There are scores of maritime shippers vying for investor attention, all of whom are enjoying appreciating stock prices. After all, “a rising tide lifts all boats.”

From among this group I've selected Danaos (NYSE:DAC) as one of the key maritime shippers benefiting from the improved sentiment.

This is no flash in the pan. The current earnings boom is directly related to the global supply chain crisis, but pronouncements that shipping stocks will plunge once we are past the peak of these problems shows only a cursory knowledge of the business.

According to the UN's International Maritime Organization (IMO) 90% of global trade travels by sea. That will not change. Maritime shipping is the cheapest way to transport goods across oceans and other great bodies of water.

For many nations, the consumer demand for goods manufactured beyond their national boundaries far outstrips the current supply, so another reason some investors shy away from the potential gains to be had in this industry is the promise by politicians that they will end the supply chain slowdown.

But facile pronouncements by politicians that they can untangle the port congestion and initiate landside delivery capability is unrealistic and untenable. I expect to see the extreme bottlenecks worked out by the local organizations and corporations involved—in time—but severe bottlenecks will still remain.

What could cause me to alter my analysis? If we all retrenched into our caves and hunkered down, buying nothing but bales and bales of toilet paper, I suppose we might see a significant slowdown in the global trade of essential as well as non-essential goods. Barring that kind of lockdown scenario, I expect the world's best shippers to continue to reap the higher prices they are now receiving in order to “deliver the goods.”

Why are ports all over the world so congested?

Using the United States as the best example of a developed nation with a large consumer base, in 2020 billions of dollars were printed in order to protect the income for so many who had either lost their jobs or were afraid to go to their jobs. While some citizens found that working from home or some other remote location allowed them to continue earning their salary, others desperately needed that hand out.

However, the money that was distributed went to all citizens regardless of need. As a result, many people had more discretionary income thanks to the COVID-19 pandemic than they had before it. With nowhere to go in terms of travel and less dining out and going to theme parks and such, many people had money burning a hole in their pockets. When finally they could spend that money somewhere besides Amazon (NASDAQ:AMZN), the floodgates were opened.

Buying switched from disinfectants, trinkets, and home-delivered pizza to new homes in different locations, furnishings and appliances for those new homes, clothing, home renovation fixtures and lots and lots of consumer goods. This trend might reach its peak this quarter, but the idea that it will suddenly evaporate is completely misguided.

We may make progress around the edges, but I do not see a sudden opening of international commerce anytime soon. There will be those who disagree and if they take action on that disagreement and sell or short some of the fine shipping companies I have researched, it would be a fine time to buy even more.

What options do the ports have to be able to move more goods?

Very few. The US president, for example, may proclaim that he is going to increase operations at US ports to a 24/7 operation at each of them. He can proclaim all he likes, but unless he is prepared to forcibly induct a civilian conservation corps of untrained additional workers—with all the problems that would entail—then there are simply not enough longshoremen and other portside workers to be able to take this on. Besides, a Union Man in good standing for 50 years does not want to rile the ILWU (International Longshore and Warehouse Union.) This union makes Hoffa and the Teamsters look like saints.

Speaking of the Teamsters, even if somehow all those additional dockworkers could be recruited and trained in time to have any effect, there is the issue of hiring hundreds or thousands of additional truck drivers. Again, edicts alone do not create qualified truck drivers.

Even if we could hire enough longshoremen, truck drivers, and other essential personnel, we still face the issue of training them to safely do the job. It takes months of training and years of experience to do it right. Add to this the fact that there are empty containers blocking access that have to be moved by trucking companies in order to clear the space needed for incoming containers.

Even then, US ports, highways and railways would require massive new infrastructure and upgrades to be able to handle all the container ships and dry bulk carriers' goods and grains. To simply fill a pothole these days road crews have to reduce traffic to one lane. To take on the massive task of increasing the road and rail infrastructure to get the products out of the ports once the ships have unloaded would mean traffic tie-ups for months on end.

These facts are frustrating to us all. It would be nice to be able to wave a magic wand and open up the ports and railways and highways to incoming goods. But there is no magic wand. And this would not be the time to make the situation worse while providing the optics of making it better.

How do port, rail and trucking constrictions and impediments affect global shippers?

It makes them wildly profitable...temporarily. Again, there will be those who see this essential part of the supply chain declining from peak congestion and conclude that shipping rates will be coming down. This could happen for a couple of weeks, perhaps a month, perhaps at one or two ports, or even more. But the trend of rates remaining, if not at a peak, at least quite high is the investor’s friend in the shipping arena.

With a roughly 40% chance that any individual ship’s cargo will arrive from manufacturer to builder, retailer, or consumer on time, shippers must respond by allowing for all of these possible problems. Plus they must also always be more willing to go out on a limb for clients who are bidding the highest prices to get their products from one destination to another.

Which shipping companies are likely to best reward investors?

The glib answer is that the entire industry is likely to benefit.

But I am not looking to find some company that has six or seven vessels or older vessels or that has too much debt from obtaining said vessels. I want to stick with the quality companies. One that comes to the head of the pack is Danaos Corp. Listed on the New York Stock Exchange and based in Greece, DAC has a fleet of some 65 container ships, most of which are chartered on long-term leases, which lessens the volatility endemic to this particular industry.

Danaos is the owner of the ships. That is not the same as being the carrier / transporter. Companies like Hapag Lloyd (DE:HLAG), privately-held MSC and CMA CGM are the actual carriers. It is these carriers that contract with customers for the transport of cargo. While DAC has one of the older fleets in the industry (an average age of about 14 years) all vessels are either Panamax or larger sized. Other ship owners may show more impressive (if volatile) earnings based upon the fact that they are getting spot prices for their leases this week or this month or this quarter.

