- Chris Gannatti, Global Head of Research, WisdomTree

- FTSE Russell Value Indices use the book-to-price ratio to denote value[2]

- FTSE Russell Growth Indices use I/B/E/S Forecast Medium-Term Growth, with a two-year horizon and Sales per share historical growth over the past five years[3].

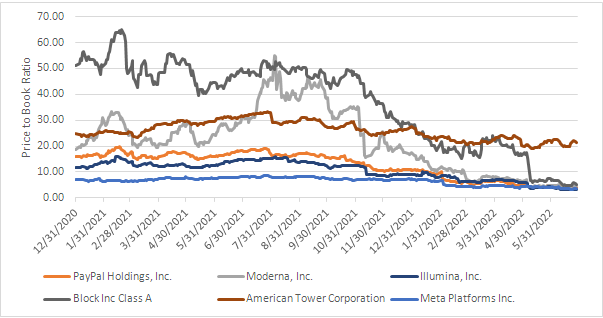

- If one stock is making headlines for moving from ‘mostly growth’ to ‘mostly value’, it is Meta Platforms (NASDAQ:META), formerly known as Facebook. Its price-to-book value ratio dropped by roughly 60% from 28 June 2021 to 28 June 2022. We are certainly not the first to write about this particular shift.

- Block (NYSE:SQ) (formerly known as Square) is a formidable player in fintech with its payments software and Cash App, not to mention its recent acquisition of Afterpay. Yet, possibly due to CEO Jack Dorsey’s association with bitcoin, even if the company itself is making small investments, the price-to-book ratio has dropped nearly 90% from 28 June 2021 to 28 June 2022. PayPal (NASDAQ:PYPL), maybe a more longstanding payments company in the cloud has done better—but its price-to-book ratio dropped nearly 80% over this same period.

- Moderna (NASDAQ:MRNA) is a firm many associate with the life-saving innovations in the mRNA vaccines during the pandemic. Its price-to-book dropped nearly 84% over this same period.

- Illumina (NASDAQ:ILMN) is at the forefront of merging advances in data analysis with advances in genetic capabilities. Over the past year, its price-to-book ratio has dropped nearly 80%.

- American Tower Corporation (NYSE:AMT) is a market leader when it comes to owning cell phone tower assets, and if we’re looking for something that only seems to increase, it is our demand for cell phone data. Yet, the price-to-book ratio still dropped during this period by about a factor of one-third—which looks oddly stable against some of these others.

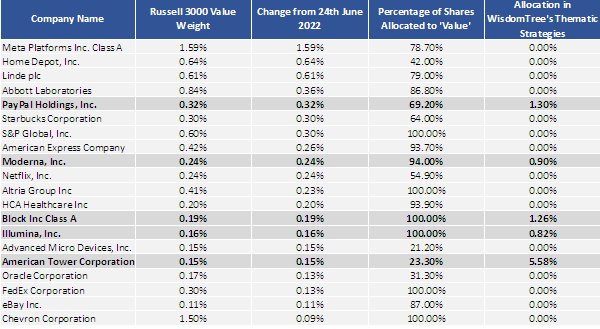

- The Russell 3000 Value weight represents the company’s weight as of 27 June 2022. If viewed in isolation, the fact that this Index has so many constituents makes distinct takeaways tricky. Meta Platforms was the biggest story by far, and yet it had only a weight of 1.59%, not a big number.

- The change from 24 June 2022 is not much different. Companies where the change from 24 June 2022 matches the Russell 3000 Value weight exactly tell us which companies had 0% starting weight and would have been added to the Russell 3000 Index.

- The percentage of shares allocated to value, to us, is one of the most notable columns. This gets at the fact that many companies are not 100% in either growth or value within FTSE Russell indices. Meta Platforms is having almost 80% of its weight allocated to value. It’s interesting that Block and Illumina see 100% of their shares allocated to value, meaning that they wouldn’t be in the Russell 3000 Growth Index at all.

- The Allocation in WisdomTree’s Thematic Strategies relates to the companies that would be represented in at least one WisdomTree thematic strategy. The reason we mention this—thematic strategies are most typically classified as ‘growth.’ If stocks represented in thematic strategies—like Cloud Computing or Artificial Intelligence—are starting to show up in value strategies. It speaks to the magnitude of the current correction that we have seen.

The first half of 2022 was characterised by ‘value rotation’. It’s noticeable because after the Global Financial Crisis of 2008-2009, growth stocks - helped by accommodative central bank policy -went on an 11–12-year run. Value investors were tested to just stick with their strategies after dramatic, sustained underperformance. But that’s changed this year.

Value is in the eye of the fundamental metric

So, what is a ‘value’ stock? If you think of all the different index providers, each has its own definition of the fundamentals that it believes denote ‘value’. Some focus on a smaller subset of fundamentals; others will look at a more diverse array. Like many things across the investment landscape, it’s difficult to note if there is a ‘correct’ approach. Each method will tend to tilt toward or away from companies with certain attributes.

The FTSE Russell Value & Growth reconstitution

At the close of 24 June 2022, FTSE Russell undertook their Value & Growth Index reconstitution[1].

More important than fundamentals is this critical fact: stocks can have their weight allocated to both growth and value indices at the same time. This means that the same company can have part of its market cap allocated to the Russell 3000 Value and Russell 3000 Growth Indices. Many people might assume the two categories are mutually exclusive, but they are not.

The lines between value and growth can blur

If stocks can experience severe reductions in their price-to-book value ratios (another way of saying increase in book-to-price ratios), per the FTSE Russell methodology, they can become allocated more and more towards value.

In Figure 1, we can see[4]:

The severity of these moves leads us to think about how these names, which many would have thought were emblematic of the ‘growth’ style, makes us think they might be ripe for at least some of their market caps being shifted into the value side of the FTSE Russell Indices.

Figure 1: The growth to value metamorphosis begins

Source: Factset, with companies selected from within the top 20 companies with the largest increase in weight within the Russell 3000 Value Index as of the close of 27 June 2022, the first trading day after the reconstitution that also had exposure within at least one of WisdomTree’s thematic strategies. While Meta Platforms did not have exposure to any of WisdomTree’s thematic strategies, we included it as the single biggest mover during this 2022 rebalance. Historical performance is not an indication of future performance and any investments may go down in value.

Russell 3000 Value Index Rebalance Results

And now, the drumroll—what happened?

Figure 2, a table, contains a lot of valuable information[5].

Figure 2: The Top 20 Gainers in Weight in the Russell 3000 Value Index (as of 27 June 2022)

Source: Factset, with companies selected from within the top 20 companies with the largest increase in weight within the Russell 3000 Value Index as of the close of 27 June 2022, the first trading day after the reconstitution. Historical performance is not an indication of future performance and any investments may go down in value.

Conclusion—what is value?

What’s clear is that the companies that comprise the ‘value’ style are not constant.

Some very well-known growth names are seeing at least some of the weight getting allocated to value, at least within FTSE Russell’s universe.

We may be far from saying ‘thematic strategies are in the value style fully’ but it is a notable way to quantify the incredible nature of the correction we’ve seen in 2022 so far.

Disclaimer: This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

[1] Source: https://content.ftserussell.com/sites/default/files/2022.02.03_russell_recon_schedule.pdf

[2] Source: Russell U.S. Equity Indexes, version 5.5. Construction and Methodology Document. June 2022.

[3] Source: Russell U.S. Equity Indices, June 2022.

[4] Source: Factset, with data up to 28 June 2022.

[5] Sources: FTSE Russell, Factset, with data as of closing price, 27 June 2022.