JP Morgan and a number of the largest US banks kicked off the second quarter of US earnings season on Friday. The season, which will run for the next month and a half, will give us an important insight into whether companies can continue the good earnings momentum from the year's first quarter.

We are keeping a close eye on the US earnings season. Not only are many of our retail investors directly invested in the US market, but with the US market accounting for around 60% of the world's total market capitalisation, the mood on the other side of the Atlantic is crucial to how most markets perform.

The season is becoming more important than it has been for a long time. The S&P 500 is up a whopping 17% since the beginning of the year and now needs to be supported by corporate earnings growth. We have long seen that stock prices run faster than corporate earnings. Only about half of this year's share price increases can be attributed to stronger earnings.

As a result, the valuations of US stocks have been well stretched. Today, the overall S&P 500 index is trading at over 21 times earnings. This is above the long-term average of just under 18 times, meaning investors are now paying a higher price for companies' underlying earnings.

A disappointing earnings season will make the market look even more 'expensive'. This could cause investors to reconsider the overweight and preference that many have had for US equities. Conversely, another strong earnings season will reinforce the narrative of 'American Exceptionalism' and further support the US market.

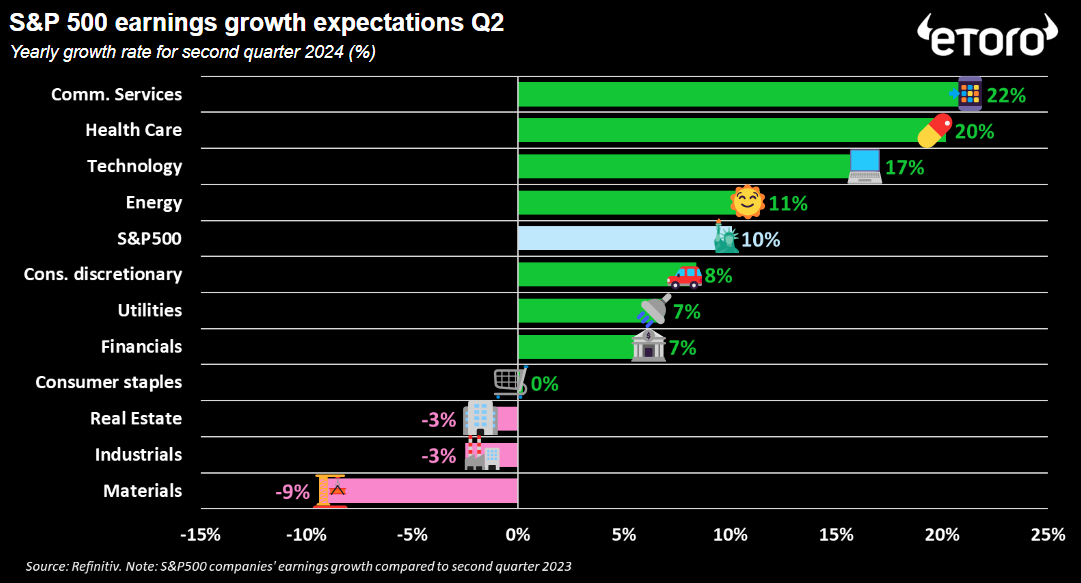

But the bar has been set high for this earnings season. This season follows a strong first quarter that delivered a surprising 8% earnings growth, with almost 80% of companies beating analysts' estimates. Analyst expectations for this season are also already high. Consensus estimates see the index reaching an overall growth of 10%. So while companies with their 'beat guidance culture' generally tend to surprise positively, this season it may prove to be a difficult task.

This earnings season could also see a shift from the tech sectors, which have been the major earnings drivers, to other parts of the market. Tech sectors such as communication services and technology are still expected to deliver solid earnings but at a slower pace than in previous quarters. On the other hand, the pharmaceutical and energy sectors are expected to deliver again after being in an 'earnings recession' for the past few quarters.

However, we'll have to be patient with the results from the tech giants, which are due later this month. They kick off with Alphabet (NASDAQ:GOOGL) and Tesla on 23 July and end with what can almost be described as a macro event, Nvidia (NASDAQ:NVDA)'s earnings presentation on 21 August.

Jakob Westh Christensen, eToro Market Analyst

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Q2 earnings season: Can earnings catch up with strong share price gains?

Published 15/07/2024, 13:12

US Q2 earnings season: Can earnings catch up with strong share price gains?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.