- Wall Street Poised For Sharp Losses Again on Monday;

- Bitcoin Testing $7,600 Lows Again;

- BoE “Super Thursday” Eyed This Week.

Wall Street Poised For Sharp Losses Again on Monday

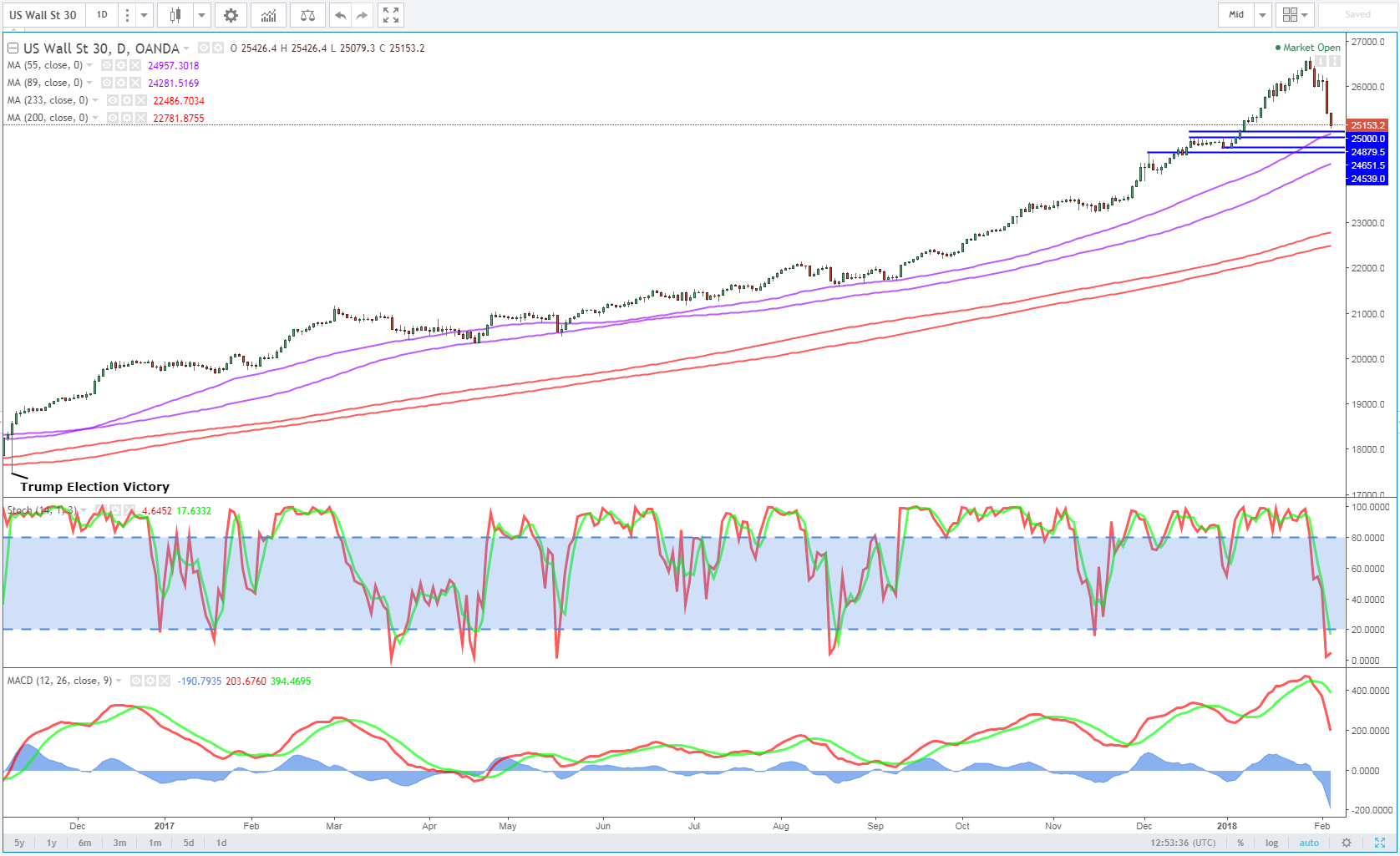

US futures are trading back in the red again on Monday, adding to substantial declines seen on Friday when higher interest rate and inflation expectations weighed heavily on stocks.

We’ve seen a sharp increase in US bond yields over the last week after the Federal Reserve released a more hawkish than expected statement - alongside its monetary policy decision – and the jobs data reported a significant increase in earnings. Markets now have three rate hikes this year more than 50% priced in and some people are even anticipating a fourth, which is unusually ahead of current Fed forecasts.

While Friday’s declines were larger than we’ve become accustomed to and the biggest drop in the Dow since June 2016, I don’t think it yet signals that a large correction is underway. Small corrections are normal in markets, even if we haven’t experienced them as often in recent years. Asian and European markets have suffered significant losses this morning in response to the US declines on Friday but we’ll have to see over the coming days whether this will trigger more downside.

Bitcoin Testing $7,600 Lows Again

Bitcoin on other hand is struggling yet again at the start of the week and is trading back below $8,000 at the time of writing. Cryptocurrencies have seriously fallen out of favour since the middle of December and constant negative news flow and speculation of increased regulation has exacerbated the move lower, much in the same way that the constant flow of positive news stories aided the explosion higher.

In much the same way that picking the high on the way up proved to be extremely difficult, it’s tough to establish a realistic low for bitcoin and others. It would appear cryptos can’t rely on the speculators to drive prices higher again as its likely they’ve been severely burned over the last couple of months and may be reluctant to jump back in.

BoE “Super Thursday” Eyed This Week

This week will be a little quieter than the one just gone, although there are a few central bank meetings that traders will be keen on. The Bank of England meeting stands out, with it being accompanied by the quarterly inflation report and press conference with Governor Mark Carney. The central bank raised interest rates last year and many people expect another in 2018. With the economic outlook so uncertain though and inflation probably having peaked, I question whether another rate hike is as nailed on as some would suggest.

Disclaimer: This article is for general information purposes only. It is not investment advice, an inducement to trade, or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Ensure you fully understand all of the risks involved and seek independent advice if necessary. Losses can exceed investment.