- As conference season continues, investors should consider guidance offered at other corporate event types too

-

Analyst & Capital Markets Days often feature important business strategy updates and Q&A sessions

-

We profile three firms with upcoming stakeholder sessions

It has been an eventful conference season for companies big and small. Key updates from a range of industries, including banks and semiconductors, have kept investors on edge. It comes as volatility has kicked up right on cue to begin September, but the S&P 500 hit record highs amid other, more macro, events.

Uncertainty was unusually high as the September 18 Fed decision date approached. The Fed Funds futures market usually has a firm beat on what the FOMC will do after its two-day policy gatherings, but the most recent meeting featured a virtual coin-flip as to whether a quarter- or half-point cut was in the works.

The Time Has Come for Rate Cuts and ‘Recalibration’

Alas, Chair Powell and all but one of the Fed’s voting members opted for a “double cut.” It may begin a protracted easing cycle that could last through next year. That is likely to have major implications for those in the C-suites of multinational corporations and at the desks of small businesses.

While it is difficult to predict what the economy will look like 12 months from now with lower borrowing costs and less impressive savings account rates, investment projects may face a lower hurdle rate in terms of the cost of capital. Small-cap companies in particular might feel as if a burden is partially lifted as that group tends to be more prone to swings in short-term and floating interest rates.

Here’s a twist: Lower rates might be a headwind for big firms with pristine balance sheets. You see, with high cash on hand and low debt, they were net beneficiaries of higher Treasury yields. The same goes for wealthy investors holding cash and bonds – loftier rates, bigger interest income. Less return on cash is now the reality.

