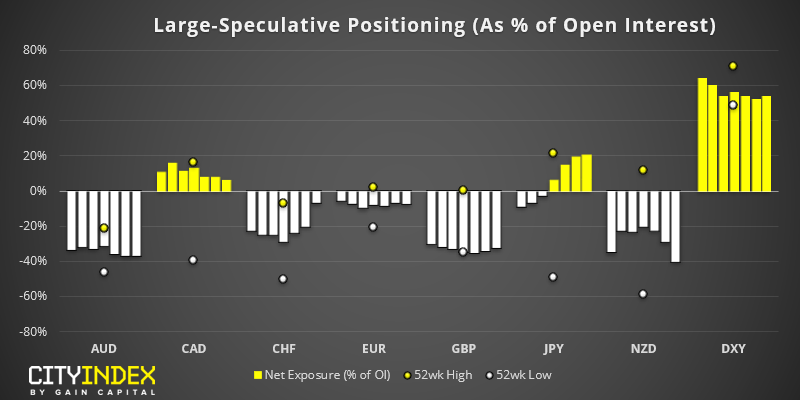

As of Tuesday 27th August:

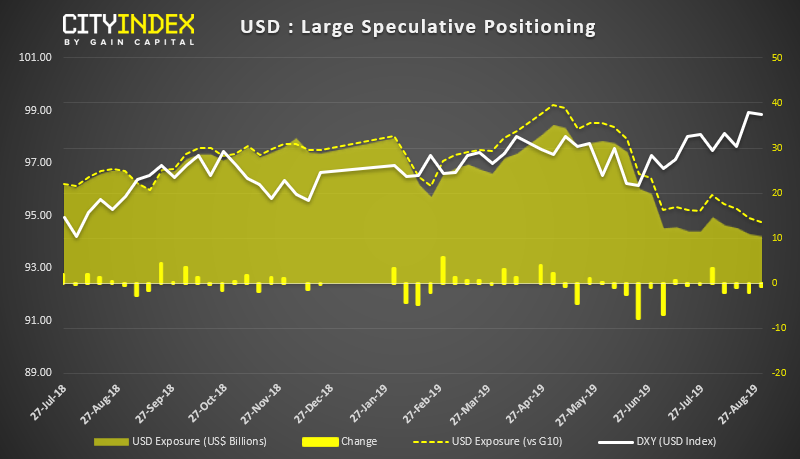

USD: The US dollar index (USD) remains resilient, despite the dwindling bullish interest among large speculators. As of Friday, it saw its most bullish weekly close since May 2017 and the trade-weighted index is at an all-time high. We previously noted that the USD tends to strengthen when the Fed ease, and it’s making no exception this time around. So, we’re curious as to why large speculators seem wary of the dollar and to when they’ll once again correlate with price action (and whether that means the dollar rolls over, or large speculators turn up to the part late).

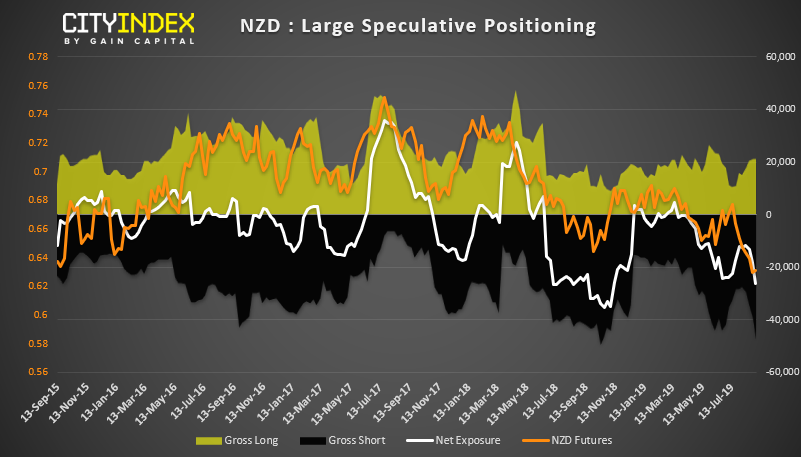

NZD: The bears are clearly in control, with prices closing to their lowest level since August 2015. Net-short exposure is it's most bearish since November, although gross-short exposure is at historically bearish levels which raises the prospect for an inflection point to occur. Interestingly, RBNZ has cut by 50 bps points and not giving the impression another cut is pending, and data is outperforming expectations according to the CESI (Citi Economic Surprise Index). Moreover, OIS rates place a low probability of a cut this year. From that, we assume it is the trade war which is weighing the Kiwi down, so any positive developments on that front could see some rapid short-covering. Until then, the trend points lower, even if it does look stretched from most metrics.

