This week, there are two more opportunities to hear from Jay Powell, as he is scheduled to speak at an ECB conference on June 28 alongside Lagarde, Bailey, and Ueda at 9:30 AM ET. Additionally, Powell will deliver another speech on June 29 at a Bank of Spain conference at 2:30 AM ET. It appears that despite having heard from him extensively last week, it is unlikely that his messaging will change significantly.

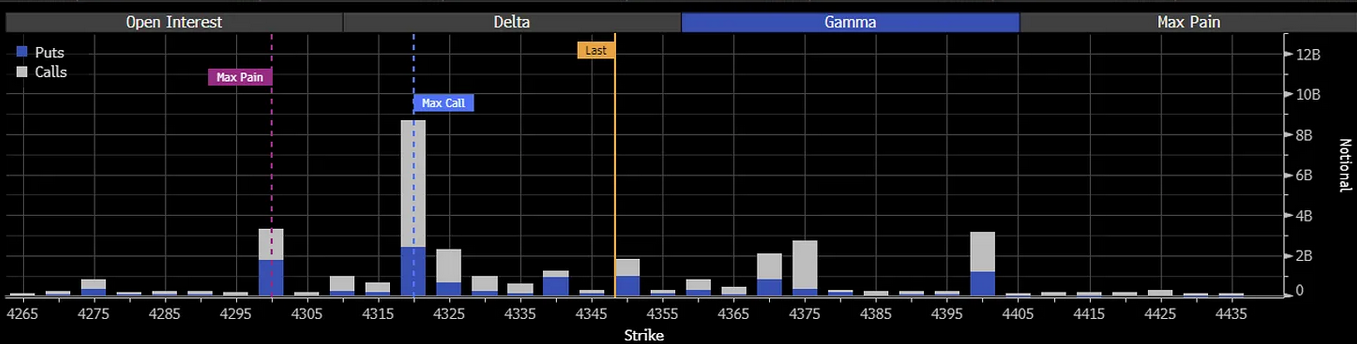

Given that it is also the end of the quarter, all the talk will be about the JP Morgan option collar trade on June 30. The critical level of importance for the collar trade appears to be 4,320, as depicted on the chart below. This level holds significant call gamma, and it could act as a support or resistance level as the end of the week approaches.

A significant level to keep an eye on for the S&P 500 Futures is the 4,330 region. This level acts as a support level that originated from the highs reached in August 2022. This week’s behavior will provide valuable insights into the strength of the bullish sentiment driving the current rally.

If the support at 4,330 remains intact, it could suggest additional room for the S&P 500 to continue rising. However, if this support level breaks down, it could indicate that the rally was merely a deceptive bull trap and could potentially lead to further losses in the market. Monitoring the price action around this level will provide important clues about the market’s direction in the near term.

Furthermore, there are indications that the timing cycle is still at play, and a descending triangle pattern suggests the potential for lower prices ahead.

