Daily FX Market Roundup 03.02.20

By Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Monday's big story was the sharp recovery in U.S. equities. The Dow Jones Industrial Average jumped more than 1,200 points intraday, extending Friday’s recovery. Surprisingly U.S. data missed expectations with the ISM manufacturing index dropping to 50.1 from 50.9. The slowdown in the global economy is taking a bite of the U.S. economy with manufacturing activity essentially stagnating in the month of February. When the March data is released, a contraction is almost certain. In China, manufacturing activity hit a record low according to the latest PMIs and with the virus spreading here in the U.S. (the death toll increased as well), stocks should be trading lower and not higher. Yet equities closed up strongly on the hope that fiscal and monetary stimulus is on the way.

On Friday, Federal Reserve Chairman Powell described coronavirus as posing “evolving risks” to the economy. This opened the door to a rate cut and led investors to look for an intermeeting move this month. In the last 24 hours, the Bank of Japan and the Bank of England also pledged to support their economies if needed. The European Commission is talking about “strong coordination on every level,” including the possibility of a coordinated fiscal response. G7 finance ministers are expected to hold a call on Tuesday to discuss how to deal with the economic impact of the virus at 7AM ET (12GM), 2.5 hours before the market opens in the U.S. Something is in the works. Central bankers have promised to ensure stability and the rebound in stocks reflects the market’s expectations for coordinated action in the next few days or weeks at the latest.

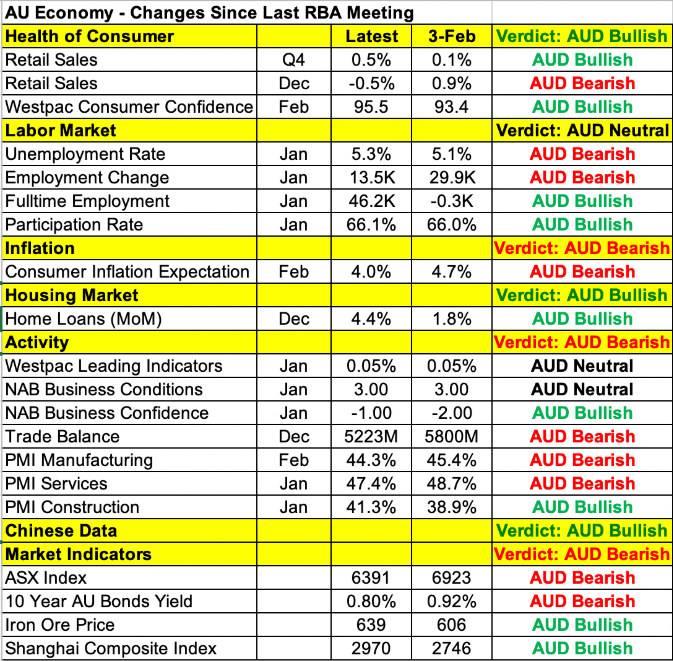

The question now is whether the Reserve Bank of Australia will jump the line and ease interest rates proactively when they meet tonight. A quarter point rate cut is fully discounted with some saying it’s a question of 25bp in March and 25bp in April or 50bp today. While there’s no doubt that coronavirus will hit Australia’s economy hard, so far, economic data has held up well. As shown in the table below, improvements have been seen in retail sales, consumer confidence, full time hiring, the housing market and business confidence. Yet, the deepening contraction in the manufacturing and services sector tells the real story.

In mid February, RBA Governor Lowe admitted that the virus is having a major impact on education and tourism sectors. The RBA minutes revealed that even last month, they discussed the possibility of a rate cut. So given how much coronavirus has spread over the past few weeks and the growing toll that it is taking on China and the global economy, the RBA will have no choice but to lower interest rates. With that said, we expect a 25bp rate cut with a commitment to ease further in the coming months. The RBA may want to wait and see what type of coordinated global response is necessary and by easing only a quarter point, they save ammunition to ease more later. Either way, the outlook for AUD is grim because the RBA will be one of the first major central banks to respond.