As of Tuesday 20th of August:

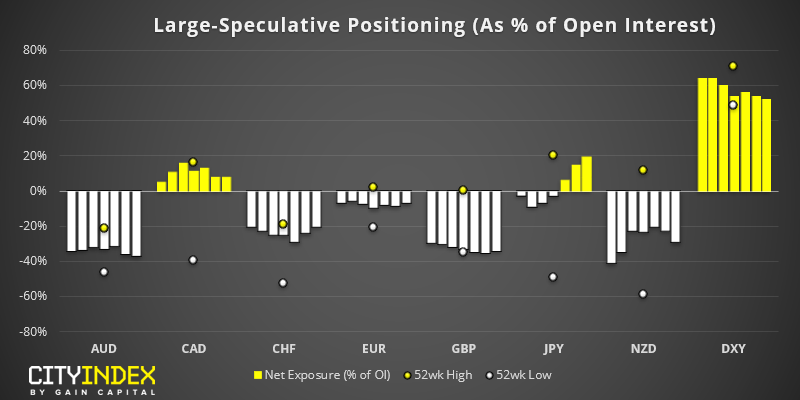

USD: Traders are the least bullish on the USD since June 2018, which is the week if flipped from net-short to net-long. We’ve seen demand for the USD move notably lower since its May peak, yet DXY had remained stubbornly high. That said, this was ahead of Friday’s tweet storm by Trump which saw DXY endure its most bearish session since January 2018. However, the 1-year Z-score is now -2.1 standard deviations to suggest it could be stretched relative to its 1-year average. Although that said, Z-scores don’t make very good timing signals, but they do flag potential for over-extension. Given we’ve seen a momentum shift from its highs, we remain bearish on USD over the near-term.

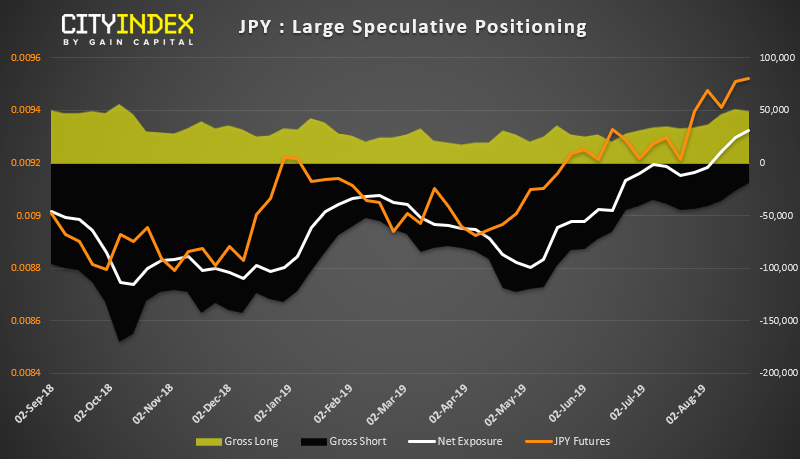

JPY: The Japanese yen remain in demand, and net-long exposure is now at its highest level since November 2016. That said, both longs and shorts reduced exposure which saw open interest drop by -9,972 contracts, so the rise of net-positioning was mostly fuelled by short-covering last week. Gross short positioning is now at its lowest level since January 2012 and, given the rising tensions over the trade war, we remain bullish on the yen overall.

