-

Sector rotation has been ongoing for the last two months while the spotlight has been on the massive tech stocks

-

We identify and profile a pair of cyclicals and one defensive company with unusual earnings reports on tap

-

Pay close attention to management guidance and economic outlooks as the second half presses on

The market has a different feel today than it did two months ago. No longer are the mega-caps powering the S&P 500 higher. Rather, small caps, cyclicals, and even defensive niches are providing a blue-chip boost. That’s highlighted perhaps most starkly in the Dow Jones Industrial Average's recent winning streak. As we embark on the heart of earnings season—when all of the tech-related stalwarts report Q2 results—traders will weigh whether the market environment since June 1 has been a corrective blip or if we are indeed in a new regime with emerging leadership.

An Earnings Season Pulse Check

That’s anyone’s wager, and we will know a whole lot more by the end of next week. For now, the second-quarter reporting period has been so-so. The beat rate is, ballpark, at the 5-year average while top-line numbers have been more on the disappointing side, according to FactSet’s latest tally. Meanwhile, the early Q3 guidance gauge leans bearish. Corporate execs are shy about setting expectations anywhere close to high, so we expect more soft bars to be set.

GDP Growth Persists Amid Unimpressive “Soft” Data

That cautious corporate theme echoes a broader trend: soft data, such as survey reports and confidence polls, are running light while hard data, like GDP, CPI, retail sales, and labor market indicators, appear more robust, according to the Citi Economic Surprise Index’s internals. Investors have been looking past this bifurcation, and after a stellar Q1 earnings season, it might just be a matter of time before corporate optimism turns up.

What clues does our team see today? Let’s sift through it together by spotting three old-school stocks: one from the Industrials sector, a Utilities name, and a Materials company synonymous with American industrialism.

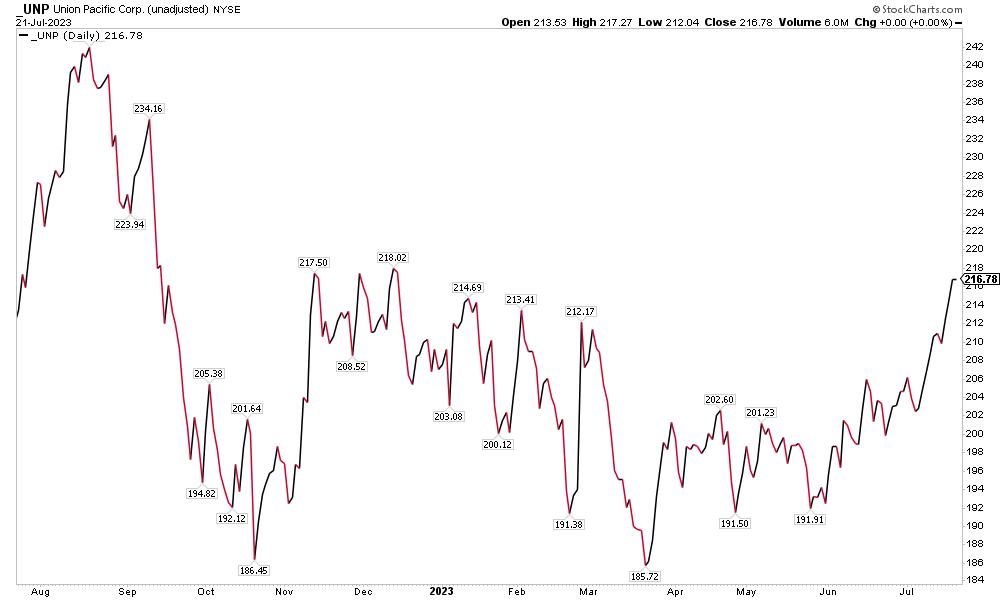

Union Pacific Bearish DateBreaks Factor

Let’s begin this trip by climbing aboard the rails. Union Pacific Corporation (NYSE:UNP), a transport stock within the Industrials sector, has been riding high. Shares are near their best marks since last September despite concerns about ebbing economic growth. Few industries are as cyclically exposed as Rail Transportation, and the group already took a hit last week when CSX (NASDAQ:CSX) issued its first bottom-line miss in two years.

Will UNP chug along the same track? Well, the company’s earnings date was originally expected to take place on July 20, so this event is later than usual, which could be a bearish indicator. Heading into this week, shares were higher in 10 of the previous 11 sessions, so momentum has been in like, well, a freight train. A bad report could stall the rally rather quickly.

