After a run of mixed macroeconomic data out of the world’s largest economy (weak jobs report, hot CPI reading, disappointing retail sales), traders are desperate for more data on the state of the US consumer. Thankfully, several of the biggest retailers in the US all report earnings this week, including heavy hitters like Walmart (NYSE:WMT), Home Depot (NYSE:HD), Lowe’s (NYSE:LOW), and Target (NYSE:TGT).

Bolstered by another round of stimulus payments and limited options for spending money elsewhere, US consumers continued to flock to these retailers throughout the first quarter. In particular, the home improvement stores (Home Depot and Lowe’s primarily) are poised to report strong results amidst surging lumber prices and a home remodelling boom as consumers seek to invest in improving their living/working/learning/exercising/entertaining spaces.

Below, we highlight the expectations, key themes, and technical levels to watch on four of the biggest US retailers ahead of this week’s earnings reports:

Walmart (WMT) earnings preview

Report date: May 18 (before the bell)

Expectations: $1.24 in EPS on $131.67B in revenue

Walmart was one of the big winners of the early days of the pandemic as consumers rushed to the big chain stores to stock up on groceries, cleaning supplies, and just about everything else they needed to shelter in place. Now, the company is entering a period where comparisons to last year’s stellar figures are more difficult, presenting a higher hurdle to maintain growth. The company plans to invest $14B in technology and order fulfillment this year in an effort to further boost its e-commerce division, which saw sales surge 69% in Q4.

Home Depot (HD) earnings preview

Report date: May 18 (before the bell)

Expectations: $3.03 in EPS on $34.01B in revenue

The Dow component saw its sales surge over 25% last quarter, though at some point, the pandemic-era trend of DIY home remodeling could certainly fade. Home Depot trades at a premium to its chief rival Lowe’s, reflecting stronger market share and operating efficiency, but if the gap between the two home improvement behemoths starts to tighten, HD could be vulnerable to profit-taking.

Target (TGT) earnings preview

Report date: May 19 (before the bell)

Expectations: $2.37 in EPS on $21.29B in revenue

Target often gets lumped into the same “superstore” category as Walmart, but there is one key difference to watch for this quarter in particular. Whereas groceries make up 57% of sales at Walmart, the equivalent figure for Target is just 20%. For consumers flush with pandemic stimulus checks in Q1, the larger proportion of discretionary items at Target may lead it to outperform its larger rival.

Lowes (LOW) earnings preview

Report date: May 19 (before the bell)

Expectations: $2.60 in EPS on $23.25B in revenue

Last but not least, LOW reports its earnings on Wednesday morning as well. Long the proverbial “little brother” to Home Depot, Lowe’s is seeking to flip that dynamic after seeing comparable-store sales rise 26% last year (better than HD’s 21% rise). Meanwhile, LOW sports an 11% operating margin but has been improving that metric in recent quarters as it strives to meet a long-term goal of 13% operating profits. As always, management’s outlook for the full-year results will be just as important as the backward-looking performance figures.

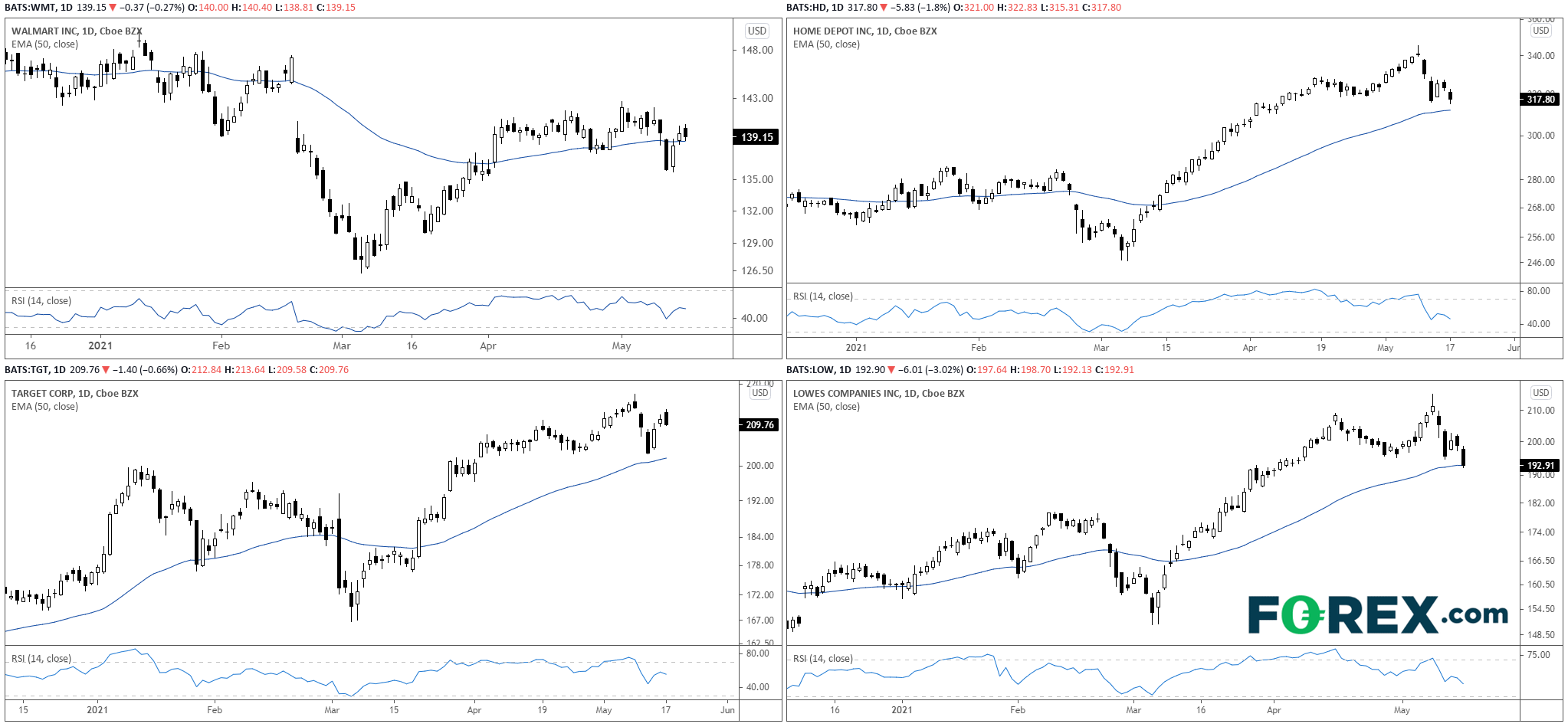

US retailer technical analysis

As the chart below shows, most of the retailers have tracked the overall market in rallying sharply over the last two months before rolling over last week. On a relative basis, WMT looks the weakest as it remains in the middle of its year-to-date range, so it may take a particularly strong report to revitalize that stock. With TGT, HD, and LOW all pulling back to their 50-day EMAs over the last week, bullish traders will be looking for strong earnings reports as a potential opportunity to join the recent uptrends at a better price this week: