Flash PMIs, CPI, and Eurozone sentiment data in focus

Flash PMIs will be released towards the end of the week for the US, UK, Eurozone, Japan and Australia. The surveys will offer a first look into worldwide economic conditions in June and will follow CPI data for Hong Kong SAR, the UK, Canada, Singapore, Japan and Malaysia. Some key economic releases, such as Eurozone, US, and India current accounts as well as UK retail sales are also lined up.

May global PMI data indicated generally weaker economic performances amid the headwinds of lockdowns in mainland China and the Ukraine war, which stymied the boost from economies reopening from Omicron. Flash PMI data will indicate whether these slowdowns have become more entrenched (see box), with eyes particularly focus on the US numbers for manufacturing and services following the Fed's 75 basis point rate hike. Supply performance will also be closely watched, given recent difficulties sourcing materials, as will the price gauges for signs of inflation hopefully peaking.

Meanwhile, in the UK, the latest Bank of England Monetary Policy meeting resulted in a fifth straight rate hike to 1.25%, its highest for 13 years. Policymakers will, therefore, be keeping a close eye on inflation data released mid-week while retail sales and consumer confidence will also be eagerly anticipated as households struggle under the weight of soaring energy bills and food prices.

In addition for Europe, the flash PMI data for the Eurozone, Germany, and France are supplemented by construction output figures and sentiment surveys including the closely watched IFO survey for Germany.

Elsewhere, in the APAC region, the BSP is expected to hike interest rates again in the Philippines as inflation surges while activity growth continues (according to S&P Global Philippines PMI). Thailand manufacturing data will also become available towards the end of the week which should shed further light on the sector's performance amidst worsening price pressures and weak supply.

A Wile E. Coyote moment for the global economy?

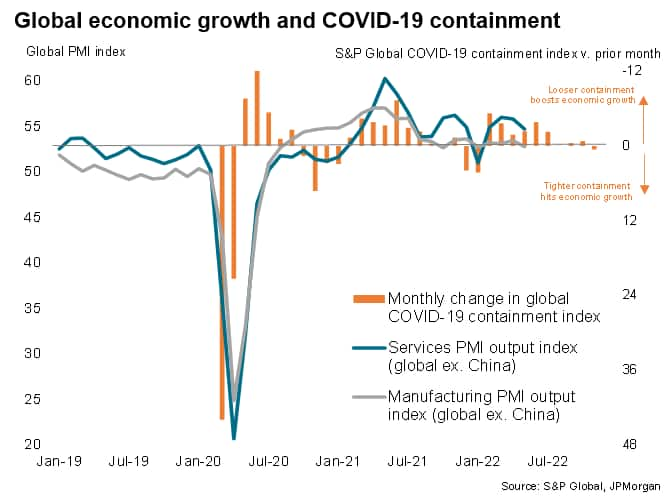

The latest PMI survey data indicate that, if mainland China is excluded, global growth retained encouraging resilience in May. Although losing some momentum, the global PMI's output index excluding China remained indicative of annualized GDP of around 3.5%. However, there's a big question as to whether the global economy is experiencing something of a Wile. E Coyote moment, whereby the cartoon character defies gravity by running on air momentary having sped off a cliff, only to then plummet down.

The concerns rest on the fact that global manufacturing growth has weakened amid ongoing supply constraints and soaring prices, leaving growth reliant on the service sector. Detailed PMI data in fact reveal how the main impetus to global growth is coming from a revival in spending on consumer-oriented services such as tourism and recreation, as many of the world's largest economies reopen from Omicron-related restrictions.

As our chart shows, we can expect some further support to service sector growth from a further loosening of global COVID-19 containment measures in June and, to a lesser extent, July. But this stimulus is clearly fading and is also being countered by various headwinds, most notably the cost-of-living crisis, falling consumer confidence, and rising interest rates. Hence, flash PMI data, updated on 24th June, will provide all-important steers on the latest health of the service sectors of the major developed economies, and help assess the risk of recession.

Key diary events

Monday 20 Jun

United States Market Holiday

Germany Producer Prices (May)

Eurozone Construction Output (May)

Taiwan Export Orders (May)

India Current Account /GDP (May)

Tuesday 21 Jun

Hong Kong SAR CPI (May), Overall Balance (Q1)

United States National Activity Index (May), Existing Home Sales (May)

Canada NHPI (May), Retail Sales (Apr)

Wednesday 22 Jun

Bank of Japan policy meeting minutes

New Zealand Annual Trade Balance (May)

Thailand Customs-Based Trade Data (May)

United Kingdom CPI (May), PPI (May)

United States Mortgage Market Index (Jun)

Canada CPI (May)

Eurozone Flash Consumer Confidence (Jun)

Thursday 23 Jun

South Korea PPI Growth (May)

Australia S&P Global Flash PMI, Manufacturing & Services* (Jun)

Japan au Jibun Bank Flash PMI, Manufacturing & Services* (Jun)

UK CIPS/S&P Global Flash PMI, Manufacturing & Services* (Jun)

Germany S&P Global Flash PMI, Manufacturing & Services* (Jun)

France S&P Global Flash PMI, Manufacturing & Services* (Jun)

Eurozone S&P Global Flash PMI, Manufacturing & Services* (Jun)

US S&P Global Flash PMI, Manufacturing & Services* (Jun)

Japan Foreign Bond Investment (Jun)

Thailand Manufacturing Production (May)

Singapore CPI (May)

United Kingdom PSNB (May), PSNCR (May)

Norway Labour Force Survey (Apr), Key Policy Rate (May)

Philippines Policy Interest Rate (Jun)

Taiwan Industrial Output (May), Jobless Rate (May)

United States Current Account (Q1)

Friday 24 Jun

United Kingdom GFK Consumer Confidence (Jun), Retail Sales (May)

Germany Ifo Business Climate New (Jun)

Malaysia CPI (May)

US University of Michigan consumer sentiment (June, final)

US new home sales (May)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

June S&P Global flash PMIs

June's flash PMIs will be released across the US, UK, Eurozone, and APAC economies including Japan and Australia. May's figures told of slowing growth and persistent price pressures, which were exacerbated by geopolitical tensions and shortages. Amid surging inflation and a general movement towards tightening monetary policy, June's PMIs will be closely watched by policymakers. Not only will June's releases provide a steer on economic growth rates and demand, but they will also shed light on the trajectory for inflation via input costs and selling price indices. Suppliers' delivery times data will likewise be assessed after some sign of supply chain stress easing in May, but output was still often constrained by supply bottlenecks after shortages for some key inputs continue to be a common theme across the economy.

Americas: US housing market updates, Current Account and Canada CPI, consumer sentiment

US consumer sentiment, new and existing home sales, and mortgage market data will be eyed for household well-being indications in the face of rising inflation and soaring mortgage costs. Current account data will be also released for the US. CPI data for Canada will also be anticipated and is expected to remain elevated.

Europe: Eurozone Construction Output, Consumer confidence, Germany Ifo business climate

Construction output is expected out of the Eurozone alongside June consumer confidence data. Meanwhile, Germany releases producer price numbers, as are June's Ifo business climate readings.

Asia-Pacific: Hong Kong, Malaysia, and Singapore CPI data, BSP meeting, and Taiwan's Industrial output figures.

The Bangko Sentral ng Pilipinas (BSP) will meet in the coming week and is expected to hike rates amid surging inflation. CPI data for various APAC regions including Hong Kong SAR, Singapore, and Malaysia will be released. Lastly, Taiwan's industrial output data is expected to give an indication on manufacturing performance for May. At the same time, Thailand manufacturing figures will also be released alongside customs-based trade data.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."