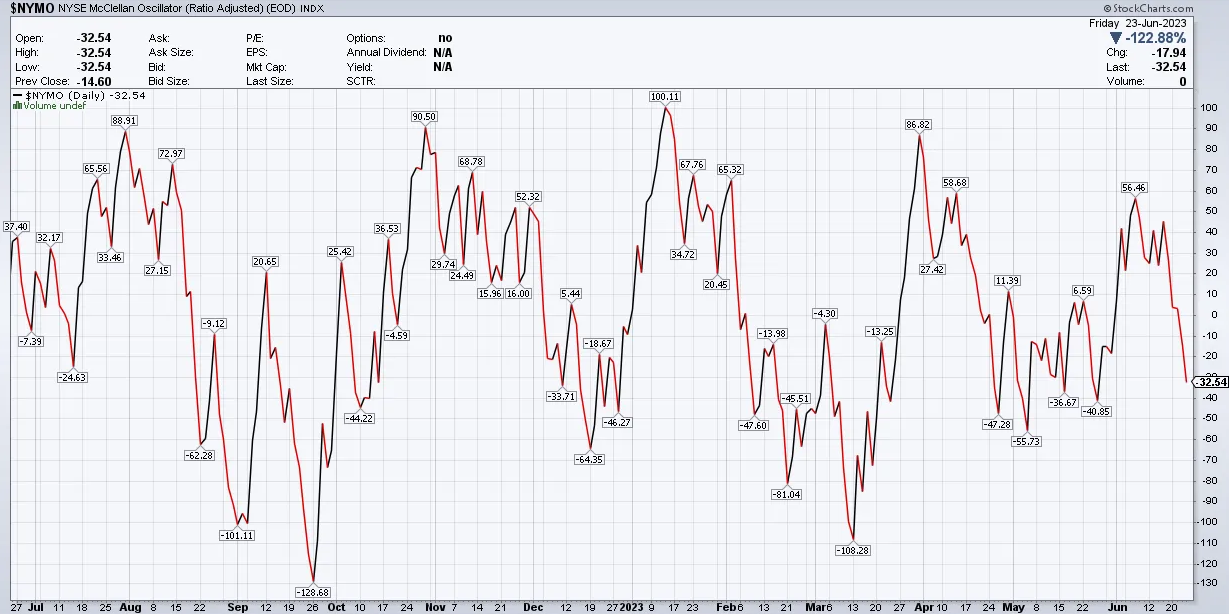

The NYSE McClellan Oscillator, which turned negative on Friday, is signaling a potential lack of conviction in the current rally. This indicator reflects weakening breadth in the NYSE, suggesting that the participation and strength of the market rally may be in question.

Furthermore, the NYSE Summation Index has experienced a downward turn this week. When the summation index turns lower, it often indicates a significant turning point for stocks. The index’s recent behavior suggests a weak rally, as each subsequent high since February has been lower than the previous high for the oscillator and a divergence from the S&P 500 index. This pattern suggests diminishing strength and potential vulnerability in the market.

