Cloud infrastructure stocks have been among the worst performers this year despite all the excitement around artificial intelligence (AI). In this report, we dive deeper into the drivers of the current underperformance and highlight the medium-term upside potential.

Contents:

- Enterprises are cutting spend and optimizing cloud usage

- Not all cloud business models are the same - consumption vs. project-based

- AI breakthroughs will drive strong medium-term cloud demand

Cloud Spend Optimization

There are two effects that are driving a temporary slowdown in enterprise spending (1) fear of recession is forcing companies to cut spending (2) after two years of robust growth, companies are optimizing their spending.

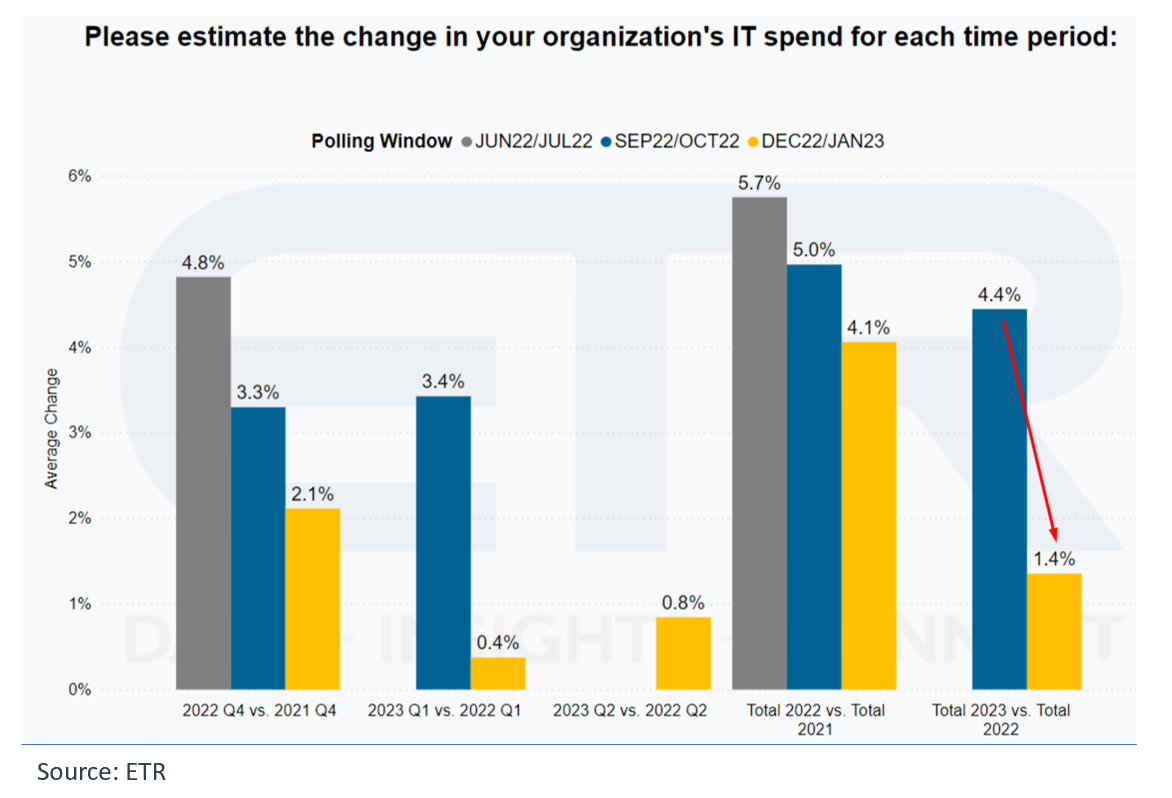

Fortune 500 decision-makers expect a dramatic slowdown in IT spending. Per a recent ETR survey, respondents expect 2023 IT spending to grow only 1.4% vs. 4.4% yoy only 2-3 months ago (based on data from over half of the Fortune 500).

