The Israeli-Palestinian conflict is a new risk factor for financial markets, but for now, there’s no contest between US shares and other asset classes as the year moves into its final stretch, based on a set of ETFs through Friday’s close (Oct. 13).

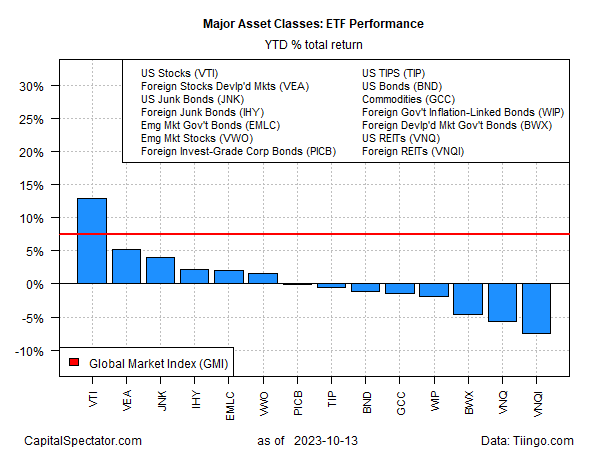

Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) is up 13.0% year to date. Although that’s well below the 20% peak for the ETF reached in the summer, this year’s performance premium for American shares remains hefty vs. the rest of the major asset classes. The second-best performer in 2023: developed-markets stocks ex-US (VEA) with a relatively modest 5.2% year-to-date return.

Roughly half of markets are posting losses so far in 2023. Property shares in the US and in foreign markets are currently suffering the steepest declines: -5.6% and -7.5%, respectively.

The Global Market Index (GMI) is outperforming most asset classes this year, with the exception of US stocks. GMI is an unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

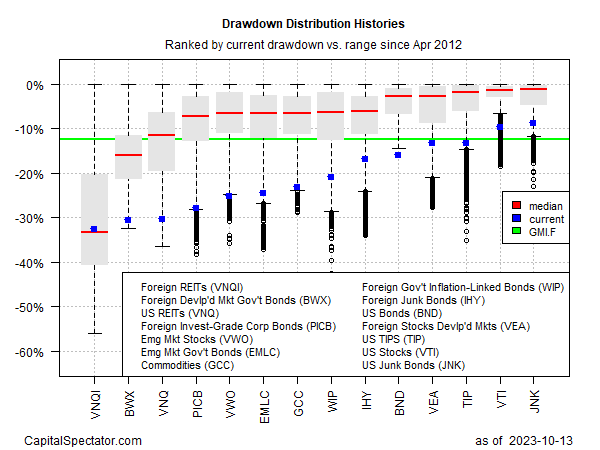

Note, too, that GMI’s current drawdown is relatively light vs. its underlying component markets. Only US stocks (VTI) and US junk bonds (JNK) are posting softer peak-to-trough declines than GMI’s -12.3% drawdown.

The question of how risk assets fare in the near term is expected to be closely linked to the path ahead for the Israeli-Palestinian conflict.

“We’re looking at the potential economic implications of the hostilities,” says US Treasury Secretary Janet Yellen. “It’s too early to speculate on whether or not there will be significant consequences. I think importantly it depends on whether the hostilities extend beyond Israel and Gaza, and that’s certainly an outcome we would like to avoid.”

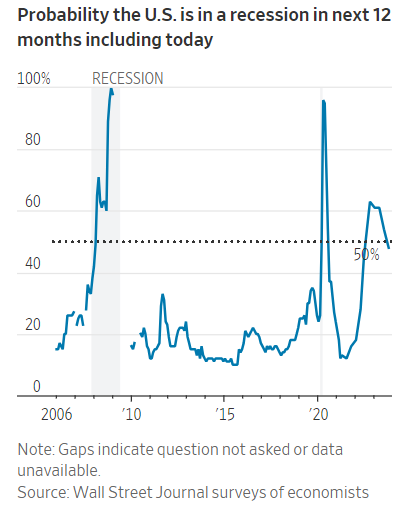

Economists are upbeat about the prospects for the US economy in the near term, according to a new survey by The Wall Street Journal. A small minority (54%) think the country will avoid a downturn, up from 48% in July.

The key question is whether Israel’s military operation, which appears set to invade Gaza, will trigger a wider conflict in the Middle East?

“I have no clue whether markets will remain relatively well behaved,” says Erik Nielsen, group chief economics adviser at UniCredit (LON:0RLS). “It almost certainly depends on whether this latest conflict remains localized or whether it escalates into a broader Middle Eastern war.”

Nomura European economist George Moran adds:

“If the Ukraine war taught us anything, it’s not to underestimate the effect of geopolitics.”