes from China, India, and the United States. Nearby ICE cotton futures reached $1.5802 per pound in April, the highest price since July 2011. Cotton was above $1.43 per pound on May 11, a level last seen in 2011.

Four of the five soft commodities reached multi-year highs in 2021 and 2022. Cocoa futures rose to the highest price since 2017 when they reached $3,054 per ton in November 2020, but the primary ingredient in chocolate has not followed the other softs on the upside. Nearby July cocoa futures were at $2,484 per ton on May 11.

4 Reasons Why Cocoa Could Break Higher

Four reasons favor an eventual move higher in the cocoa futures arena:

- The highest inflation in more than four decades is increasing all production costs. Higher employment, energy, fertilizer, transportation, and other related expenses put upside pressure on all raw materials, and cocoa is no exception.

- West African political stability always increases the potential for logistical and production issues.

- The global population rises by around 20 million each quarter, increasing the demand side of cocoa’s fundamental equation.

- Most commodity prices are trending higher, and cocoa’s upside bias could translate into a break to the upside when it breaks out of the wedge formation that contained prices over the past years.

Source: Barchart

The chart shows the wedge formation with support at just below the $2,200 level, and resistance at around $2,900 per ton. A break above or below either level could lead to a technical follow-through. In the current inflationary environment, the odds continue to favor the upside.

NIB ETF Tracks Cocoa Futures Prices

The charts show that buying cocoa futures on dips has been the optimal approach to the soft commodity over the past years. The most direct route for a risk position in the cocoa market is via the futures and futures options on the ICE. Market participants looking for an alternative to the futures arena can opt for the iPath® Bloomberg Cocoa Subindex Total Return(SM) ETN. At $27.48 per share, NIB had $25.2 million in assets under management and trades an average of 15,953 shares each day. The ETN product charges a 0.70% management fee.

July cocoa futures rose from $2,366 on Dec. 1, 2021, to a high of $2,855 on Feb. 10, 2022, or 20.7%.

Source: Barchart

Over the same period, the NIB ETN moved higher, from $26.50 to $32.28 per share, or 21.8%. The NIB product does an excellent job tracking the cocoa futures on the up and downside. At the $27.48 level on May 11, NIB and cocoa were back to the lows of early December 2021. If the pattern of higher lows and higher highs continues, mid-May 2022 could be the perfect time to add some cocoa exposure to your portfolio. Cocoa is long overdue for a rally that takes the price to multi-year highs to join the other soft commodities.