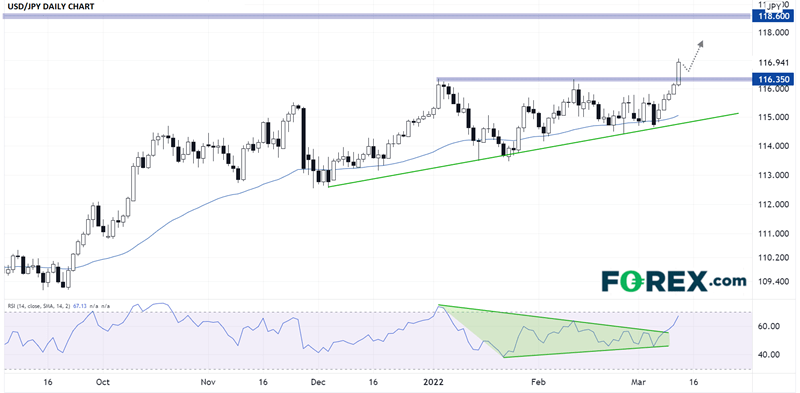

It’s no secret that USD/JPY has been trending consistently higher for nearly six months now, but some traders have been caught off guard by the ferocity of today’s move through resistance.

As the chart below shows, the pair has been riding its 50-day EMA higher since September, though the price action over the last four months could be better characterized as an ascending triangle, with higher lows showing increasing pressure on a horizontal level of resistance, in this case at 116.35. The textbook explanation for the pattern is that once an instrument breaks above its resistance line as we’ve seen today, a strong continuation higher is likely to follow:

Source: TradingView, StoneX

To the topside, the next level of previous resistance sits in the mid-118.00s, USD/JPY’s six-year high.

From a fundamental perspective, there are several key events to watch next week:

- US PPI (Tuesday)

- US Retail Sales (Wednesday)

- The Federal Reserve’s Monetary Policy Meeting (Wednesday)

- The Bank of Japan’s Monetary Policy Meeting (Friday)

Of these, the two most important ones to watch for USD/JPY traders will be the dueling central bank meetings. With the BOJ likely to cut its forecasts for economic growth and inflation in the island nation remaining elusive despite rising energy and commodity prices, a dovish message out of Japan is likely.

Meanwhile, traders will be eager to see if the Fed follows in the footsteps of the ECB by emphasizing the inflationary risks of the conflict in Ukraine over the deleterious impact on economic growth; while a 25bps interest rate increase seems like nearly a “done deal” at this point, the release of the central bank’s Summary of Economic Projections (including the closely-watched “dot plot”) and any update on an outright reduction in the Fed’s balance sheet could have a big impact on USD/JPY in particular. Be sure to check back for our full FOMC preview report on Monday!

As it stands though, the path of least resistance for USD/JPY remains to the topside as long as previous-resistance-turned-support at 116.35 holds.