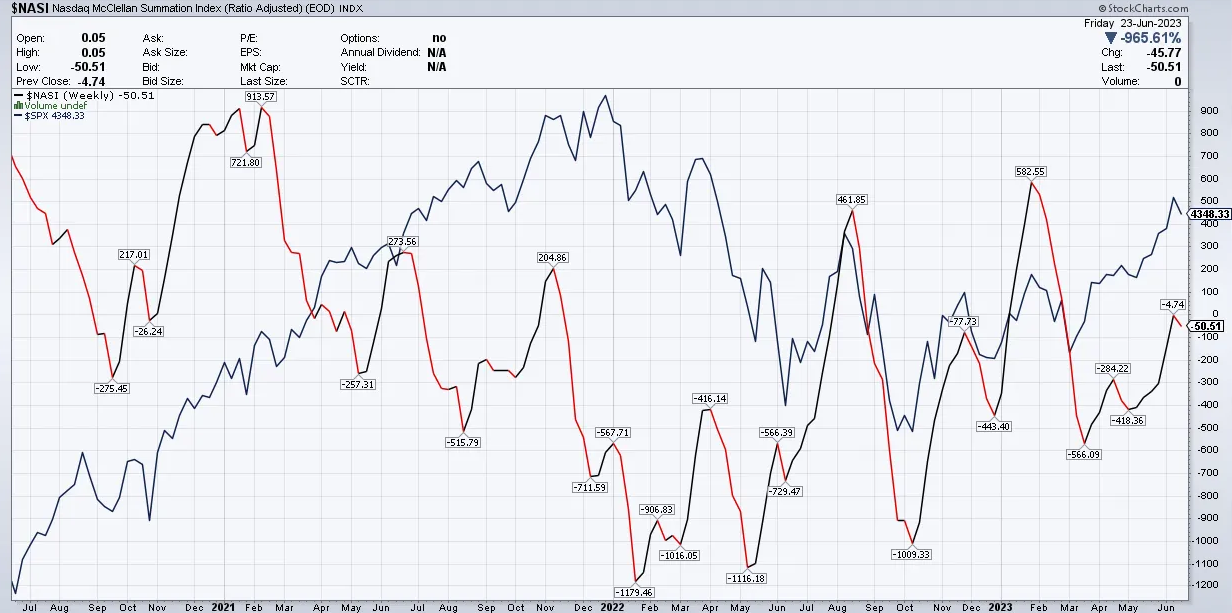

The similarities in the chart patterns of the Nasdaq 100 and Nasdaq Summation index, which indicate weak breadth, further support the notion that the current rally may lack substance. The fact that the summation index barely managed to cross above 0 marginally suggests a notably feeble rally. These observations collectively indicate the market’s upward momentum may be tenuous and potentially unsustainable.

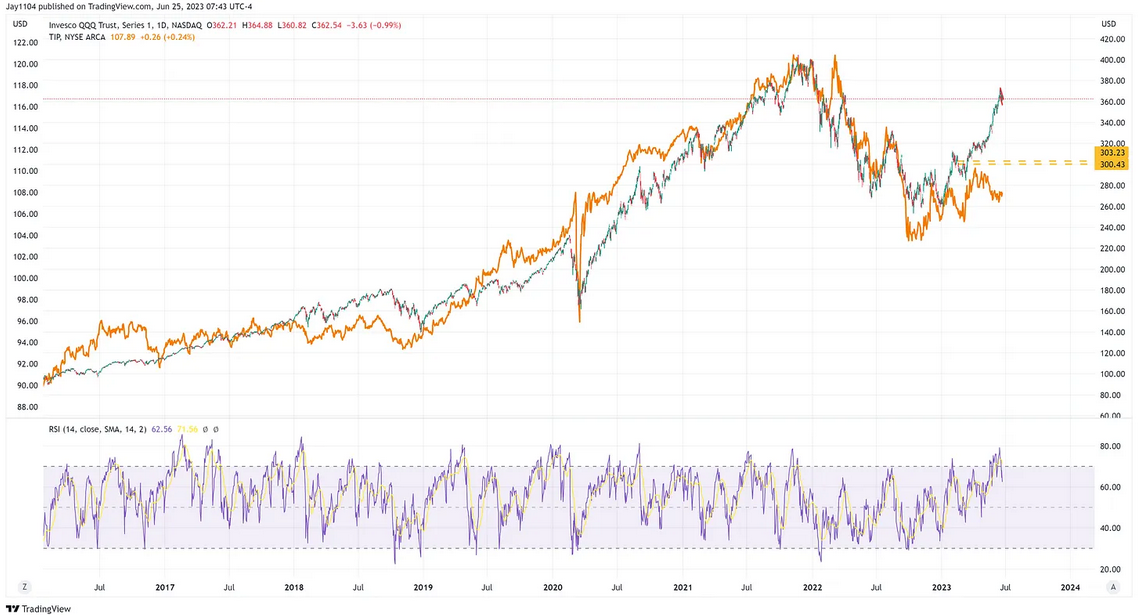

It is worth noting that the Invesco QQQ Trust (NASDAQ:QQQ) (NASDAQ-100 ETF) has recently exhibited a significant deviation from the iShares TIPS Bond ETF (NYSE:TIP) (Treasury Inflation-Protected Securities). Historically, these two ETFs have displayed a relatively close correlation. The widening spread between them suggests that the NASDAQ may be experiencing a state of overvaluation when compared to the TIP ETF. This divergence could indicate a potential disparity in market perceptions.

Currently, there are indications that the US 10-Year rate may be inclined to rise, as suggested by the presence of a cup-and-handle continuation pattern. If it surpasses the 3.9% level, it could increase to approximately 4.1%.

Similarly, a comparable pattern can be observed in the 30-year rate, indicating a potential upward movement. If the 30-year rate exceeds the 4% threshold, it could propel the rate toward its previous highs. This suggests the possibility of a significant increase in the 30-year rate.

