Last week can be summed up as “the week global governments saved the world economy”, in the wake of the economic fallout of the coronavirus. Global central banks continued to slash interest rates and provide liquidity through QE and extension of credit lines. Individual governments stepped up to the plate and passed massive amounts of stimulus, promising more to come, if necessary. We have not seen something like this since the Great Financial Crisis in 2008. Despite these efforts, stocks continued to fall, and the US Dollar became the flight to safety. Crude Oil crashed 25% on Wednesday, only to come roaring back by the same amount on Thursday. This week expect cases of coronavirus to increase and government interventions to continue. We’re in the early innings of a long ballgame.

Even before markets opened on Monday, the RBNZ cut rates to 0.25% and the US Fed slashed rates to 0%. In addition, the US launched QE4. These efforts continued throughout the week as the BOJ, ECB, BOE and other central banks continued to build on efforts from last week. The United States passed a $1.3 trillion stimulus package, Australia passed $10 billion package, and many other nations have passed spending proposals for governments to provide financial assistance to those who need it the most. The world is coming together to try and stop the spread of the coronavirus, while at the same time, supporting a fragile world economy. More of this will continue this week as countries are preparing 2nd and 3rd phases of stimulus to help their nations.

Stocks had another route last week as many world indices were down another 10%. The DJIA closed down over 17% on the week, below 19,000. The S&P 500 closed the week down over 15.5%, below the December 2018 low. The FTSE and DAX were also down over 8%.

The US Dollar continued to take the flight to safety status, with the DXY up 4% this week! In turn, many of the USD counter currencies were down significantly last week: EUR/USD: -4%, GBP/USD: -5.5%, AUD/USD: -6%, and USD/CAD +4.5%.

WTI crude oil continued to move lower over the past week, closing down another 27%. This included a dramatic move lower of -22% on Wednesday. On Thursday, President Trump suggested buying oil for the SPR and oil shot up 25%. On Friday, WTI moved lower again and closed down -11%. Watch for the volatility to continue as OPEC+ members continue to bicker over supply amounts as demand continues to fall.

Have the markets moved too far, too fast? Central banks have done just about all they can do. Will it help? Have governments provided enough fiscal stimulus to keep their economies afloat as lockdowns around the world become more prevalent? These are all questions the markets will be looking for answers to over the coming weeks and months.

Watch the data!

With the exception of China’s data, the rest of the world’s economic data has primarily been irrelevant. The only data that mattered to the markets was data related to the coronavirus. Now however, the world will begin to see economic data from March, when the rest of the world was uprooted and tossed into the coronavirus mix. This past Thursday, we got to see the US Philadelphia Manufacturing Index (Philly Fed) for March. Expectations were for a reading of +10. The actual number was -12.7. For comparison, February’s number was 36.7. We also got to see Initial Jobless claims for the week ending March 14th. Expectations were for 220,000 vs an actual reading of 281,000. This reading may not be that far off, however expectations for the week ending March 21st continue to rise. Estimates are ranging from +300,000 to +3,0000,000 (not kidding!). Expect the actual number to be on the higher side!

Also, pay particular attention to the global PMI’s which are set to be released on Tuesday. These will be the first global data figures releases from March and will give an initial reading of how much world manufacturing has slowed.

Below is a list of other important economic data to be released next week:

Tuesday

- GLOBAL PMI DATA (MAR)

- UK: BOE FPC Statement

Wednesday

- Japan: BoJ Monetary Policy Meeting Minutes

- Germany: IFO Business Climate Final (MAR)

- UK: Inflation Rate (FEB)

- US: Durable Goods (Feb)

- Crude Inventories Data

Thursday

- Germany: GfK Consumer Confidence (APR)

- EU: ECB Economic Bulletin

- BoE Interest Rate Decision (although they just cut to 0.1% on Thursday)

- US: Initial Claims (week ending March 21st)

- US: GDP Growth Rate QoQ Final (Q4)

Friday

- New Zealand: Consumer Confidence (MAR)

- China: Industrial Profits (YTD) YoY (FEB)

- US: Michigan Consumer Expectations Final (MAR)

