As we noted in our CPI preview report on Monday, a reading near economists’ consensus expectations of 8.1% year-over-year for price increases “would be the first meaningful decline in the annualized inflation rate since the depths of the COVID recession.”

As it turns out, inflation remains more stubborn than economists were expecting. The headline US CPI reading for April came in at 8.3% y/y, higher than expected and down only incrementally from last month’s 8.5% reading.

Core CPI (excluding food and energy prices) also came in hotter than anticipated, printing at 6.2% vs. 6.0% eyed.

In terms of the individual components, much of the increase was driven by a spike in the price of food (largest 12-month increase since 1980!), which offset a big decline in the price of used cars.

Put simply, inflation is becoming more widespread across a broad swathe of consumer spending categories, raising the risk that it could become entrenched.

Market Reaction

So far, traders don’t believe this report will prompt the Fed to raise interest rates more aggressively through the summer, with the market still pricing in “just” a ~25% of a 75bps rate hike at one of the next two FOMC monetary policy meetings.

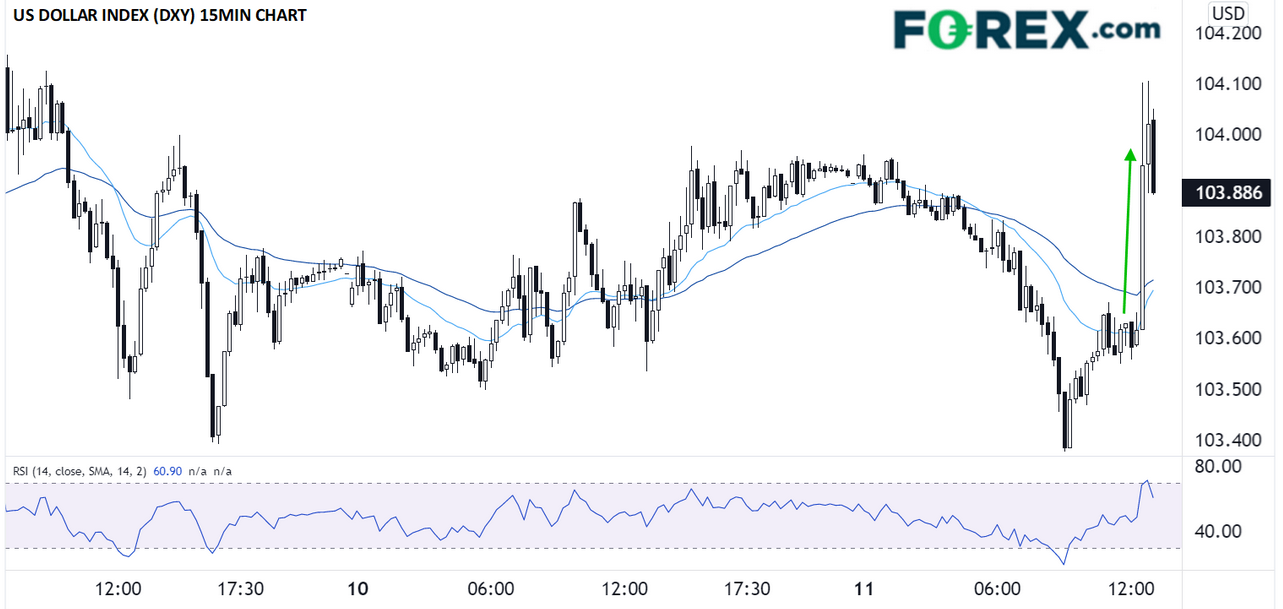

That said, traders in other markets are certainly taking notice of the elevated inflation reading. As we go to press, the US dollar is rallying by about 40 pips against most of its major rivals.

US index futures have flipped into negative territory, and yields on US Treasury bonds have spiked by 10bps across the curve.

Source: StoneX, TradingView

With yesterday’s inflation report confirming that price pressures are NOT rapidly dissipating of their own accord, tightening financial conditions are likely to keep “risk on” trades (global indices, growth stocks, commodity currencies, etc.) on the back foot for now.