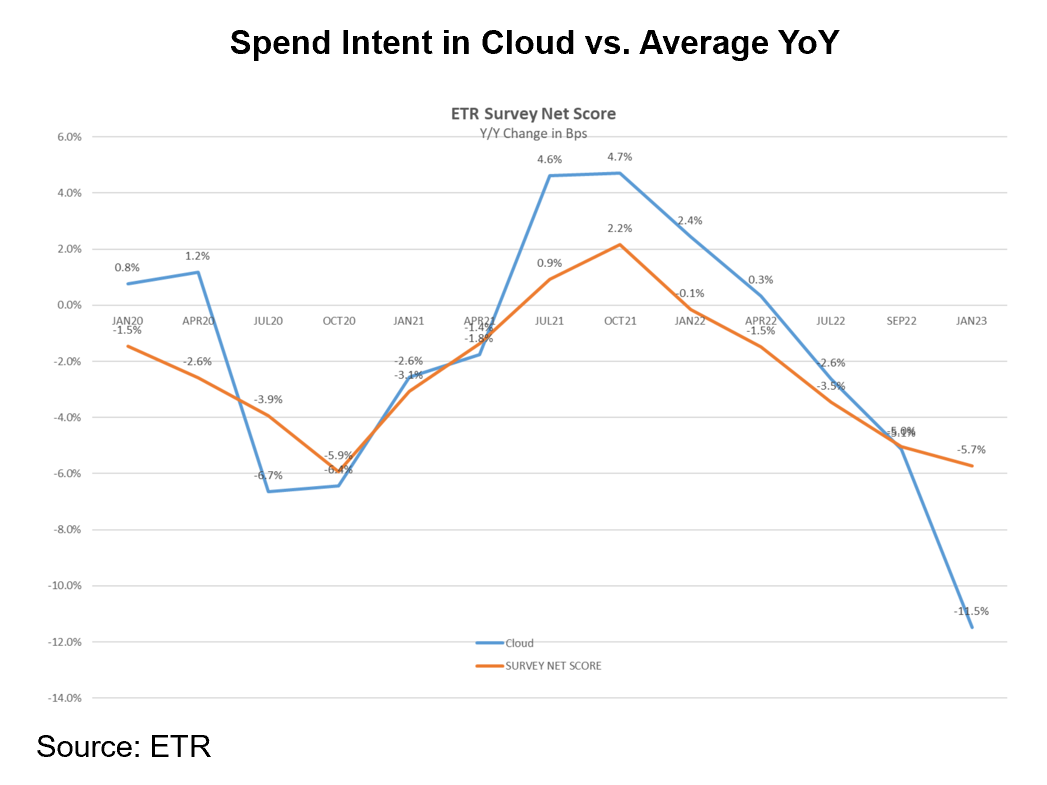

Interestingly, cloud spending is expected to fare worse than the average IT spending. In addition to broader slowdown in IT spend, companies are optimizing their cloud usage and delaying new projects.

Per Microsoft's (NASDAQ:MSFT) F2Q23 earnings call, the company expects the optimization to last several quarters (but not years). Microsoft noted that in addition to the delays, "when the new projects start they don't start at peak usage...They start and they scale. So the two cycles are creating an air-pocket in demand."