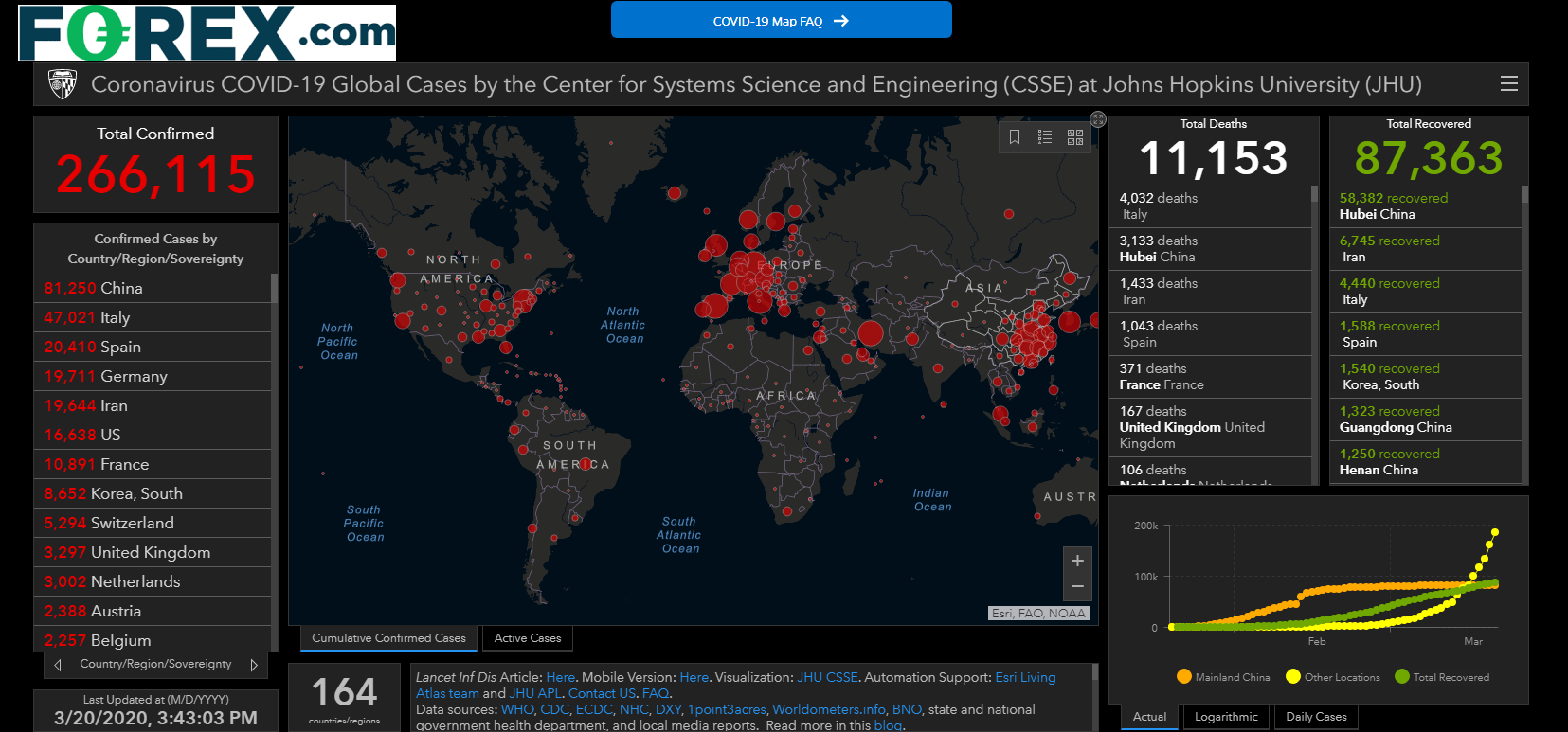

Chart to Watch: John Hopkins Coronavirus Map

Expect market volatility to continue as long as these number are increasing. Until the rate of number of cases and the rate number of deaths begin to turn lower, expect that volatility will continue.

Good News

With all the bad news related to the coronavirus recently, I thought I’d offer a bit of good news during these times:

- GM is going to convert some manufacturing plants to build much needed ventilators

- 3M (NYSE:MMM) has doubled production of masks to help fight the coronavirus, to 1,000,000 per month

- Amazon (NASDAQ:AMZN) is hiring 100,000 workers for their warehouses to help meet demand

- Walmart (NYSE:WMT) is hiring 150,000 workers to help meet demand

- 1,000 retired and private New York City doctors and healthcare professionals have volunteered to assist in helping those infected with the coronaviruses, bringing the total healthcare workers there to 10,000

- On Thursday, there were no new cases of coronavirus in Wuhan, China, where the outbreak began

- Apple (NASDAQ:AAPL) reopened their stores in mainland China.

Governments worldwide have responded and are continuing to do what is necessary to fight off the coronavirus. The wheels are now in motion. We need to make sure they don’t come off the track!

As we mentioned last week, as long as the volatility continues and markets continue to be erratic, try to always remember these 3 things:

1. TRADE SMALLER SIZE TO COMPENSATE FOR THE VOLATILITY.

2. USE STOPS.

3. PRESERVATION OF CAPITAL IS KEY. MAKE SURE YOUR ACCOUNT IS AROUND TOMORROW TO TRADE ANOTHER DAY!

And make sure to always wash your hands!

Have a great weekend!