Source: Stockcharts.com

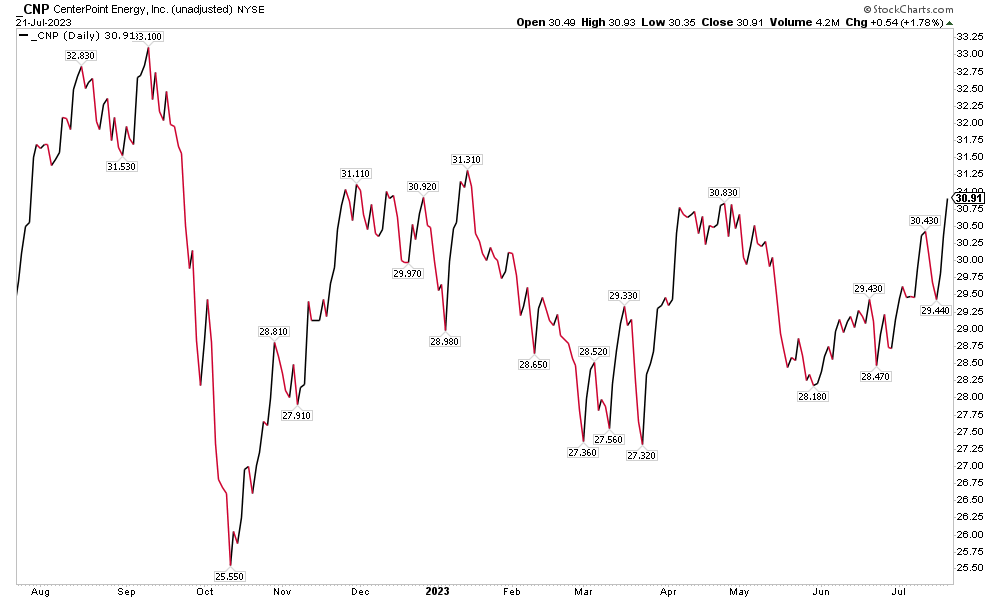

Bullish DateBreaks Factor: CenterPoint Energy

Sticking with the value-stock theme, CenterPoint Energy Inc (NYSE:CNP), a $19.5 billion market cap Multi-Utilities industry company within the Utilities sector has a bullish early DateBreaks Factor. The Texas-based firm was previously expected to issue second-quarter earnings on August 1, but back on June 27, it confirmed an earlier-than-anticipated reporting date. Utilities had been a major laggard in 2023, but the small sector has just recently gained a head of steam.

From Wednesday through Friday last week, the Utilities Select Sector SPDR® Fund (NYSE:XLU) powered higher by 4.4%, the best 3-day climb since last November. Relative to the S&P 500’s performance, those three sessions were the best in a year. CNP has a strong beat-rate history, topping estimates in 10 of the last 12 instances, and options traders have priced in a small 2.6% earnings-related stock price swing after the numbers hit the tape Thursday morning.

Source: Stockcharts.com

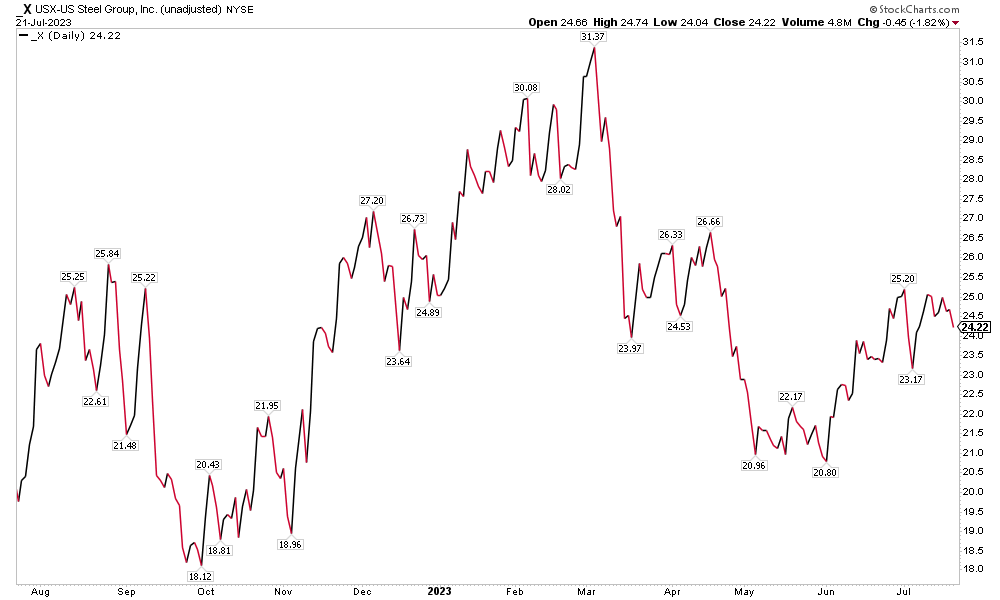

U.S. Steel Bullish Preliminary Earnings (or is it?)

With UNP’s bearish DateBreaks factor and CNP’s bullish earnings date, “Letter X” (trader parlance for the United States Steel (NYSE:X) Corporation) reports Q2 results Thursday AMC. The report follows upside preliminary profit guidance issued in June. Few companies are as dependent on a healthy domestic economy as U.S. Steel, and the street sees a steep year-on-year drop in per-share profits. But, as stated in the June 19 guide, the Materials-sector company’s management team expects to earn between $1.81 and $1.86 per share versus the consensus forecast of $1.76.

Higher selling prices and steady demand were cited for the positive revision. It wasn’t entirely bullish, though, as Letter X also said it forecasts Q2 adjusted EBITDA of $775 million, below the consensus estimate of $792 million. Be on the lookout for positive numbers Thursday night and an upbeat tone in its conference call Friday morning if generally favorable trends have continued.

Source: Stockcharts.com

The Bottom Line

Sector rotation has been going on under the surface of the market’s rally this summer. Quarterly reports this week and next will play crucial roles in where equities go from here as we venture further into the notoriously volatile third quarter.