Recently, there has been a downward slide in regional banks, as evidenced by the Regional Banking ETF (NYSE:KRE) ETF decline. The ETF has dipped below a broken downtrend line, indicating that the earlier upward move may have been a false breakout.

If this turns out to be the case and the move was indeed a fake move higher, it wouldn’t be surprising to see the ETF test its previous lows. This suggests a potential continuation of the downtrend in regional banks, and investors should closely monitor the price action to assess if the ETF confirms this bearish scenario.

Furthermore, the Biotech ETF (NYSE:XBI) recently broke below an uptrend line that had been in place since the March lows. Biotech stocks are known to be highly sensitive to changes in interest rates, so it is not unexpected to see the XBI decline further, particularly as interest rates have been rising.

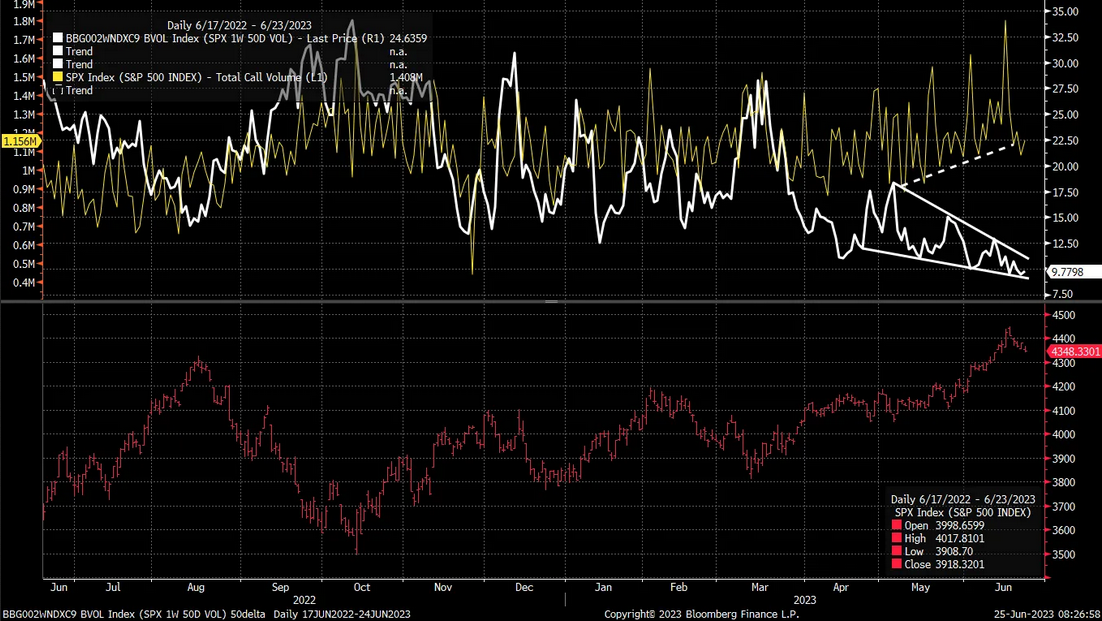

A falling VIX and implied volatility have significantly increased stocks in recent weeks. However, it appears that this trend is approaching its end. The implied volatility of the S&P 500 1-week 50 delta option has experienced a notable decline. This decline in implied volatility has been a significant driver of the daily call volume in the S&P 500. The chart indicates that implied volatility is starting to show signs of reaching a bottom, and if it begins to rise again, it is likely to lead to a significant decrease in call volume.

The VIX has experienced a substantial decrease and has entered a period of compression, as depicted on the chart. It is worth noting that based on the chart’s analysis, this compression is anticipated to reach its limit by Friday. Considering the significant decline already witnessed, it is unlikely that the VIX has much room to fall. Instead, I would expect a break higher in the VIX.

Have a good week.