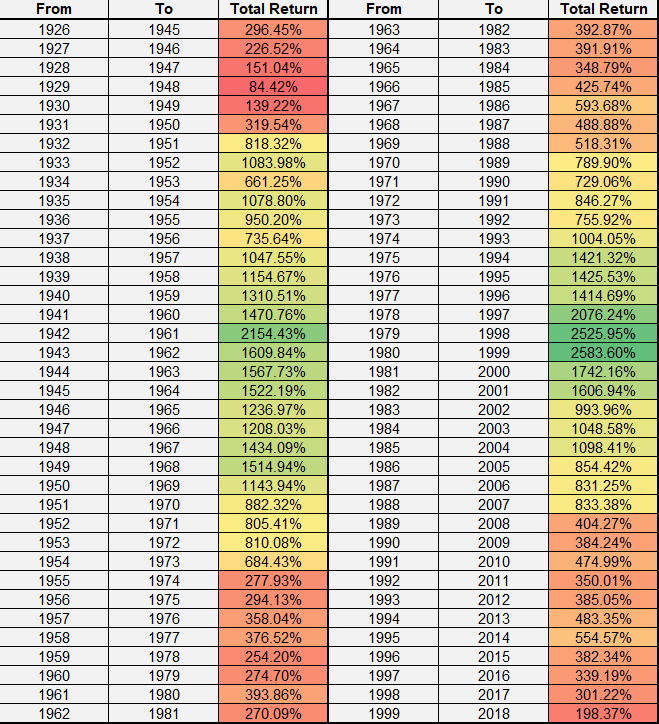

Consider this: since 1926, the first year in the data set used for this post, there has never been a 20- or even 30-year period where returns on the S&P 500 were negative. That's staggering, particularly for the myriad investors currently focusing on the fact that returns on the benchmark index have been flat for the past 12 months.

It also underscores the huge fallacy of making an investment decison based only on returns for a single year, irrespective of the period being considered. To more starkly play up this point: if you invested in the S&P 500 during any given year and left your money there for 20-years or more—your returns will always have been positive.

Younger investors may find this surprising, particularly since equities have been relatively volatile recently, as they have been on occasion for extended periods in the past. From 1929 to 1932, during the great depression, the S&P 500 fell for four consecutive years, including in 1931 for the biggest one-year drop on record, when the benchmark lost -43.34%.

Even then, however, the return for that 20-year period which began just before the 1929 crash yielded +84%. That may be a lackluster performance considering the gains seen during similar two-to-three decade-long periods, but consider that this was arguably the worst period ever for the U.S. economy.

More recently, the SPX saw three consecutive years of declines, from 2000 to 2002. An investment in the index on January 1, 2000, would have yielded a loss of -37% over the next three years.

At that point, selling might have seemed like a good idea, but in hindsight it would only have locked in losses. Over the following 19-years, the same investment would have returned +146%, even though initially almost 40% of the original capital disappeared and had to be recovered. As well, had that investor hung on, they would have had to survive the losses from the 2008 financial crisis as well.

Considering the dot com bubble and financial crisis both occurred during that timeframe, it’s incredible that even that 20-year period ended up as profitable for investors.

Of course, not every 20-year window is equally beneficial. If you're a relative newbie, or a young investor just starting out, you've got to work with the decade-plus period the fates have given you.

The best period in this survey was from 1980-1999 which included the economic boom of the '80s through the final days of the dot com bubble, when the S&P gained +2583%. That means an investor who put in $10,000 initially, would have finished with $268,300 in 20-years.

The average 20-year SPX performance was +820%, the median +735%. For an investment initiated during the 1970s, the average 20-year performance was +1300%; the same investment only returned +385% on average in the 1990s.

Still, no matter when an investor was born, it remains their choice whether to invest or not.

Given the statistics, there's no argument that a return of +385% is still better than 0. And if you're older and don't believe you have another 20-year investment horizon ahead, consider this adaptation of an old Greek proverb: 'a family grows wealthy when grandfathers invest in stocks whose profits they know they'll never enjoy.'

To close, a note about market timing: ultimately, timing the market requires a lot of skill and even more luck. This often makes it a losing proposition for many. The good news—you don’t need to try and time the market. While past performance may not be indicative of future performance, history suggests that in the longer term, general well-being, technology and the economy all improve. Don’t let temporary speed bumps get in the way of growing wealth for the long term.