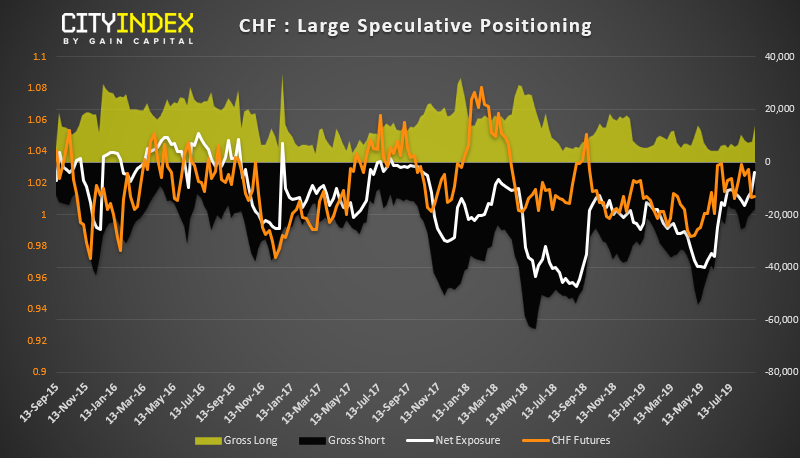

CHF: Despite its safe-haven appeal, traders have been net-short the Swiss franc for two years. However, at the current rate of trajectory, this could be about to change. Net-short exposure was reduced by 22% last week, from 11.2k to 3.8k short exposure. Moreover, we noted that CHF generally performs well in September according to the seasonality of the past 30-years, so we keep to see if it follows its historic path this year too.

As of Tuesday 27th August:

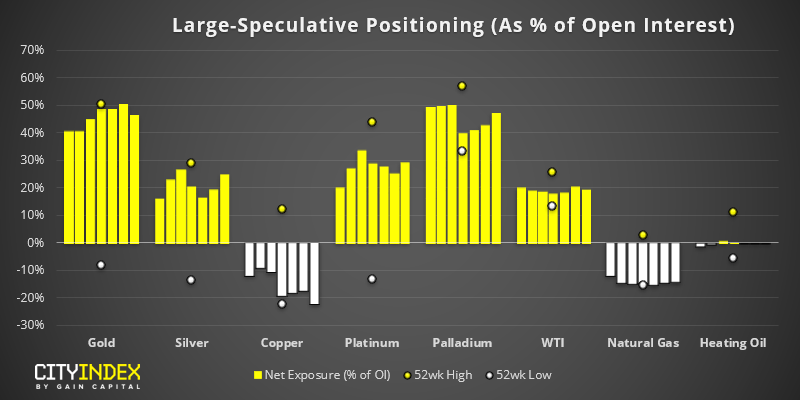

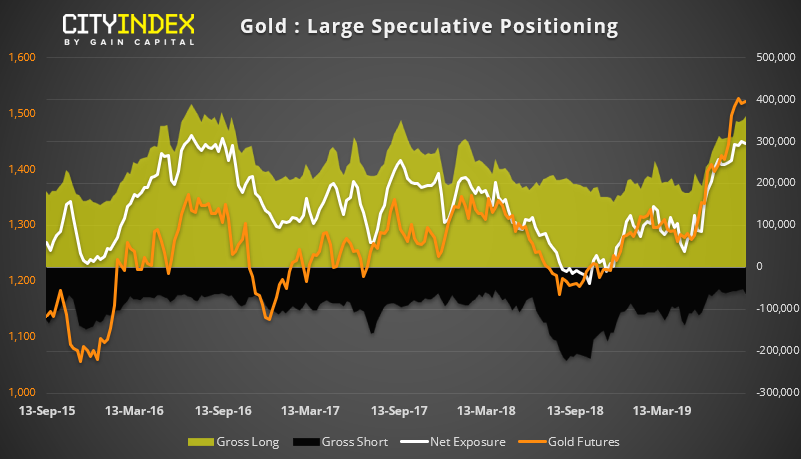

Gold: Without trying to sound like a broken record, bullish exposure on gold continues to look stretched on every metric. Net and gross-long exposure is at levels that have been associated with inflection points, although the current dynamic of trade wars and a bearish Fed continue to support prices, so if we don’t see a large correction, we could see gold trade sideways until its next lev higher. Whilst we’re not saying it can’t go higher from here, once should question the reward to risk potential, given its parabolic move in recent weeks.

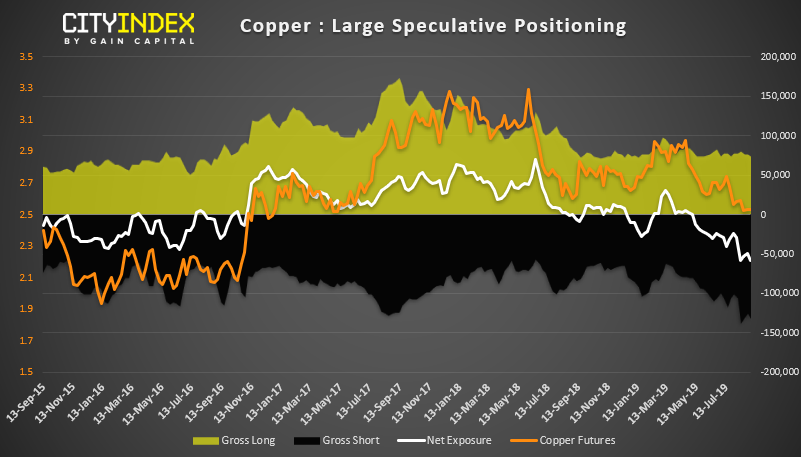

Copper: traders have been net-short on copper for 18 consecutive weeks, and at their most bearish level on record. We highlighted the multi-month head and shoulders top recently, so we’re now waiting for prices to confirm large speculators grizzly view. Or, for them to short-cover and prices soaring. Given the lack of ‘credible’ developments on the trade-war front, we’re waiting for prices to roll over.