As of Tuesday 20th of August:

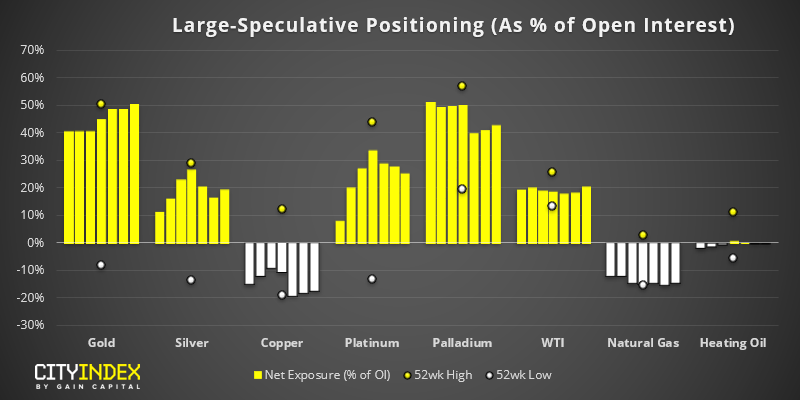

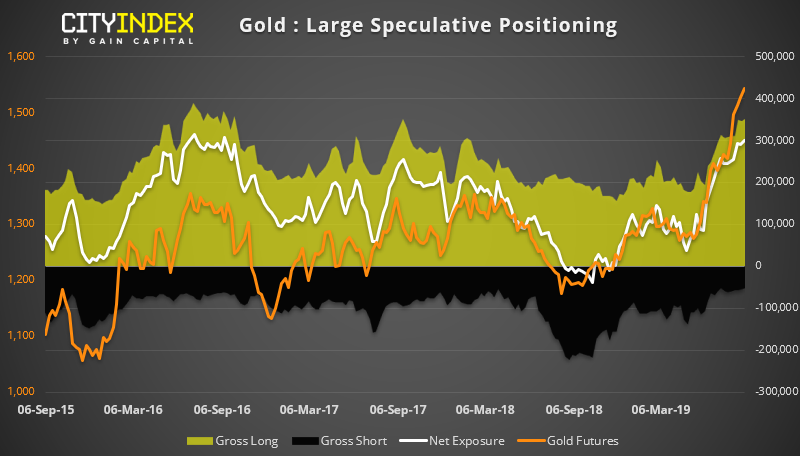

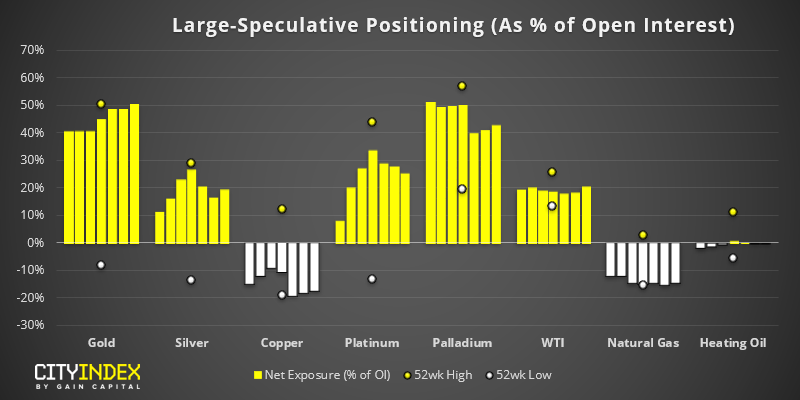

Gold: The bullish rally continues with the precious yellow metal having tested $1556 early Asia. Pretty much every metric we look at suggests the move is stretched, but we still need price action to confirm anything like a correction. The fact that we’ve clearly seen a regime shift makes these ‘overbought’ levels less reliable, yet it does bear keeping in mind that net-long and gross-long exposure is at levels last seen in 2016, to suggest it’s at or near a sentiment extreme. Therefore we’d suggest caution around current levels if entering long on the daily chart, yet without any topping price action, urge against fading into this bullish rally to try and catch a top.

Copper: Traders have been net-short on copper for 17 weeks. Moreover, they were the most bearish on record last week. Yet, despite this, you could argue that prices remain elevated. So this could mean that prices are yet to roll over and confirm large speculators as correct, or there’ll be a lot of shorts to cover if shorts get shaken out, which could spark quite a rally in the metal. For now, we remain bearish on copper as it recently confirmed a head and shoulders top pattern. Now we just need prices to accelerate to the downside.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."