Not All Cloud Companies Are the Same

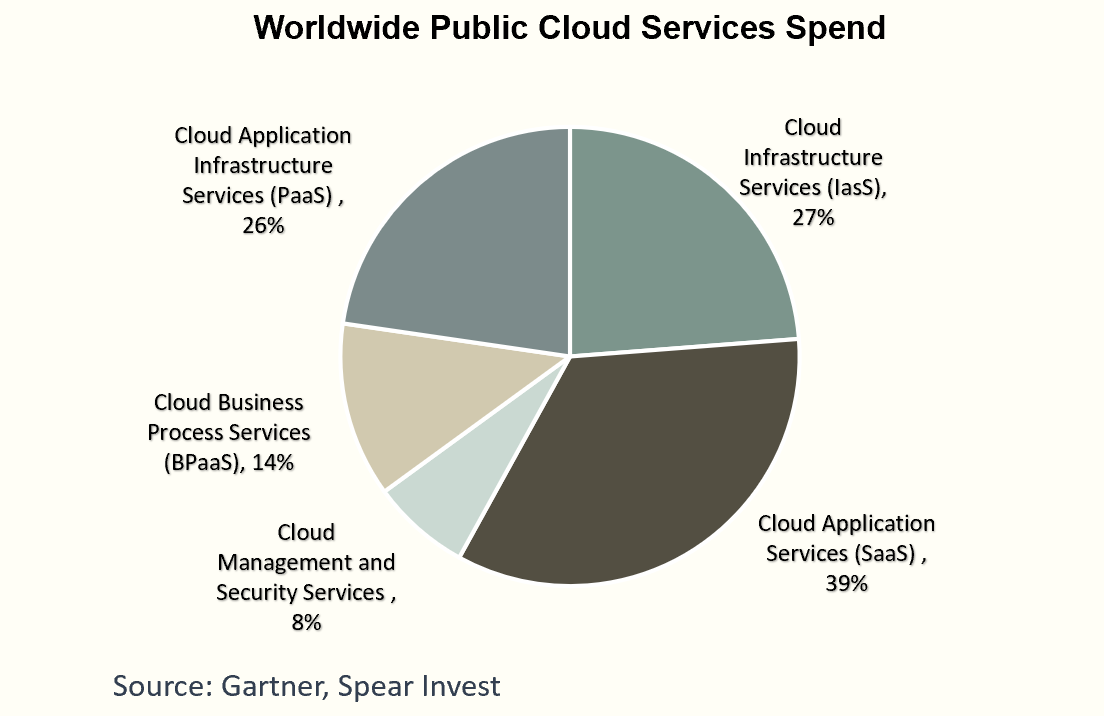

The global spending on public cloud services totaled $490.3bn in 2022, according to Gartner (NYSE:IT).

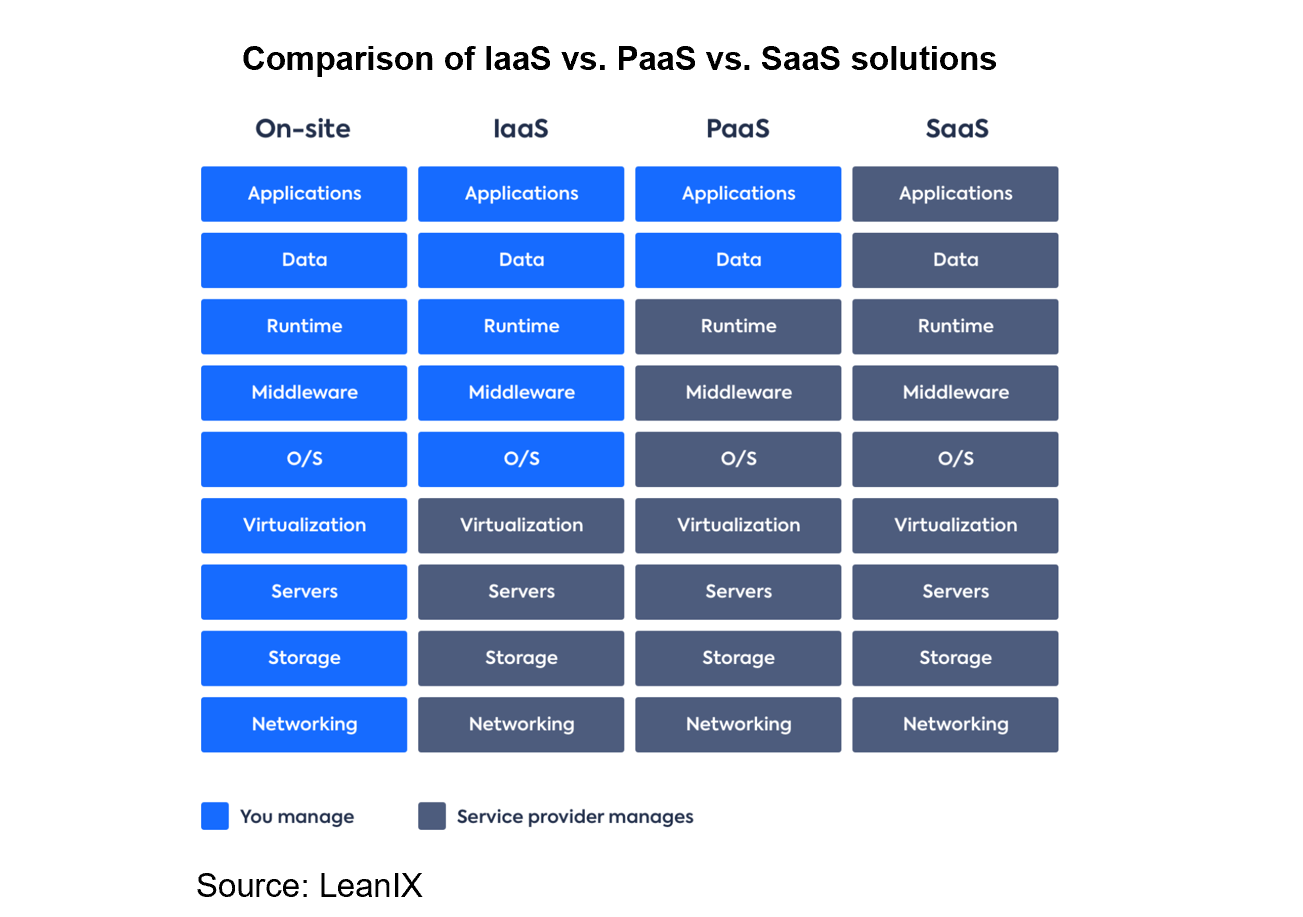

- Cloud infrastructure (PaaS) and (IaaS) represented ~50% of the total ($227bn). The hyperscalers (AWS, Azure, GCP) represented 70% of that.