New Year, New Vibes

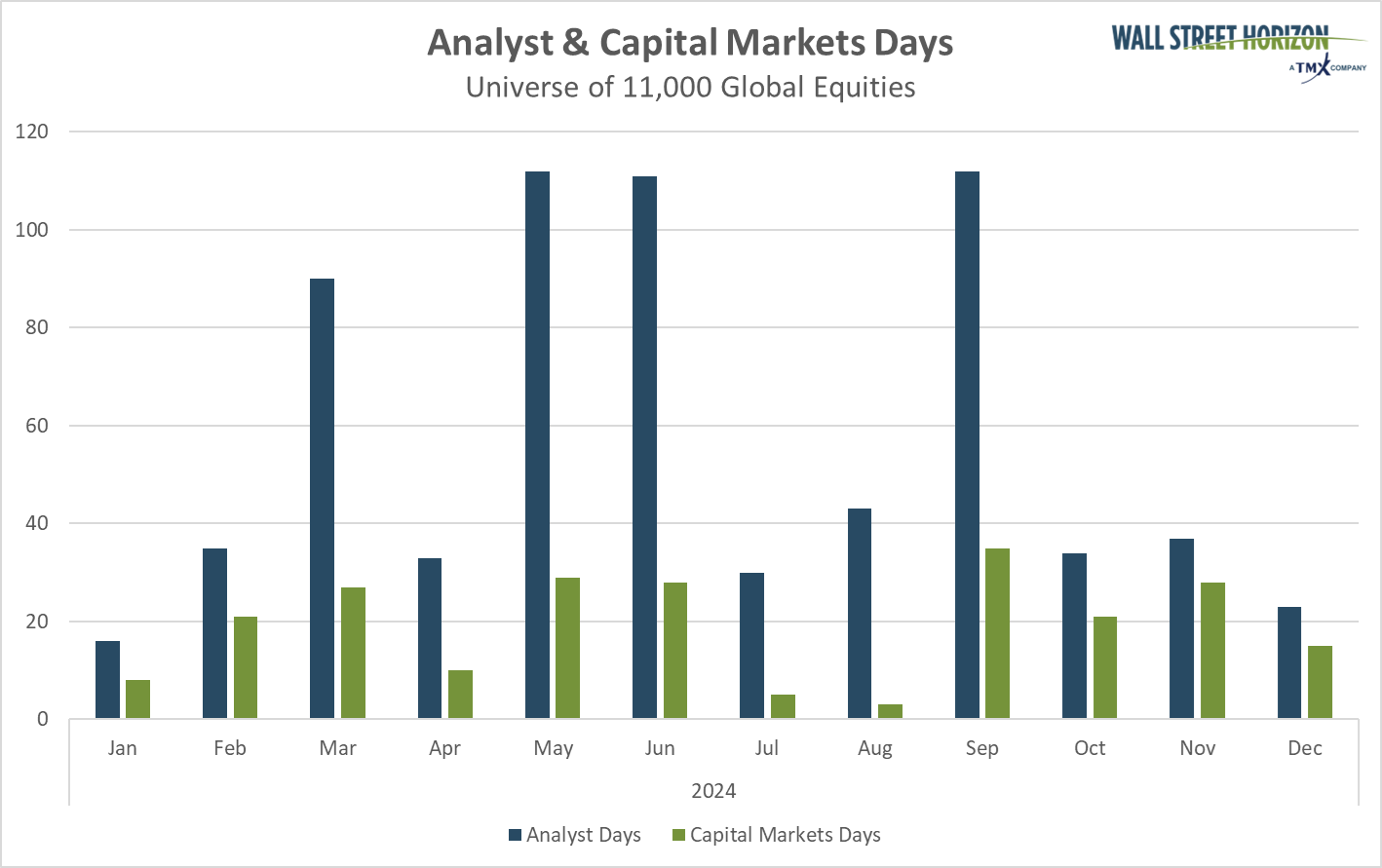

Put it all together, and 2025 will likely look and feel different than 2024. Portfolio managers, traders, and investors can get important clues before we call it curtains on this year, however. Through early December, there will be scores of important Analyst Days and Capital Markets Days hosted by bellwether companies.

October and November Feature Many Analysts & Capital Markets Day Events

Source: Wall Street Horizon

As a refresher, Analyst Days are put on to engage shareholders, analysts, and the media. They provide a platform for CEOs and CFOs to present updates on business strategy, financial performance, and upcoming growth plans. There’s often a Q&A session where analysts and reporters can probe company executives.

Capital Markets Days are similar, but they usually target a broader audience, including institutional investors and bondholders. Mutual funds, hedge funds, and the like, attend to learn about a firm’s specific financial goals and the goings on across business segments or geographic regions. Both event types are meant to provide clarity to stakeholders.