DAC has taken a different approach. You may not see the same spectacular rising (or falling) stock prices because Danaos has chosen to enter into longer term charters with the big carriers. In fact, the average duration of its charters is a little more than three years. For some investors, this kind of certainty of revenue is more important than the “potentially” greater earnings power from those who place their faith in the continued mayhem and excitement of the spot market.

Danaos has about a 90% contract coverage for the coming year at high, though not spot-price stratospheric, charter rates. Of course, as some of its current charters expire the company may well decide to place a slightly higher percentage of its vessels at the spot market rates.

I believe that rates will likely moderate somewhat as new ships are built and as more manufacturing is onshored, particularly in the United States and the eurozone. But I do not see those rates moderating at a rate that will keep companies like DAC from continuing to grow its earnings over the coming years.

In addition, DAC owns a large number of shares in ZIM Integrated Shipping Services (NYSE:ZIM). A couple of months back this holding totaled 8 million shares. (ZIM is one of those firms that uses the spot market much more aggressively.) DAC has indicated it is willing to sell “some portion” of those shares. Until it does, this gives DAC a back door entry into the spot price market.

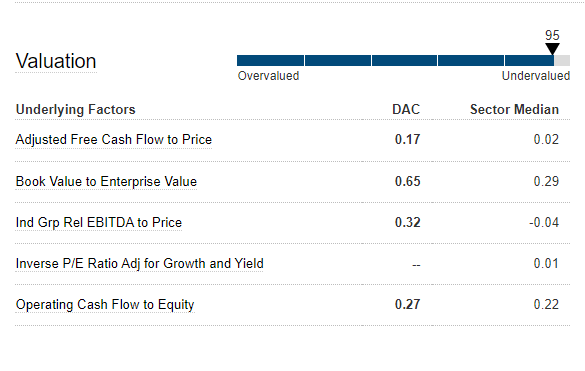

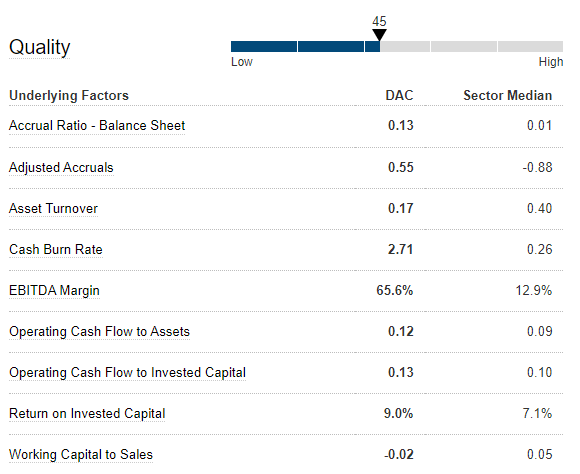

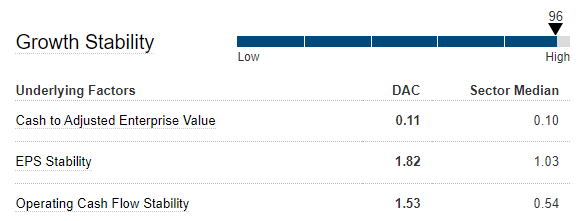

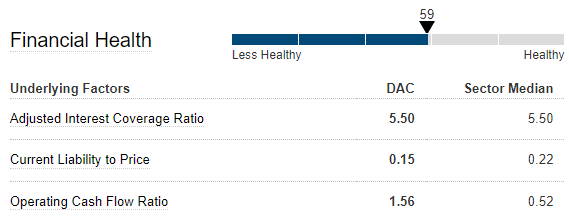

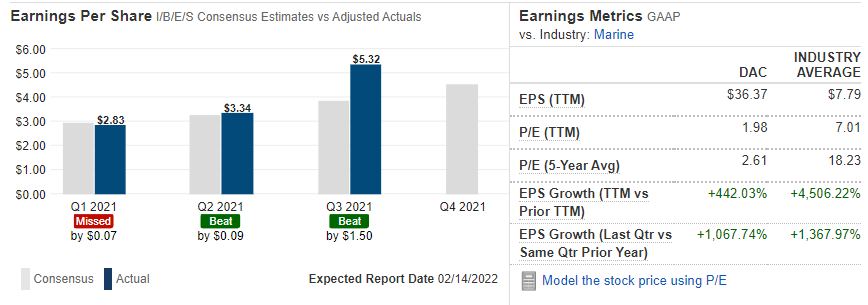

To aid in your due diligence of DAC, here are some key metrics I find of great value. All these fundamental analysis indicators are courtesy of S&P Market Intelligence via Fidelity.com.

And here are some current metrics specific to DAC earnings:

Source: Fidelity.com

Finally, here's how some respected research firms rate the shares:

Source: Fidelity.com

Are there risks with this company?

There are risks with any investment. If container rates come down, that will affect the company adversely. I personally do not see them coming down more than incrementally for the next 3-9 months, but it is a possibility.

Ocean transportation is a commoditized service and DAC is not the biggest kid on the block. Companies with deeper pockets might be able to afford to slash rates to gain market share.

Oil prices could skyrocket—they have done it before. Many of DAC’s vessels are still oil-burners.

I don’t see any of these as major factors in my consideration of whether to buy or not to buy. If container prices stay even within 20% of current pricing, this is a company with real assets, little debt, a great business plan and excellent management.

Bottom Line

Danaos is trading at a price I find quite attractive given its earnings pipeline for the next few years. At these prices, I am a buyer.

Disclosure: I and many of my clients own shares of DAC. Unless you are a client of my advisory firm, Stanford Wealth Management, however, I do not know your personal financial situation. Therefore, I offer my opinions above for your due diligence and not as advice to buy or sell specific securities.