- SaaS applications represented 39% ($167bn). The use cases for SaaS are very broad (from CRM systems to design software). Within SaaS, there are several new entrants that sit on top of the cloud infrastructure platforms and provide ways of using the platforms more efficiently and securely e.g., separating storage from computing, sharing data without having to store it twice, etc.

Consumption-based business models were the first ones to go into the downturn and noted deteriorating demand since 1H22 (e.g., Snowflake (NYSE:SNOW) pointed to optimization efforts, and Datadog (NASDAQ:DDOG) noted weakness in their logs business). As we went through the year, the consumption side stabilized at lower levels, but the headwinds broadened to the project side where recession fears are influencing investment decisions (e.g., hyperscalers just started noting demand softening in 2H22).

We believe that as the hyperscalers may be facing 1-2 more quarters of weaker demand, the consumption-based models will start facing easier comps.

Interestingly, this cyclical downturn in IT spending is coming at a time when Artificial Intelligence (AI) adoption is reaching an inflection point, creating a meaningful medium/long-term tailwind for these companies.

The Strong Medium-Term Outlook Is Driven by AI inflection

AI is undergoing a significant breakthrough driven by several successful applications of a new foundational model (Transformer) in large language model training. The Transformer model is a neural network that learns context and can therefore be used for "generative" rather than "predictive" applications.

We believe that this will be transformational for many industries and has already generated a fair amount of hype. But what investors are not appreciating is the amount of data and compute power that these applications will require which will likely be provided in the cloud.