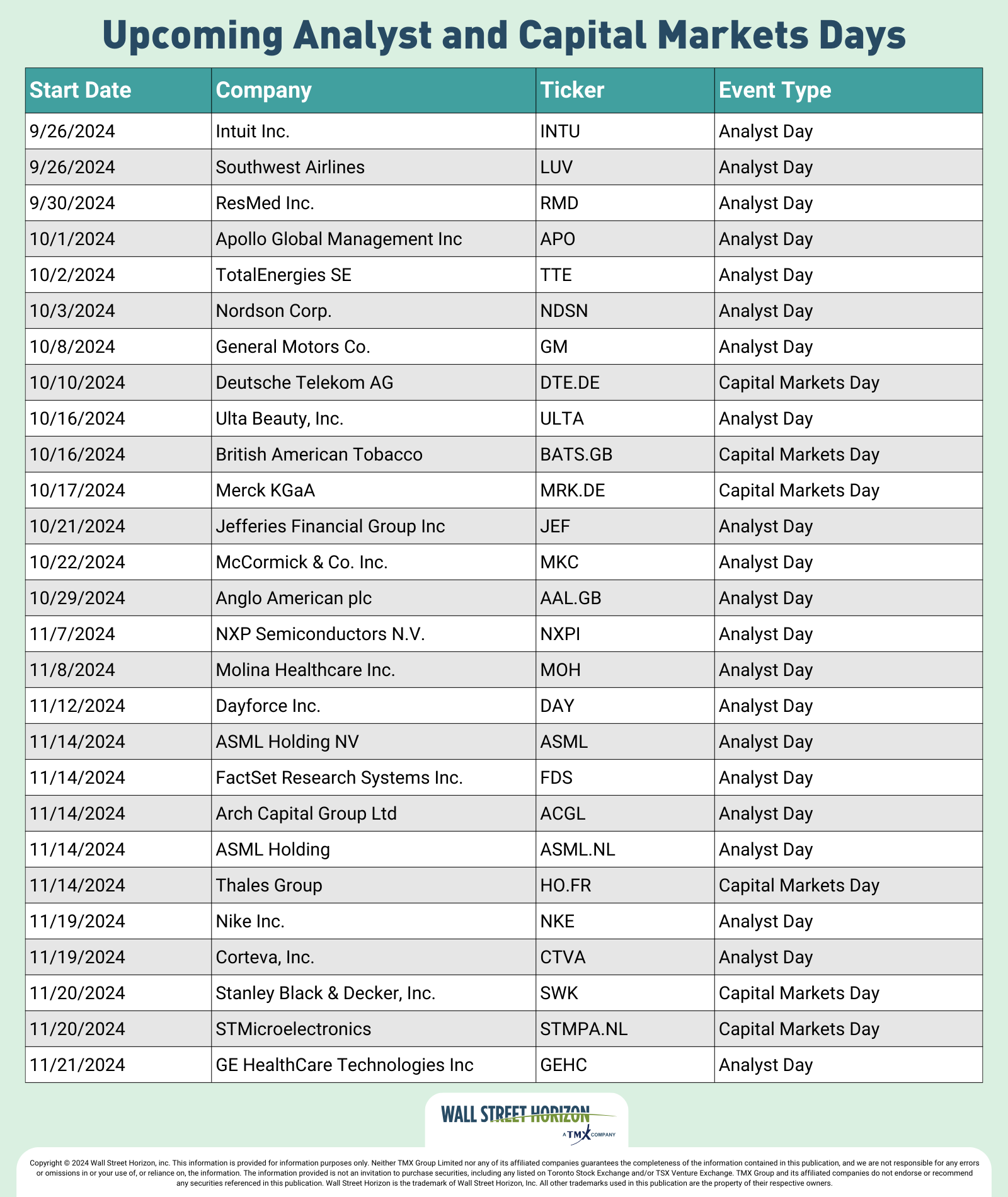

Let’s dig into a few notable companies with upcoming Analyst or Capital Markets Days lined up as we enter the home stretch of 2024.

Southwest Airlines

Airlines continue to struggle with industry challenges and changing traveler preferences. The so-called “revenge travel” period is long gone, but individuals, families, and business travelers are flying the friendly skies at a record pace, at least according to TSA checkpoint data. The Q2 earnings season highlighted fundamental concerns, though. An oversupply of seats resulted in some US airlines announcing reductions of capacity through year-end.

Back in March, the Texas-based company announced it would re-evaluate its 2024 financial performance amid Boeing’s delivery delays. Then earlier this month, activist investor Elliott Management told the carrier’s biggest union that despite a new board, CEO Bob Jordon should no longer remain as CEO. Its Analyst Day on Thursday, September 26 could be an eventful one.

Southwest Airlines (NYSE:LUV) is also slated to present at the Mobile World Congress MWC Las Vegas conference that begins on Tuesday, October 8 and it has a confirmed Q3 earnings date of Thursday, October 24 BMO.

Apollo Global Management

While struggles are ongoing for Airlines, asset management looks to be having a moment. This year’s stock and bond market rallies have generally resulted in strong profits for both traditional managers and those in private equity, including Apollo (NYSE:APO). Dealmaking expectations are high for 2025 and beyond as well. Year to date, APO is higher by 28% compared with a 19% total return in the S&P 500.

The $67 billion market cap US company, which is not yet listed in the S&P 500, has been active on the investment front, inking several notable deals in the past month. You might hear more about its latest moves and thoughts on financing markets at its October 1 Analyst Day which will feature presentations by senior leaders on Apollo’s strategic priorities. Presentations will begin at 8 a.m. ET, followed by a Q&A session.

APO’s next earnings date is unconfirmed for Wednesday, October 30 BMO.

General Motors

The Automobile Manufacturers industry has been particularly uncertain this year. Falling new and used vehicle prices and consumer preference shifts away from EVs have meant volatility for a handful of large automakers. However, General Motor’s (NYSE:GM) stock has returned close to 40% year to date.

In July, strong numbers from its ICE (NYSE:ICE) segment drove a large Q2 profit and its management team boosted its FY 2024 guidance. Soft demand in China was a sore spot and perhaps a cause for a range-bound stock price in the past few months, but CEO Mary Barra was upbeat in her letter to shareholders.

Will the same optimistic tone be voiced on October 8 at GM’s Analyst Day? Be sure to log in and find out. The company also presents at the FedEx (NYSE:FDX) Forward Service Provider Summit that begins on October 1 and it has an unconfirmed Interim Sales update on October 2 followed by a Q3 earnings date of Tuesday, October 22 BMO (confirmed).

Major Analyst and Capital Markets Days Through November

Source: Wall Street Horizon

The Bottom Line

Analyst and Capital Markets Days can offer specific insights as to the state of a company’s fundamental operations and industries writ large. Just as the Q3 conference season has had broad market impacts, so too might some of the many corporate events on the docket through November.