Flash PMI data for May will be released next Tuesday for a first look into economic conditions midway into Q2. Meanwhile, central bank updates will be in abundance with the May Fed FOMC minutes due while monetary policy meetings unfold in New Zealand, South Korea, and Indonesia. Key data to watch also include US, German, and Taiwan GDP data, while April US personal income and consumption figures are also expected.

Inflation and growth concerns remain centre stage this week. Despite a solid US retail sales reading in April, disappointing earnings performance reported by US retailers dampened sentiment this week. This again heightens concerns over slowing growth, casting a cloud over global equities. Meanwhile, Fed speakers, including Fed Chair Jerome Powell, reiterated their focus on taming inflation, which adds to concerns over slowing economic growth.

Given this backdrop, next week's flash PMI data and US economic data may be watched extra carefully for insights into growth and inflation conditions while the Fed minutes will be scrutinised for the Fed's thoughts on upcoming rate hikes. As far as April's PMI figures suggested, the US had seen surging inflationary pressures amongst the developed economies and the trend into May will be closely watched with the flash PMI figures. The Fed's preferred inflation gauge, the core PCE reading for April, will also be updated on Friday after core CPI surprised on the upside.

In APAC, central bank meetings will be held in Indonesia, New Zealand, and South Korea. While the RBNZ may continue on their rate hike cycle, and BI could pave the way for their first hike in June, the BoK will be watched with heightened uncertainty after the new central bank chief suggested that a 50-basis point hike should not be ruled out in the coming week. A string of economic data including Taiwan's Q1 GDP and Singapore's inflation reading is also lined up for APAC's week ahead.

Flash PMI surveys: What to watch

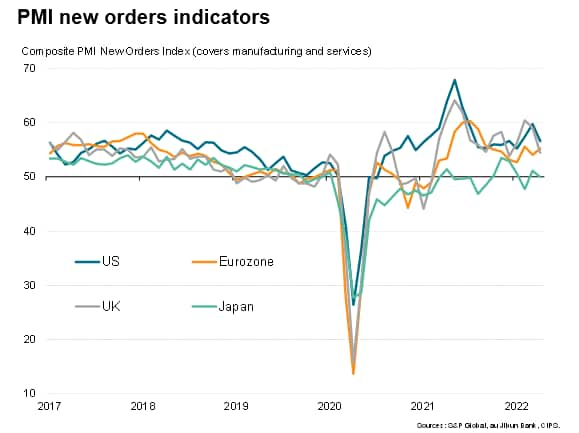

Flash PMI data for the US, eurozone, UK, Japan, and Australia will provide the first major clues as to the health of the world economy in May. April's data had shown economic growth slowing in the US and UK as strong pandemic rebounds showed signs of fading. In contrast, a reopening of economies in the eurozone and Japan helped drive improvements, helping to offset weakened manufacturing performances arising from fresh supply delays. Shortages of inputs were linked to the Ukraine war and lockdowns in mainland China. China's downturn meant that measured globally, supply delays worsened and global factory output fell into decline for the first time since June 2020.

May's PMI data will therefore add further insights into the extent to which the Ukraine invasion and China's lockdowns are damaging supply chains and adding to inflationary pressures. However, the service sector data will also be of great interest in assessing the degree to which price pressures are feeding through from goods to services, notably via wages, as these second-round inflation effects could have a major influence on monetary policy.

Importantly, the PMIs will also reveal just how resilient economies have been amid the growing headwinds of geopolitical uncertainty, supply chain issues, and soaring inflation. The key leading indicators to watch in this respect be the strength of demand signalled by the survey's new orders indices as well as the level of business confidence indicated by the future expectations indices.

Key diary events

Monday 23 May

Canada Market Holiday

Thailand Customs-Based Trade Data (Apr)

Thailand Manufacturing Production (Apr)

Singapore Consumer Price Index (Apr)

Germany Ifo Business Climate (May)

Taiwan Industrial Output (Apr)

Taiwan Jobless Rate (Apr)

United Kingdom CBI Trends (May)

Tuesday 24 May

Indonesia, Switzerland, Norway Market Holiday

Australia S&P Global Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany S&P Global Flash PMI, Manufacturing & Services*

France S&P Global Flash PMI, Manufacturing & Services*

Eurozone S&P Global Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Indonesia 7-Day Reverse Repo (May)

Wednesday 25 May

New Zealand Cash Rate (25 May)

Germany GDP (Q1)

Germany GfK Consumer Sentiment (Jun)

Norway Labour Force Survey (Mar)

United Kingdom CBI Distributive Trades (May)

United States Durable Goods (Apr)

United States Fed FOMC Minutes (May)

Thursday 26 May

South Korea Bank of Korea Base Rate (May)

Australia Capital Expenditure (Q1)

Singapore Manufacturing Output (Apr)

United States GDP 2nd Estimate (Q1)

United States Initial Jobless Claims

Canada Retail Sales (Mar)

United States Pending Sales Change (Apr)

Friday 27 May

Japan CPI, Overall Tokyo (May)

Australia Retail Sales (Apr, final)

Taiwan GDP (Q1, revised)

Eurozone M3 Annual Growth (Apr)

United States Personal Income and Consumption (Apr)

United States Core PCE Price Index (Apr)

United States UoM Sentiment Final (May)

* Press releases of indices produced by S&P Global and relevant sponsors

can be found here.

What to watch

Flash manufacturing and services PMIs for May

The global economy continued to expand for the twenty-second straight month in April but the rate of growth slowed amid a steep downturn in mainland China. While services activity sustained its expansion, the manufacturing sector recorded the first output contraction since June 2020. This was amid worsening supply chain conditions, aggravated by the lockdowns in China and the Ukraine war. As a result, inflationary pressures intensified, fuelling further expectations for policy tightening by central banks.

As such, the focus in the coming week will be on the growth, supply, and inflation, studying the flash PMIs released for major developed economies including the US, UK, eurozone, Japan, and Australia.

Refer to our PMI release calendar for the full schedule of monthly releases.

North America: Fed minutes, US Q1 GDP, April core PCE, personal income and consumption data

The May Fed FOMC meeting minutes will be released in the coming week following a gathering which saw a 0.5% hike by the Fed. Subsequent comments from Fed speakers including FOMC chair Powell retained the inflation focus, highlighting the need to tackle rising prices even if that meant growth slowing. With further 50 basis point rate hikes not off the table, the minutes will be scrutinised for the Fed's plans going forward. PCE data will likewise be under scrutiny for indicators of consumer spending and inflation.

Europe: Germany Q1 GDP, Ifo business climate index

Besides the flash PMI data, detailed Q1 GDP data from Germany and the Ifo business climate figures will be released next week, as well as consumer confidence data.

Asia-Pacific: BI, RBNZ, BoK meetings, Taiwan GDP, Singapore CPI

Central bank meetings in Indonesia, New Zealand, and South Korea will unfold in the coming week with the Reserve Bank of New Zealand (RBNZ) expected to raise rates according to our forecasts. A further rate increase since a change of Bank of Korea (BoK) chief is also not ruled out for the May meeting while Bank Indonesia (BI) may pave the way for their rate increase in June.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."