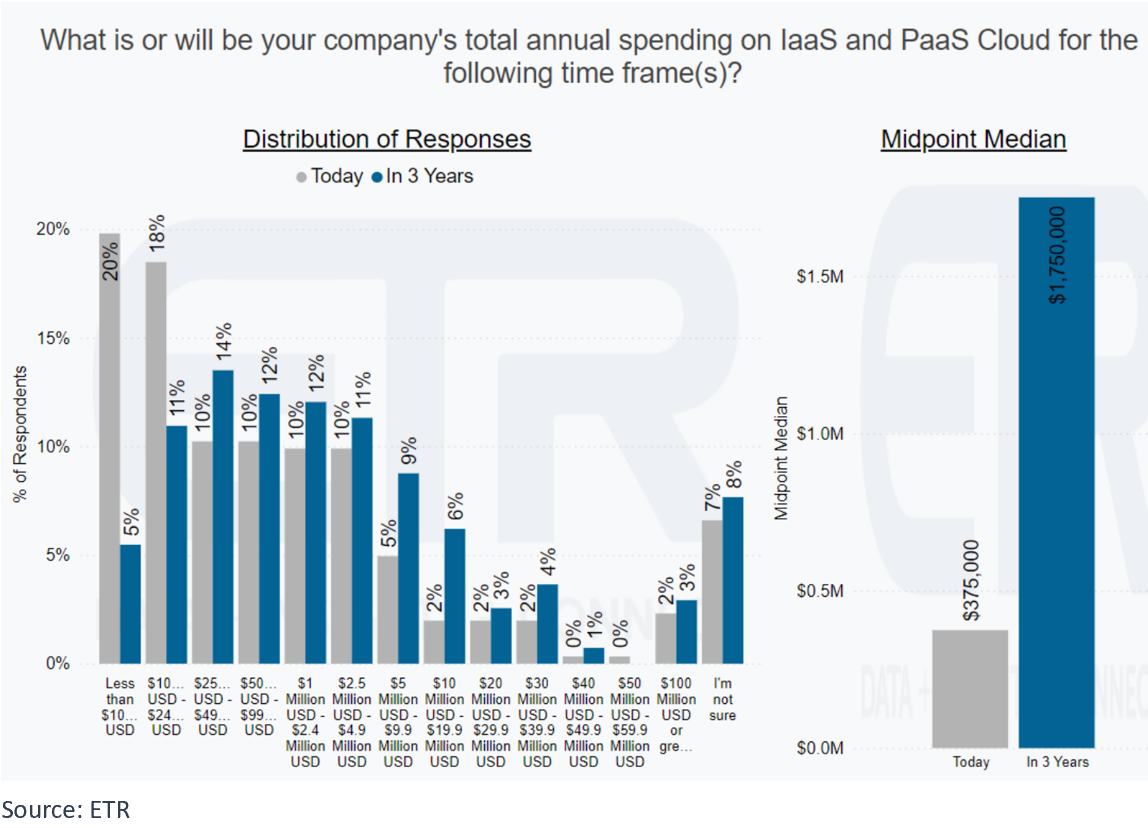

According to an ETR report surveying companies and budgets, the cloud spending CAGR (for PaaS and IaaS) may be as high as 67%. Among all respondents, the median annual spend on IaaS/PaaS is currently $375,000 and is expected to increase to $1,750,000 in 3 years. Looking at large organizations, spending is currently $750,000 today but is expected to increase to $3,750,000 over that same time period.

These spending projections tie to commentary that we are hearing from companies, such as Snowflake. Once their customers see what they can do with their data, the spend grows exponentially. While we are using a more conservative ~40% growth estimate, we believe that there is room for upside.

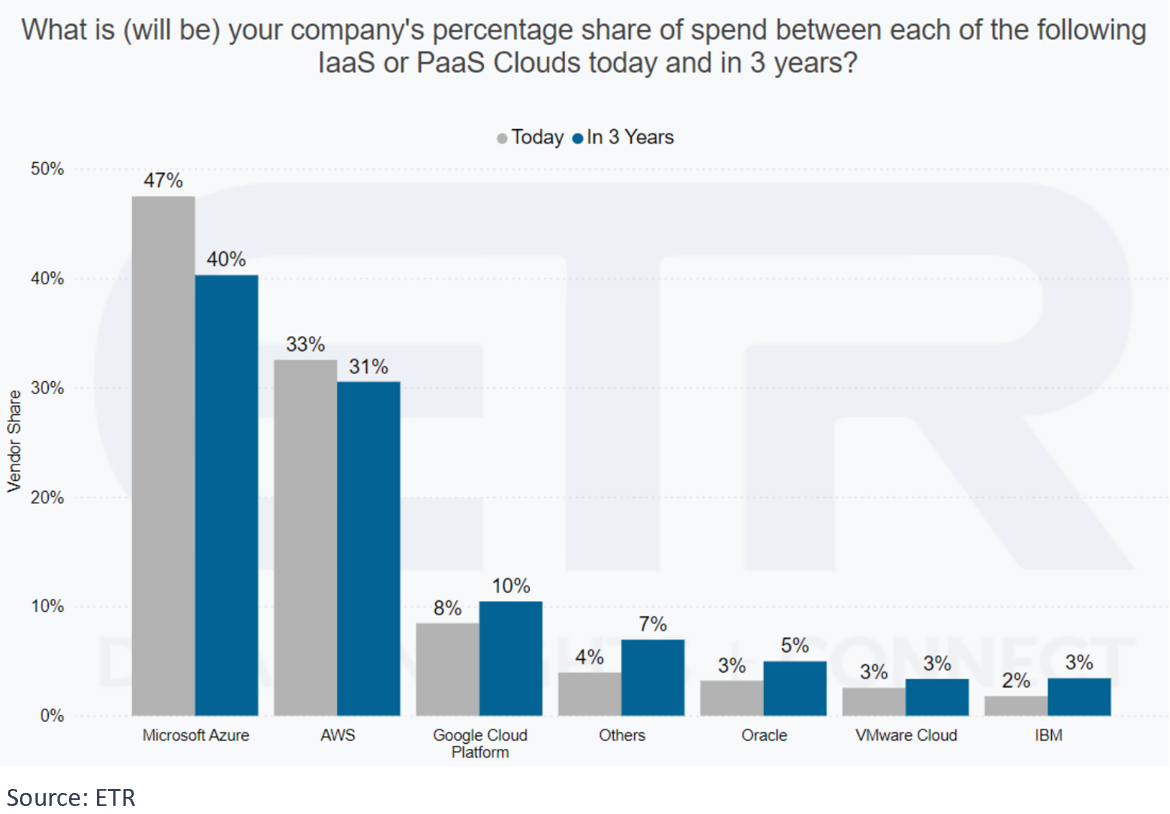

Another interesting observation from the same survey is that respondents expect that while AWS and Azure will remain the top platforms, there will be an opportunity for new entrants and smaller players to gain market share.

DISCLOSURES:

Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings, click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile, or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR's current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statement and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax, or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR's objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.